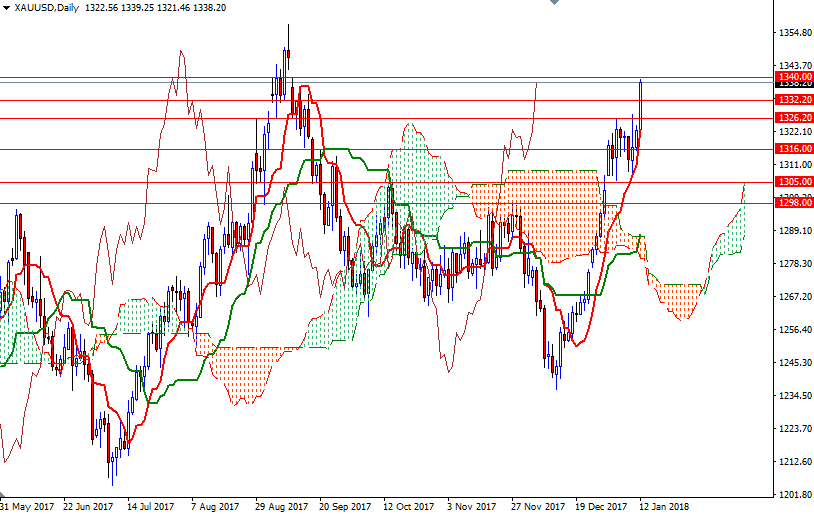

Gold prices settled at $1338.20 an ounce on Friday, gaining 1.35% on the week, as the weakness in the U.S. dollar continued to lure buyers into the market. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 203288 contracts, from 163268 a week earlier. XAU/USD tested the support in the $1309-$1308 area at the beginning of the week, before heading higher to pass through the critic barrier around the $1326.20 level.

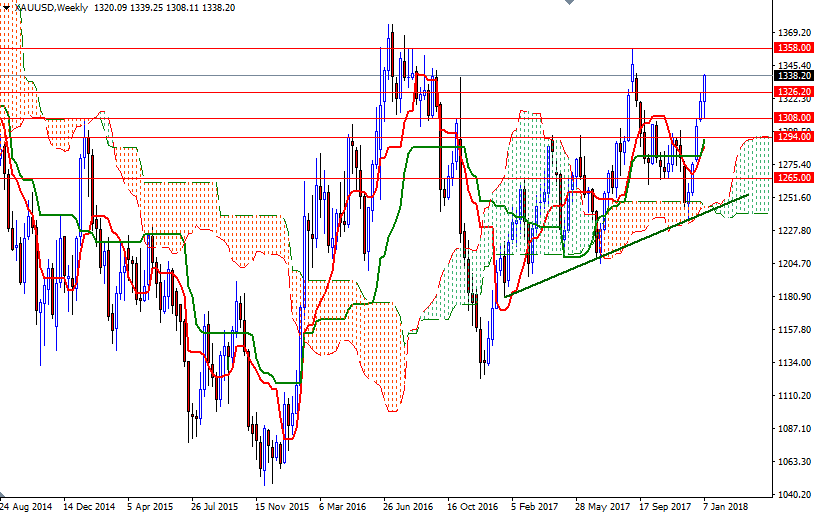

The market is trading above the Ickimoku clouds on almost all time frames. The weekly and the daily Chikou-span (closing price plotted 26 periods behind, brown line) are above the clouds as well. All these suggest that the bulls have the overall long-term technical advantage.

As I mentioned last week, the current upside momentum has a potential to push prices higher towards 1358/5. The bulls have to break through the strategic barrier in the 1344/0 area if they are determined to reach there. Closing above 1358 on a daily basis makes me think that the market is going to challenge the resistance in the 1370/67 area next. To the downside, keep an eye on the 1326 level. The bears will need to produce a daily close below there to make an assault on the 1316-1315.80 area. If this support is invalidated, then the next stop will be 1308/7. Breaking below 1307 would foreshadow a drop to 1302-1299.