Gold prices settled at $1331.57 an ounce on Friday, suffering a loss of 0.38% on the week, as a bounce in the U.S. dollar index put pressure on the market. World stock markets were mostly firmer last week, including U.S. stock indexes hitting fresh record highs. Absence of risk aversion is usually a negative element for the safe-haven gold (risk on and risk off assets tend to move in opposite directions). So, the ability of gold to score a four-month high while equity markets continue to perform well is impressive.

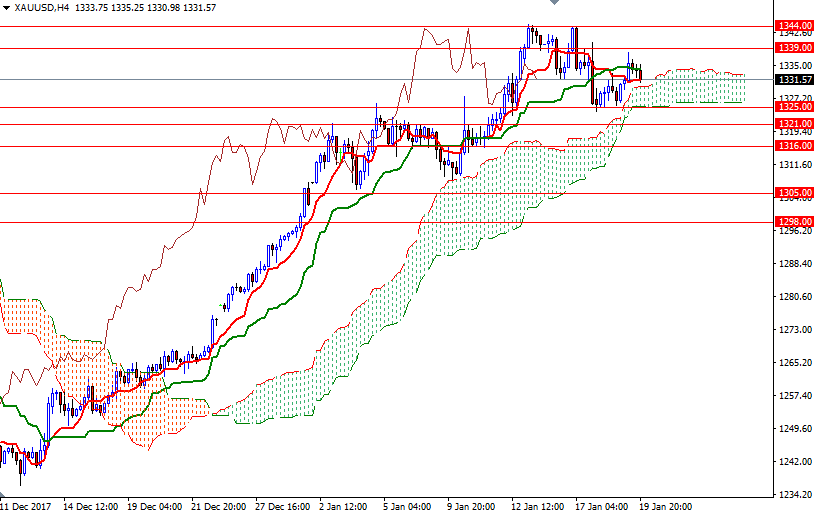

Some profit-taking was also behind gold’s first weekly loss in six weeks. XAU/USD was unable to penetrate the strategic barrier at 1344 for the second time. As a result, the market pulled back to the Ichimoku cloud on the H4 chart. Prices are trading above the weekly and the daily Ichimoku clouds, but negative Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross, along with Chikou Span/Price cross in the same direction, on the 4-hourly chart indicates the market may test the support in the 1325/1 area.

A break below 1321 implies that the bears are getting ready to challenge 1316-1315.80 next. The bears have to produce a daily close below 1316 to make an assault on the critical support in the 1308/5 zone. To the upside, the initial barrier stands in 1340/39, followed by 1344. The bulls have to confidently push prices above 1344 to gather momentum for 1350.80-1350. Closing above 1350.80 on a daily basis could provide the bulls the extra fuel they need to march towards 1358/5.