Gold prices settled at $1351.81 an ounce on Friday, rising 1.26% on the week, as investors bet on monetary policy tightening outside the United States. The precious metal is being supported by a plunging U.S. dollar index and a soaring Euro. The dollar has weakened on growing confidence that a global recovery would outpace U.S. growth and prompt other major central banks to unwind their loose monetary policies at a faster pace. Gold is usually inversely correlated with the main reserve currency (USD) and correlated with the second reserve currency (EUR).

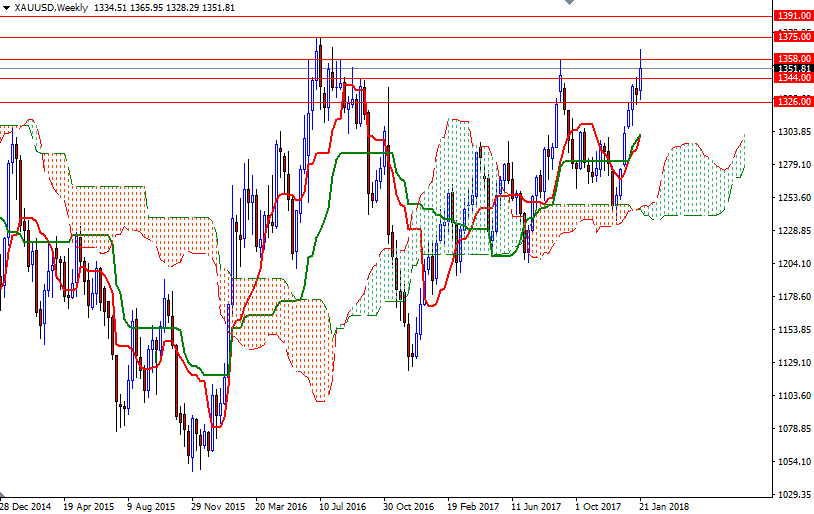

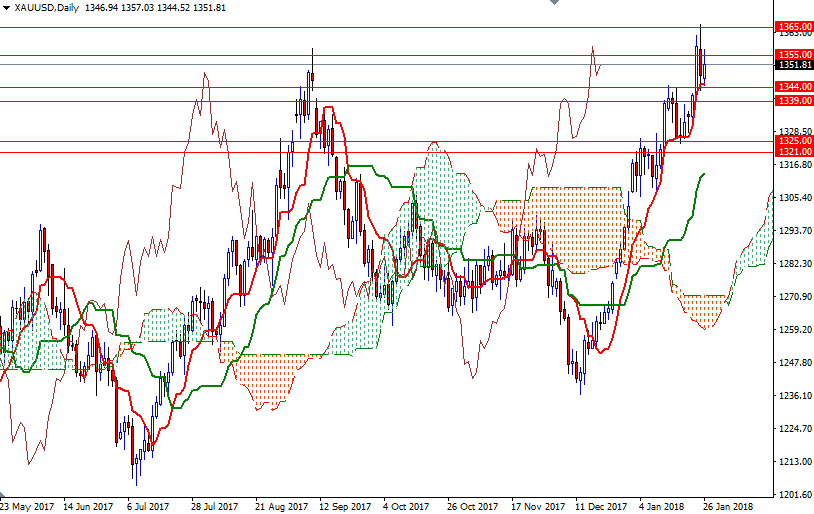

The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 214684 contracts, from 211711 a week earlier. The market is trading above the Ichimoku clouds on the weekly, the daily and the 4-hourly time frames, suggesting that the bulls have the overall technical advantage. In addition to that, we have positively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line), and the Chikou-span (closing price plotted 26 periods behind, brown line) resides above the clouds. Despite this positive picture, we may see some normal profit-taking and chart consolidation in the near term as there a few though barriers ahead such as 1375 and 1396/1.

If XAU/USD can climb and hold above 1358/55, the may pay another visit to 1365. The bulls have to confidently take out last week’s high to test 1375. If the bulls can capture this strategic camp, look for further upside with 1384/3 and 1391 as targets. A break above there brings in 1396. To the downside, the bears have to clear nearby supports such as 1344 and 1339. A break below 1339 suggest that XAU/USD will return to the 4-hourly Ichimoku cloud. The Ichimoku cloud on the H4 chart occupies the area roughly between 1333 and 1225, so the bears will need to pull prices below there to tackle the support at 1321. If the market dives below 1321, then 1315/2 will be the next port of call.