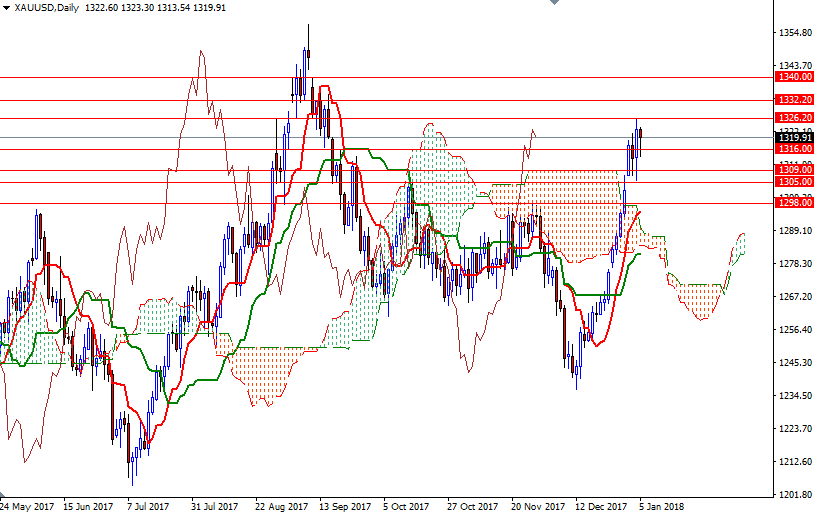

Gold ended the week up by 1% at $1319.91 an ounce, recoding a fourth consecutive weekly gain, as the continued weakness in the dollar bolstered demand for the precious metal. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 163268 contracts, from 135948 a week earlier. XAU/USD tested the resistance at $1326.20 after the market found enough support around the $1305 level.

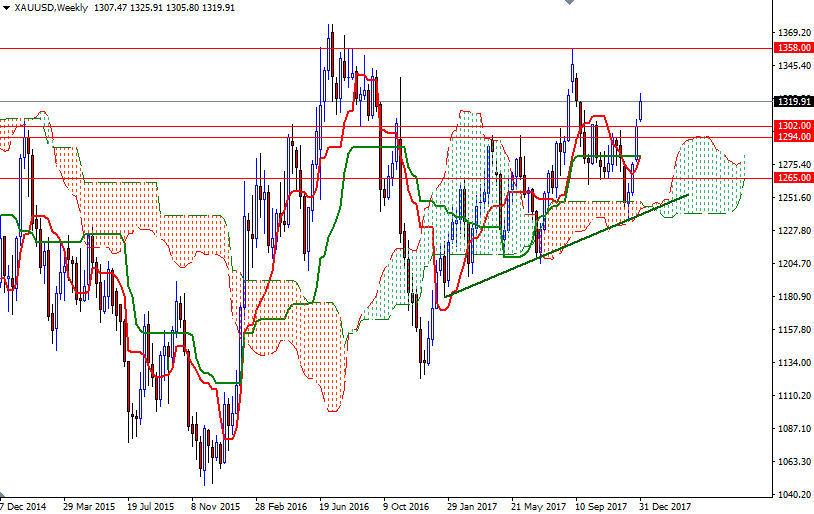

The technical charts are bullish, with prices moving above the weekly and the daily Ichimoku clouds. Positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) also support this view. The current upside momentum could offer enough inspiration for bulls to send prices higher towards 1358/5, but in order to reach there, the bulls have to confidently lift the market above the 1326.20-1323 area first. Beyond there, the bears will be waiting at 1333 and 1340.

Despite the positive long-term outlook, the RSI on the H4 chart suggests that a retracement downwards is likely. If the bulls run out of steam, XAU/USD may revisit 1316 and 1313/2. Closing below 1312 on a daily basis implies that the market will return to the 4-hourly cloud. In that case, look for further downside with 1309 and 1306/5 as the next targets. A successful break below 1305 would open up the risk of a fall to 1298/4.