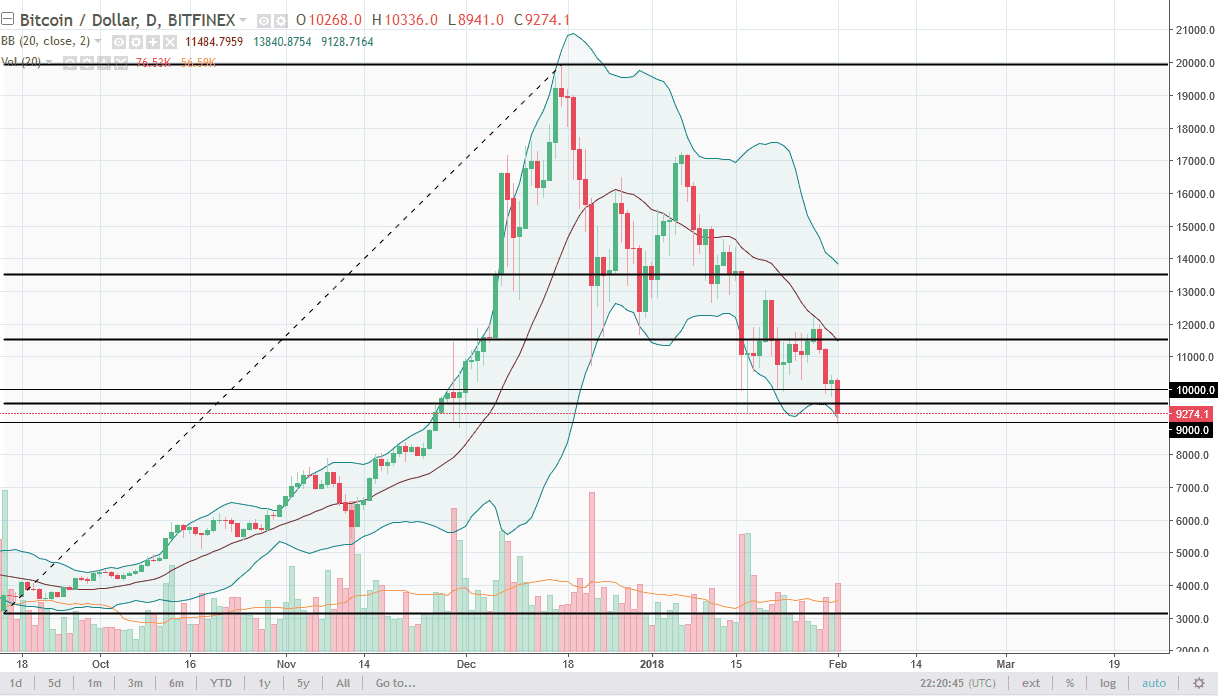

BTC/USD

Bitcoin traders sold off the crypto currency during the session on Thursday, slicing through the $10,000 level, and of course the 61.8% Fibonacci retracement level. We even went as low as $9000 during the trading session, and on the short-term charts volume was rather strong. Depending on which exchange you are trading on, you have seen a wildly different market. We are hanging on by a thread at this point, and although it would not surprise me to see a bounce, if the jobs number in the pushing the USD higher, that could be yet another reason for this market to fall apart and go looking towards $8000. At this point, selling rallies will be the best way to trade this market, and as far as buying is concerned, we need to do a lot of work to stabilize the marketplace.

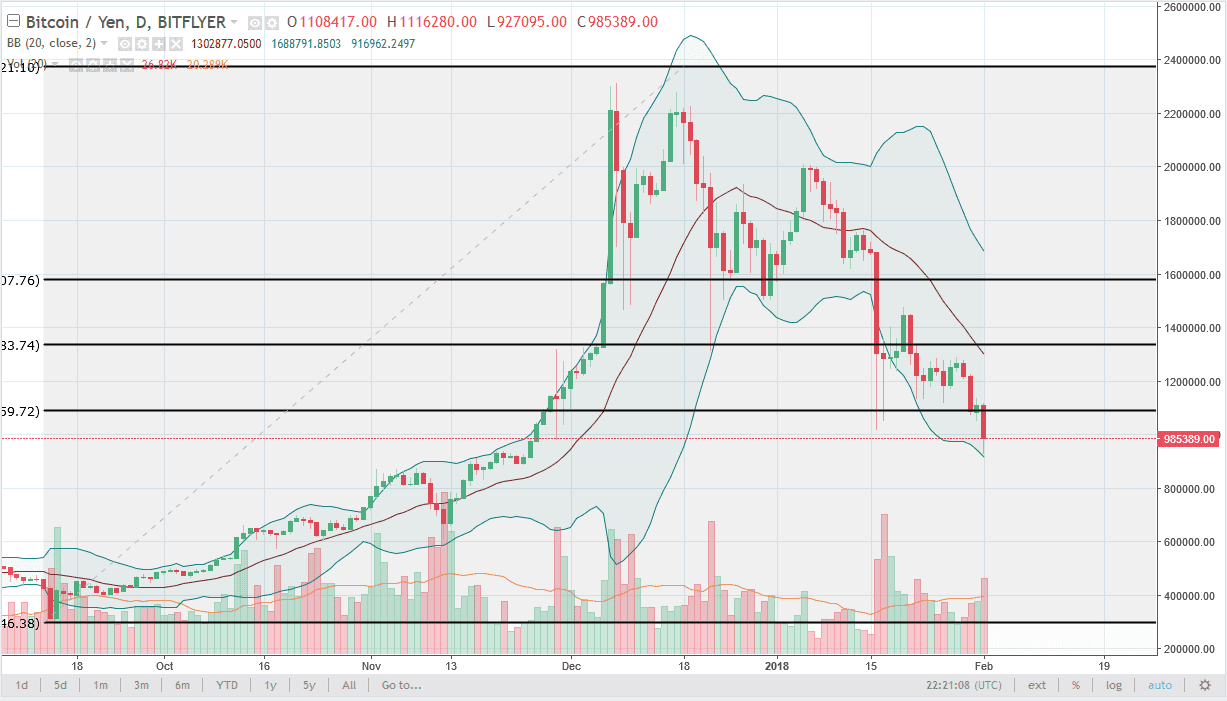

BTC/JPY

Bitcoin traders sold off against the Japanese yen as well, as the market finally got below the ¥1 million level. By breaking below there, it frees up more selling pressure, perhaps reaching down to the 800,000 and level. I think rallies at this point will be selling opportunities, and I don’t see much in the way of an opportunity to start buying. I think that there has been far too much in the way of damage to the Bitcoin markets for retail traders to feel comfortable. I believe that these days where we lose 11% will continue to be a major issue, so I think that if you have the ability to trade these markets on a leveraged account, you might be able to make money on the downside. Until we get a strong and strong volume day, it’s very difficult to buy this market as we continue to see selling pressure pick up occasionally, and volume seems to be favoring the sellers overall.