The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 18th February 2018

In my previous piece last week, I saw the best possible trades for the coming week as short of the Forex currency pairs GBP/USD and AUD/USD. The results were not good, with GBP/USD rising in value by 1.51%, and AUD/USD also rising in value, by 1.21%, producing an average loss of 1.54%.

The most important development in the market last week was the recovery in the U.S. stock market from its recent corrective low, with more than half of the S&P 500 Index’s losses being recovered now. The market also saw the U.S. Dollar resume its downwards movement in line with the long-term trend, so overall, it seems to be a story of trends resuming. Many analysts note that there has been no notable change to underlying economic conditions, except for the 10-year bond yield rising towards 3%.

As for other currencies, the Japanese Yen is in the spotlight, as it breaks up and makes a new 15-month high price against the U.S. Dollar, and a new 3-month high price against the Euro. The Japanese Central Bank is not sending out any signals in favor of this strengthening, and there is speculation that some of the Yen’s rise may be caused by Japanese investors repatriating overseas investment, yet that is questionable. It is true however that the market consensus sees the Bank of Japan as likely to begin tightening monetary policy later this year, even though dovish senior staff are being left in place, and the Finance Minister remarking last Friday on the importance of exchange rate stability and the possibility of market intervention.

Fundamental Analysis & Market Sentiment

Sentiment on fundamentals is hard to read, except on the U.S. stock market where it seems both are aligned with bulls. The two factors affecting sentiment in the Forex market over the course of this week are likely to be the FOMC Meeting Minutes release, followed by the British second GDP estimate, which could affect the U.S. Dollar and British Pound considerably.

Technical Analysis

U.S. Dollar Index

This index printed a strong bearish candlestick, although it has a significant lower wick, which closed in its lower half. The price was unable to make a new low. There is a strong, long-term bearish trend, and a bearish trend line dominates the price chart shown below. However, despite the generally bearish action, the lower wick rejecting the low might give bears some reason for caution.

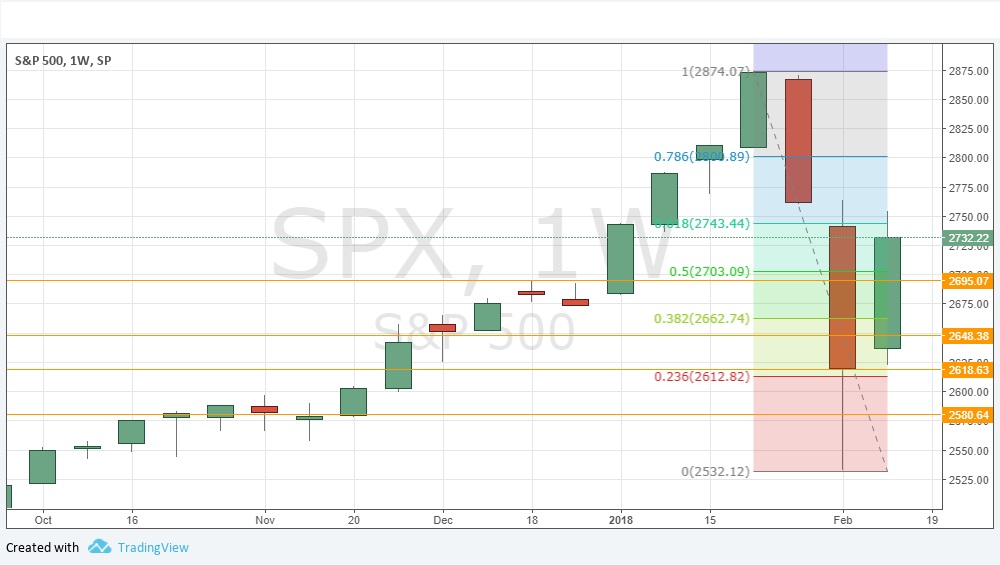

S&P 500 Index

This stock Index is in a long-term upwards trend, and despite the strong, sharp fall since the end of January, last week saw a bullish inside candle that closed near its high and erased more than half of the losses. There is high volatility, but this is a bullish sign that the bullish trend has most likely resumed.

GBP/USD

This pair is in a long-term upwards trend, yet it has clearly failed to rise higher over the past four weeks, printing a bullish inside candle last week but with a significant upper wick. Despite the trend, I am only cautiously bullish as the recent price action shows a persistent selling pattern above 1.4150 or so.

EUR/USD

This pair is in a long-term upwards trend, yet it has clearly failed to rise higher over the past four weeks, printing a bullish candle last week but with a significant upper wick. Despite the trend, I am only cautiously bullish as the recent price action shows a persistent selling pattern above 1.2475 or so.

USD/JPY

This pair has been in a slight long-term downwards trend, and it just got much stronger with a very large bearish candlestick which closed near its low at a new 15-month low price. It is true that the close was above a very pivotal support level at 106.14, however.

Conclusion

Bearish on the S&P 500 Index and USD/JPY, cautiously bullish on GBP/USD and EUR/USD (quarter size in each compared to full size in S&P 500 and USD/JPY).