The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 4th February 2018

In my previous piece last week, I saw the best possible trades for the coming week as long of the S&P 500 Index, and long of the Forex currency pairs GBP/USD and EUR/USD. The individual results were mixed, with the S&P 500 Index falling this week by 3.67%, while GBP/USD fell by 0.31%, and EUR/USD rose by 0.21%, producing an average loss of 1.26%.

The most important development in the market is the sharp fall in the U.S. stock market from an open at an al-time high price. Although many analysts are pinning the fall on rising long-term U.S. bond prompting profit taking, which came into focus with Friday’s strong earnings number suggesting a steepening pace of rate hikes, the market had already been falling strongly all week, with stronger momentum over time that the preceding price rise over recent weeks. Weekly falls of more than 3% in the Index from 5-year highs are not common, happening only 16 times since 1950. On 4 of those occasions, they have signaled the start of a major bear market, although the price tends to recover at first over the next week or so. This suggests that it is worth keeping a close eye on the stock market over the next few weeks as we may be seeing the beginning of the end of this bull market.

Forex markets over the past several weeks has been bearish on the U.S. Dollar, despite December’s interest rate hike, although the Dollar did recover on Friday after the release of strong average earnings data. Technically the Dollar is below its prices of three and six months ago, which puts it in a long-term downwards trend. However, sentiment may have changed. The Euro has the greatest and most consistent long-term strength of any major currency.

The news agenda this week will probably be dominated by central bank input scheduled from the U.K., Canada, and Australia, which might place the greenback on the sidelines for a few days at least.

The American stock market remains technically in a strong and clear long-term bullish trend, yet this is questionable after its sharp fall. Of the three major Forex pairs, both the EUR/USD and to a lesser extent the GBP/USD are in convincing long-term bullish trends, while the USD/JPY currency pair in a long-term bearish trend but moving against it.

Following the current picture, I see the highest probability trades this week as long of both the GBP/USD and EUR/USD currency pairs, but I would give twice the weighting to EUR/USD than GBP/USD.

Fundamental Analysis & Market Sentiment

Sentiment on fundamentals is starting to turn more bullish on the U.S. Dollar and bearish on stocks. Fundamental factors are mostly supporting the Euro.

Technical Analysis

U.S. Dollar Index

This index printed a reasonably strong bullish inside candlestick candlestick, which closed in its upper quarter with only a small upper wick. The price made a new 3-year low last week, which is a bearish sign. There is a strong, long-term bearish trend, and a bearish trend line dominates the price chart shown below. The signs point to an uncertain future over the short term, but over the longer term there is still bearish momentum.

S&P 500 Index

This pair is in a strong long-term upwards trend, yet it fell very strongly last week, and closed right on its low which is a bearish sign. Most of the time, such strong falls are followed by another fall over the next week, yet the overall edge statistically remains slightly with the bulls, with a rise of 0.27% next week suggested by the historical average. There is a meaningful chance, perhaps about 25%, that we are seeing the first signs of a new bear market in U.S. stocks. However, the probability still lies with the bulls.

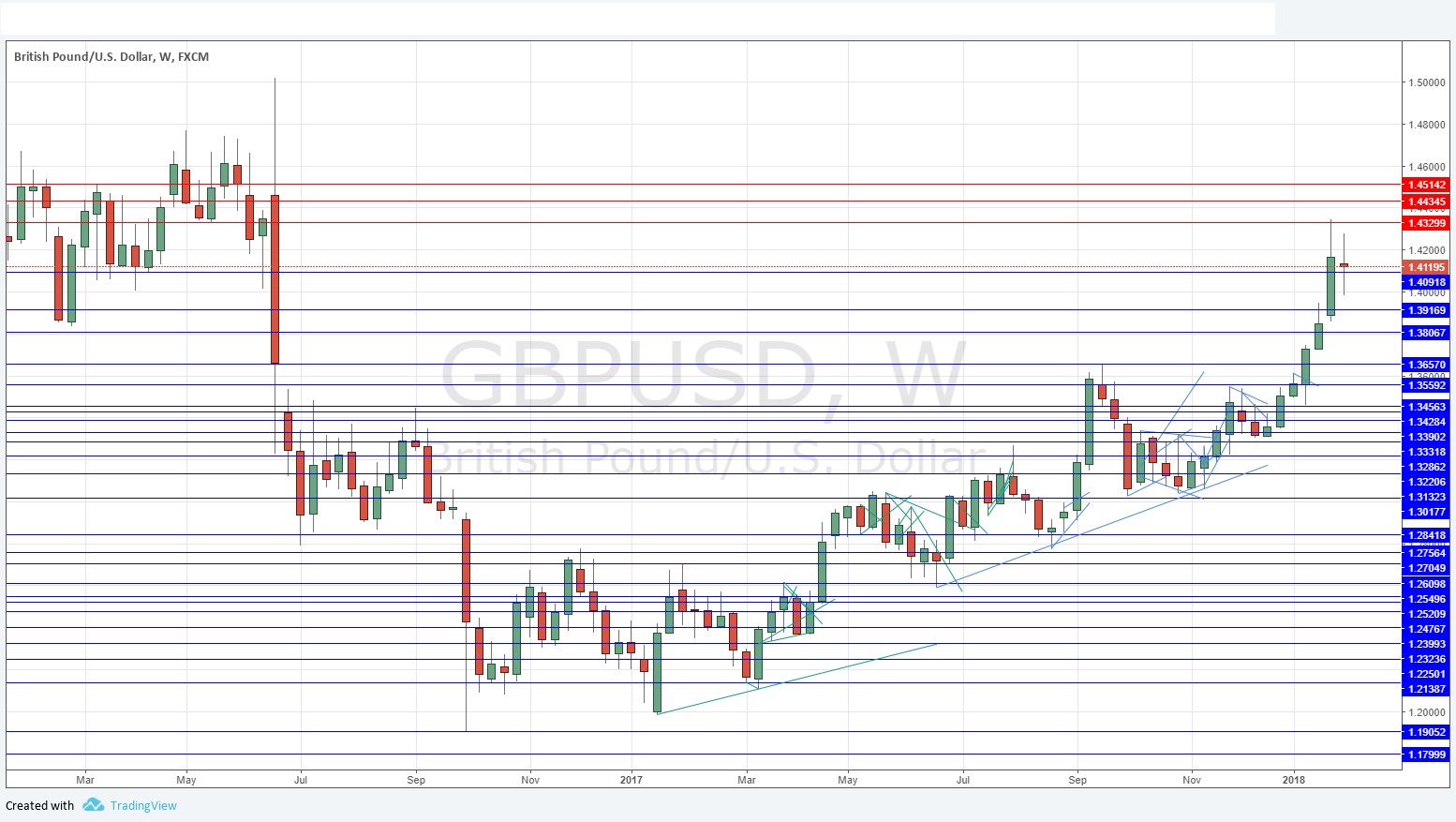

GBP/USD

This pair is in a long-term upwards trend, yet it failed to make a new 18-month high last week. Last week’s candlestick was an inside doji candlestick, suggesting indecision and signifying that bulls need to be cautious. The rejection of the psychologically key resistance at 1.4330, which marked a key inflection point in pre-Brexit trading, might also be another cap on the rise.

EUR/USD

This pair is in a long-term upwards trend, yet it failed to make a new 3-year high last week. Last week’s candlestick was a bullish inside near-doji candlestick, suggesting some indecision and signifying that bulls need to be cautious. The rejection of the psychologically key resistance at 1.2500, which marked a key inflection point in the past, might also be another cap on the rise.

Conclusion

Bullish on the EUR/USD and to a lesser extent the GBP/USD currency pairs.