Gold prices rose for a third straight session on Wednesday to settle at their highest level since January 29 as continued weakness in the U.S. dollar and inflation fears increased demand for the precious metal. XAU/USD tested the support at $1321 following strong U.S. inflation data but reversed its course when the stock market sold off and became volatile. Consumer price index for January came in at up 0.5% from December and the Commerce Department reported that U.S. retail sales dropped 0.3% last month.

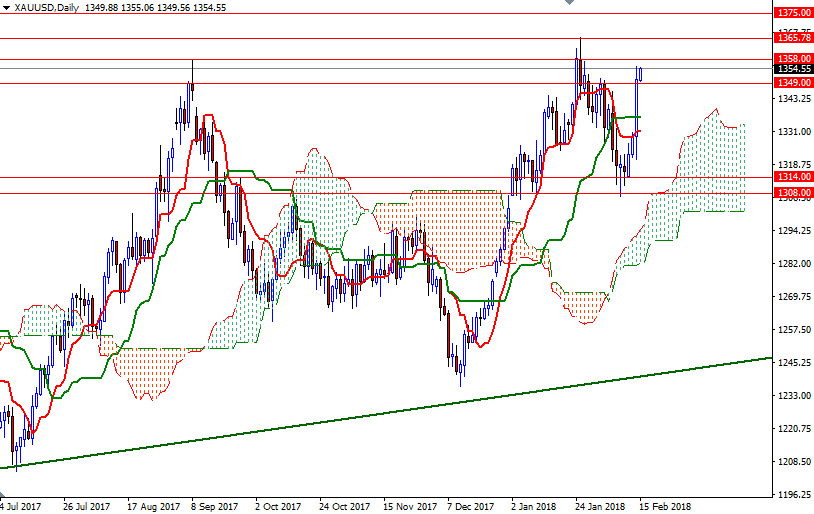

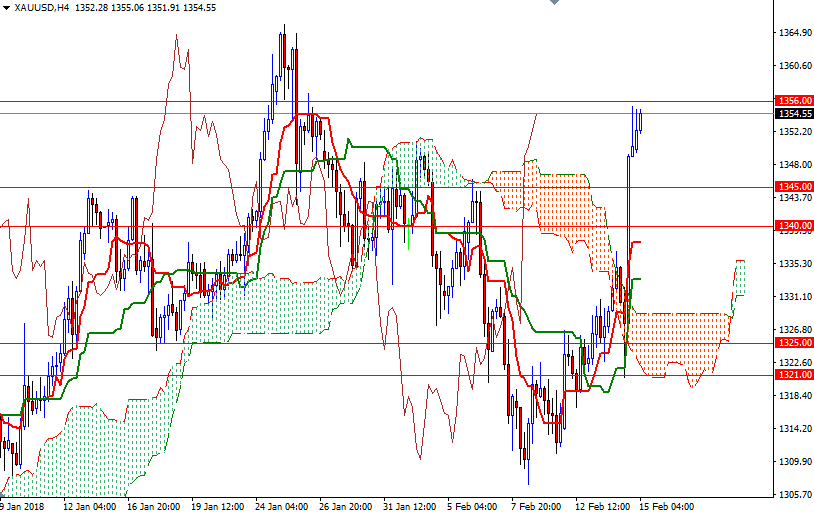

Technical buying was also behind gold’s 1.56% jump yesterday. Penetrating the resistance in the 1342/0 area triggered a fresh round of buying and lifted prices towards the next barrier in 1358/6. Prices are above the Ichimoku clouds on the daily and the 4-hourly charts. On the 4-hourly chart, the Tenkan-sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned and yesterday’s rallly pushed the Chikou-span (closing price plotted 26 periods behind, brown line) above the cloud.

Despite this positive picture, the bulls still have to pass through 1358/6 to challange 1362 and 1367/5. Closing above 1367 on a daily basis indicates that the market is about to test 1371 next. However, if the aforementioned resistance in 1358/6 remains intact, it is likely that XAU/USD will visit 1348. The bears will need to capture this strategic camp to tackle the next support at 1345. If this support is successfully broken, then 1340 will be the next target.