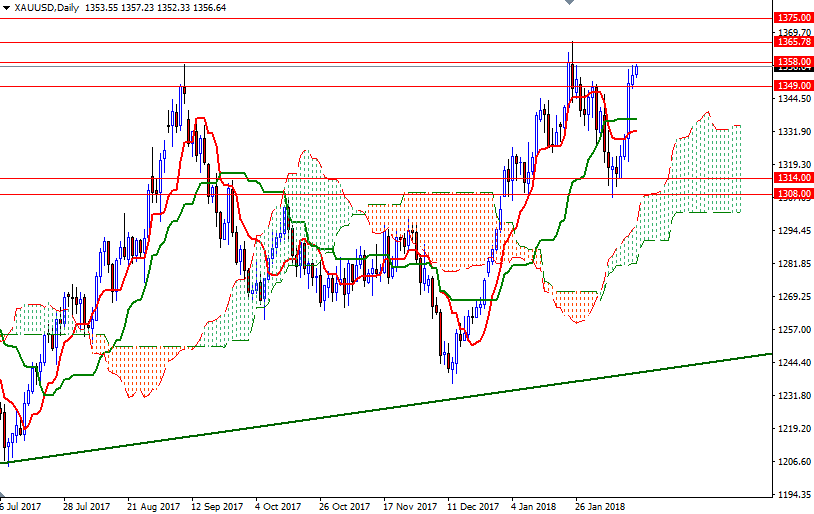

Gold prices ended Thursday’s session up $3.21 an ounce, extending gains to a fourth straight session, as dollar weakness continued. XAU/USD tested the anticipated support in the $1349-$1348 area before heading higher. The daily trading range was relatively tight as a critical resistance in the $1358-$1356 area prevented prices from going higher. The market is currently in the process of testing this barrier again.

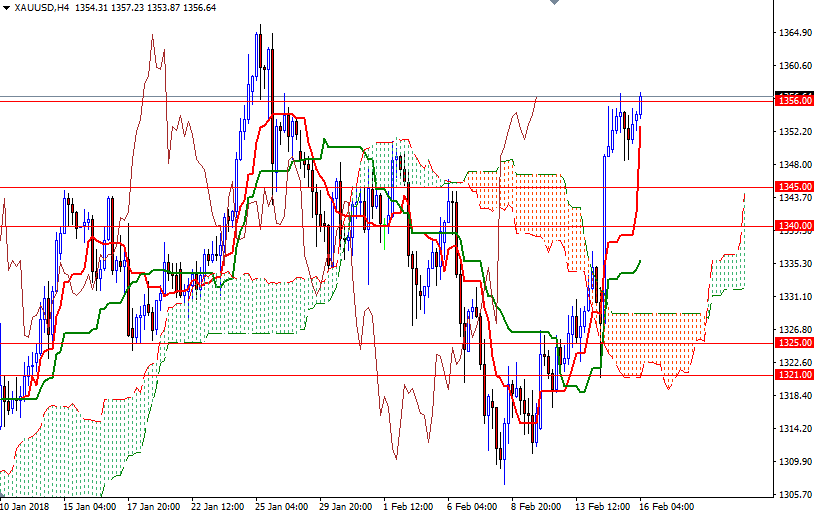

The short-term charts suggest that the bulls have momentum on their side. The market is trading above the Ichimoku clouds on the H4 and the H1 charts. The Tenkan-sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned. The Chikou-span (closing price plotted 26 periods behind, brown line) is above the 4-hourly cloud.

If the bulls can convincingly push prices above 1358/6, look for further upside with 1362 and 1367/5 as the next targets. A sustained break above the solid resistance in 1367/5 could foreshadow a push up to 1375. To the downside, the bears have to clear nearby supports such as 1351 and 1349/8. If the support in 1349/8 is broken, then the bears will be aiming for 1345. A break below 1345 paves the way for a test of the 1341 level.