Gold prices fell $14.16 an ounce on Tuesday, weighed down by a rally in the U.S. dollar following Federal Reserve Chairman Jerome Powell’s testimony before the House Financial Services Committee. “Some of the headwinds the U.S. economy faced in previous years have turned into tailwinds...Despite the recent volatility, financial conditions remain accommodative. At the same time, inflation remains below our 2 percent longer-run objective. In the FOMC’s view, further gradual increases in the federal funds rate will best promote attainment of both of our objectives,” Powell said. Gold prices seem vulnerable to the downside as the likelihood of four rate hikes this year by the Federal Reserve increases, but high volatility in the stock markets may lend some support to gold.

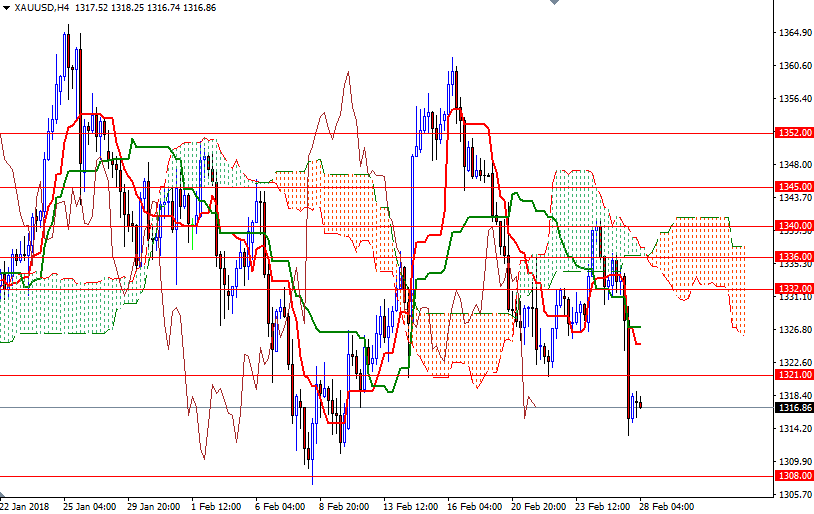

From a chart perspective, the bears still have the near-term technical advantage, with the market trading below the 4-hourly and the hourly Ichimoku clouds. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on the H4 chart and the Chikou-span (closing price plotted 26 periods behind, brown line) is below prices. However, note that the daily cloud sits right below, so I wouldn’t rule out the possibility of a bounce to 1321 (or even to 1325/4). The bulls have to push through 1325 to gain momentum for 1332. A break through there paves the way for 1336.

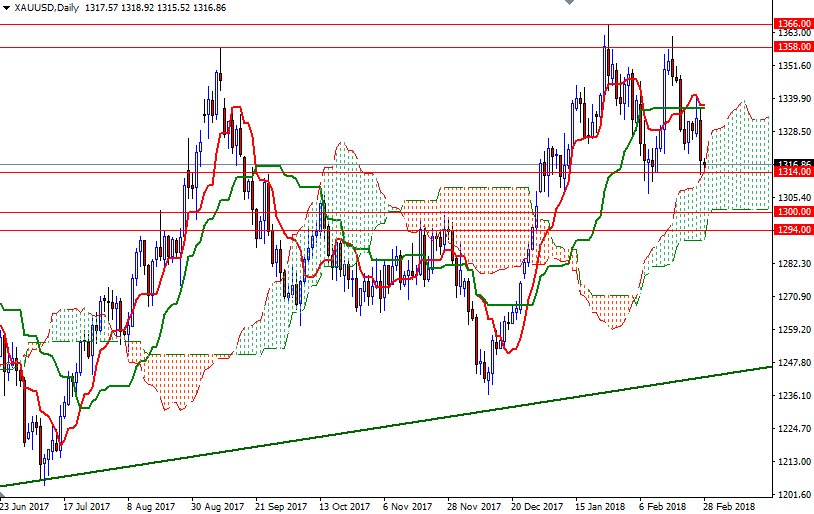

To the downside, keep an eye on the support in the 1314/2 area. If this support is broken, then XAU/USD will fall to 1308/5. The bears have to produce a daily close below 1305 to make an assault on 1301/0. A sustained break below 1300 implies that the 1294 level will be the next port of call.