Gold prices ended Monday’s session down $0.72 an ounce as the dollar recovered some of its recent losses. Although there is a perception that the dollar’s rebound will not last long, investors are understandably cautious ahead of the release of minutes from the Federal Reserve’s January meeting. XAU/USD is currently trading at $1341.79, lower than the opening price of $1346.82.

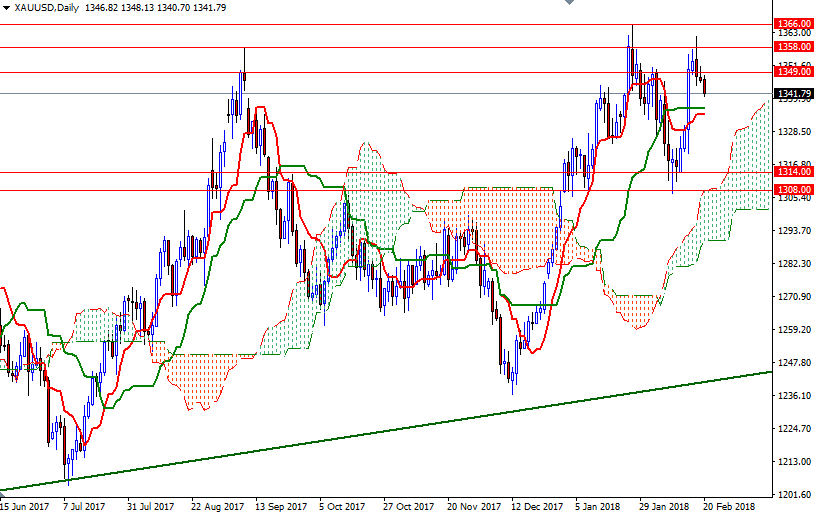

The market is currently in the process of testing the support at 1345. From a chart perspective, residing above the weekly and the daily Ichimoku clouds suggests that gold is likely to maintain bullish trend over the medium term. However, in the near term, downside risks remain as the market trades below the clouds on the H1 and the M30 charts. Negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) support this view.

If XAU/USD breaks down below 1340, prices will probably retreat to 1336/4. The daily Tenkan-sen and Kijun-sen converge in this area so the bears will need to drag prices below there to gain momentum for 1332/0. Below there, the 1325/1 zone stands out as a strategic technical support. To the upside, the initial resistance sits in 1346.60-1345. The bulls have to capture this camp to march towards the hourly Ichimoku cloud occupying the area between 1353.10 and 1351. If the bulls penetrate this barrier, they will be targeting 1358/6.