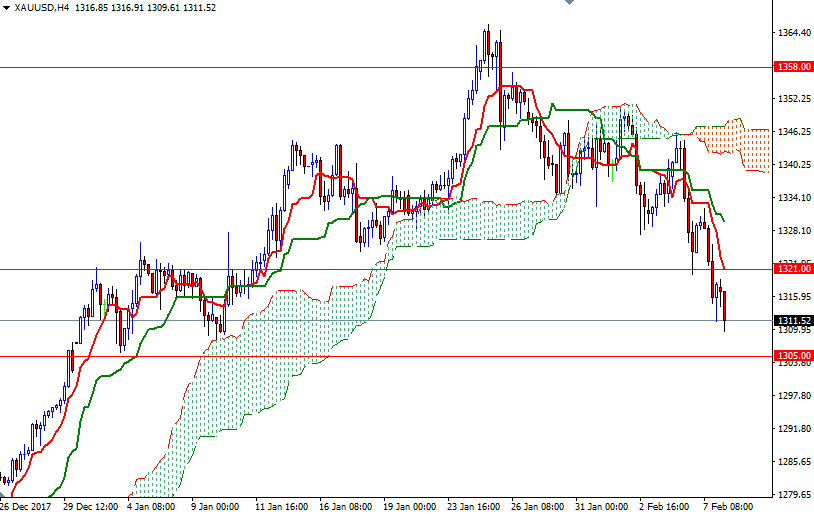

Gold prices declined for a second straight session on Wednesday to settle at their lowest level since December 11 as the American dollar continued to gain strength. The market initially headed higher but sellers returned to the market in the $1333-$1332 area. Not surprisingly, breaking below the $1321 level accelerated the downward movement and dragged prices to the next significant support in the $1314-$1312 zone. XAU/USD is currently trading at $1311.52 an ounce, lower than the opening price of $1317.66.

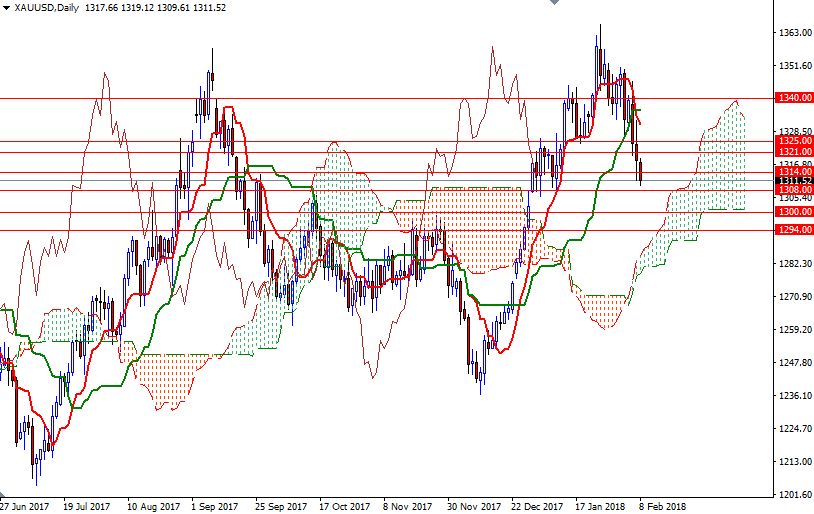

The short-term charts are still bearish, with the market trading below the Ichimoku clouds on the H4 and the H1 charts. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned. Prices are unable to climb back above 1314/2 so far, suggesting that downside risks remain. However, we have a critical support right below in the 1308/5 area, so expect to see some short-side profit taking as we approach. If the bears capture this strategic camp, they will be targeting 1300-1298 next.

To the upside, the initial resistance sits in 1315/4, followed by 1317. The bulls have to pull prices above 1317 to test 1321/19. If XAU/USD convincingly breaches this key barrier, then the 1326/5 area will be the next stop. Only a daily close above 1326 provide the bulls the extra fuel they need to march towards 1333/2.