Gold prices rose $5.39 an ounce on Monday as the dollar’s recent rally stalled ahead of key U.S. economic reports and a speech from Federal Reserve Chairman Jerome Powell later in the week. U.S. stocks started the week off with broad gains on Monday. Asian stock markets continue to advance today following gains on Wall Street. XAU/USD traded as high as $1340.95 after prices climbed above the $1332 level. However, a failure to sustain a push above the strategic $1340 level weighed on the market and dragged prices back to $1332.

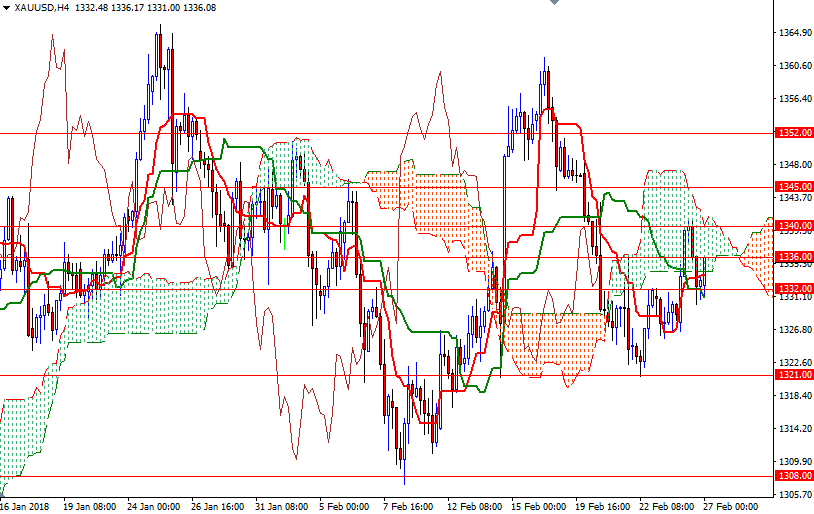

The market is currently in the process of testing the initial resistance at 1336, which also happens to be the daily Kijun-Sen (twenty six-period moving average, green line). Prices are moving within the borders of the 4-hourly Ichimoku cloud for the time being and in addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen are flat on both charts, indicating sideways trading in the near term.

If XAU/USD fails to break through 1336, we will eventually return to the critic support at 1332. The bears have to take out yesterday’s low to tackle 1326/5. A successful break below 1325 implies that the market will visit 1321 next. However, if prices get back above 1336, then the market will head towards the top of the Ichimoku cloud on the H4 chart. The bulls have to lift the market above 1342/0 to challenge the key resistance in 1347/5. A close above 1347 on a daily basis indicates that the bulls are going to challenge 1352 next.