Gold prices rose $6.60 on Wednesday, supported by pullbacks in major stock markets and a weaker dollar. The U.S. Federal Reserve kept short-term interest rates unchanged yesterday but signaled that borrowing costs would continue to climb gradually this year. Traders are now awaiting Friday’s non-farm payrolls report, which is arguably the most important U.S. data point of the month.

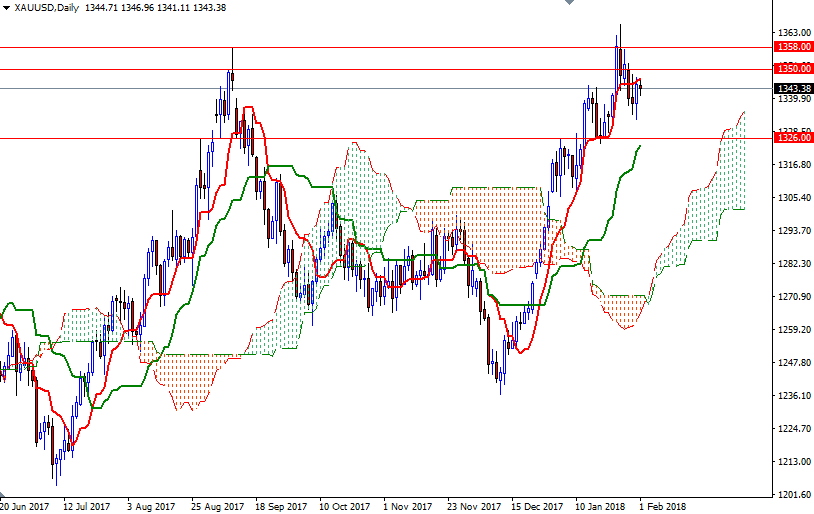

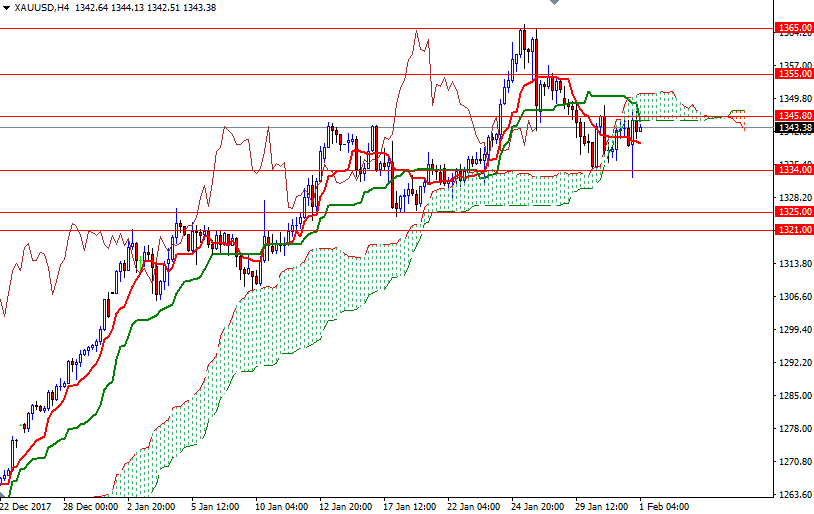

XAU/USD retreated to the 1334/3 area after the Fed announcement but found enough support there to reverse its course, creating a long lower shadow on the daily candle which suggests that buying interest continues to emerge on dips. However, downside risks remain as the market continues to trade below the Ichimoku cloud on the H4 chart. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) also supports this view.

The bulls have to lift prices above 1345 and take out yesterday’s high to tackle the resistance in the 1351/0 area. If prices can anchor somewhere above 1351, the top of the 4-hourly cloud, a move towards the 1358/5 area seems possible. A daily close above 1358 implies that the market is on its way to test 1365. To the downside, the initial support sits at 1338, followed by 1334/3. The bears have to capture the strategic support in the 1334/3 zone to gain momentum for 1329. If this support is broken, then 1326/5 will be the next port of call.