Gold prices ended Monday’s session up $7.72 an ounce as a rout in global equities pushed investors back into gold. The Dow Jones Industrial Average posted its biggest intraday decline in history, the S&P 500 recorded its steepest drop since 2015 and major indexes world-wide gave up their gains for the year. The recent turmoil in the wider financial markets is fuelling interest in gold as a shelter while reducing the likelihood of four rate hikes this year by the Federal Reserve.

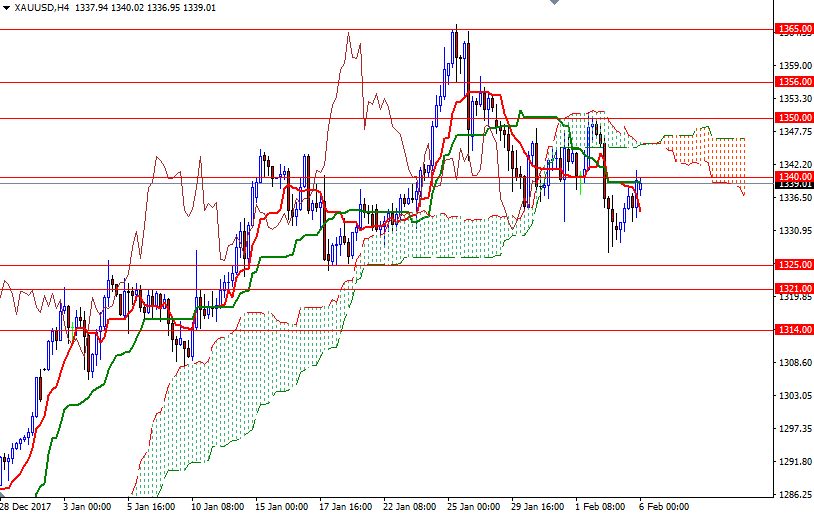

Yesterday’s advance pushed prices above the Ichimoku clouds on the H1 and the M30 time frames. Additionally, we have positive Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses on both charts. In other words, the short-term charts suggest a trip to the 4-hourly cloud, as long as the market stays above the hourly Ichimoku cloud. The bulls will need to lift prices above 1347/6 (the daily Tenkan-sen) to test the next barrier in the 1352/0 area. If this resistance is broken, the market will probably challenge 1358/6 next.

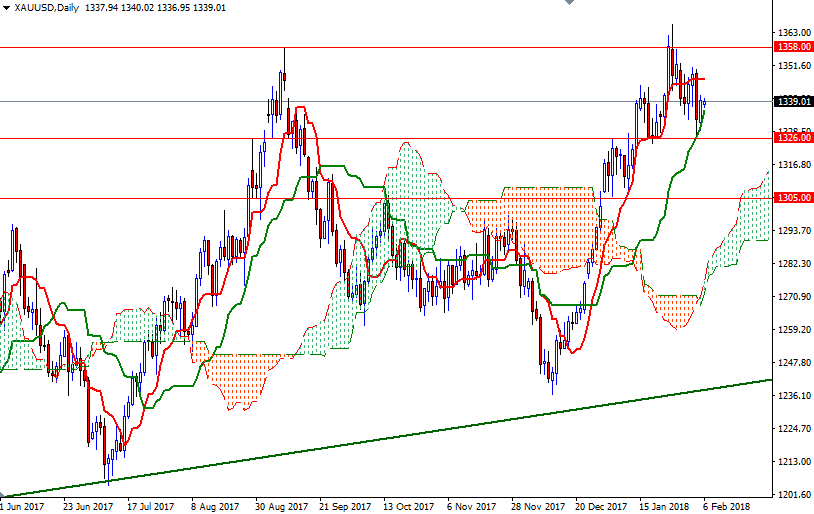

To the downside, the initial support sits at 1332, followed by 1326/5. If XAU/USD drops below 1325, the next target will be 1321. The bears have to produce a daily close below 1321 to gain momentum for 1314/2 (the 38.2% retracement of the bullish run from 1236.40 to 1365.95). Below 1312, the 1308/4 area stands out as a strategic support.