Gold prices rose $8.18 an ounce on Monday, helped by a softer dollar. The dollar slipped yesterday as world stock markets rebounded after two weeks of sharp declines. Gold has failed to attract strong investor interest as a safe haven despite big swings in stock markets but it still demonstrates a pretty strong inverse correlation with the main reserve currency. XAU/USD is currently trading at $1323.31 an ounce, slightly higher than the opening price of $1322.54.

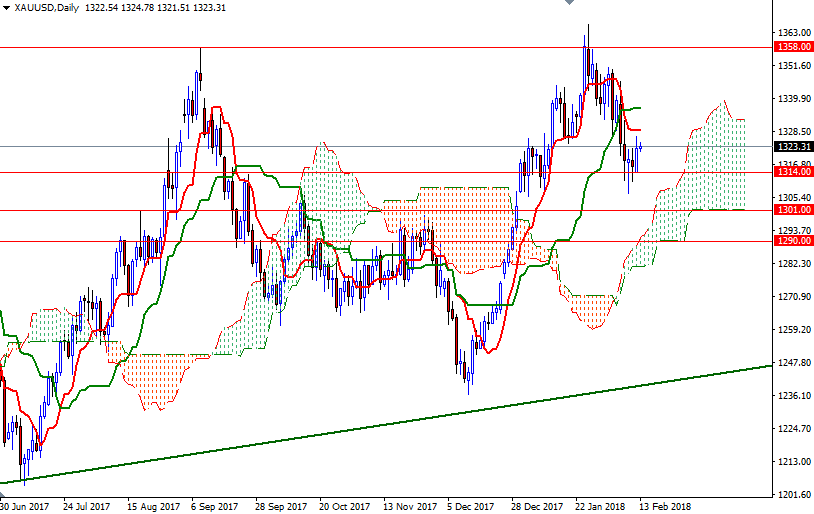

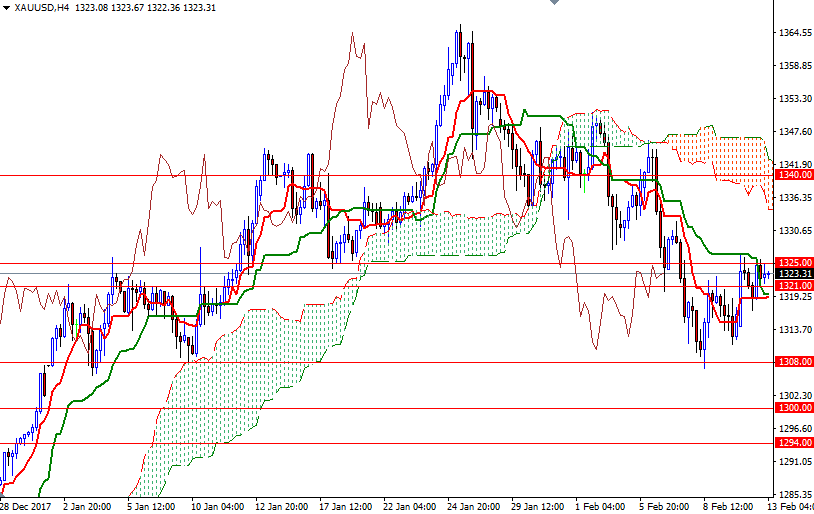

The market is trading below the Ichimoku clouds on the H1 and the M30 charts. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are positively aligned on both charts. It looks like XAU/USD will try to climb above the 1326/5 area one more time. If the bulls confidently takes out yesterday’s high, then the market will be heading towards the 4-hourly Ichimoku cloud. The bulls have to produce a daily close above the 1334.30-1332 area to gain momentum for 1342/0.

To the downside, the initial support sits in 1319-1316.60, the area occupied by the cloud on the H1 chart. If prices fall through, we could see the market testing 1314/2. The bears have to capture this strategic camp to revisit the key technical support in the 1308/5 zone. A break below 1305 suggests a move down to test 1300-1298.