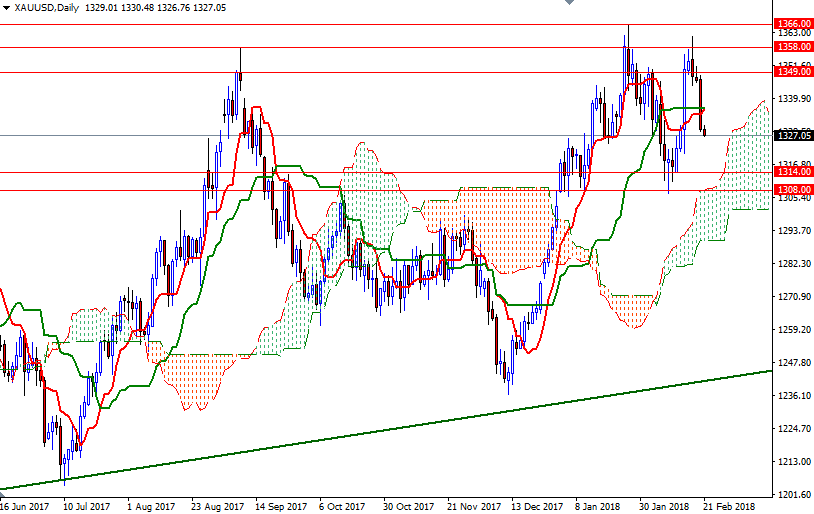

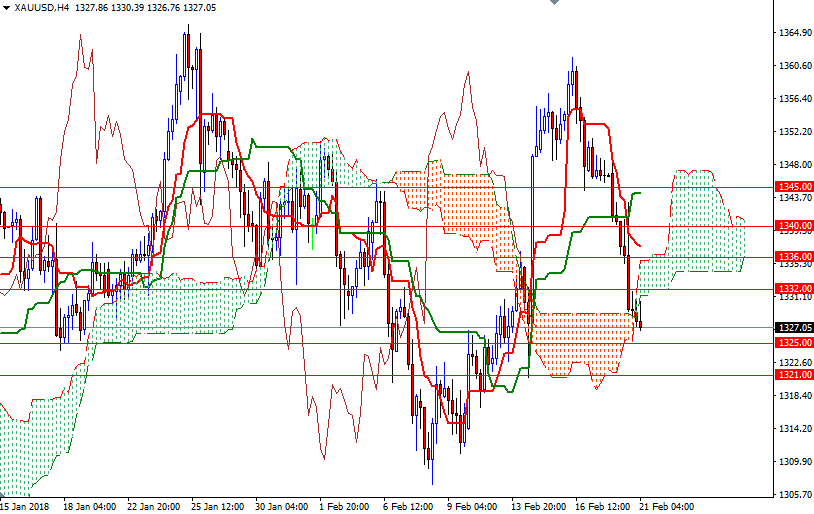

Gold prices continued to slide yesterday, extending losses from Monday’s session, as the dollar continued to appreciate. Technical selling pressure was also behind gold’s decline on Tuesday. Dropping through the support at $1340 attracted chart-based sellers and dragged prices to the Ichimoku cloud on the 4-hour chart as anticipated. XAU/USD is currently trading at $1327.05 an ounce, lower than the opening price of $1329.01. Market participants are awaiting minutes from the latest Federal Reserve Open Market Committee meeting, due to be released later today, for clues on policy makers’ opinion on the economy.

The near-term technical outlook for gold has shifted to the downside since prices broke below the 1345 level, and it looks like the market will test the nearby support in 1326/5 soon. The market is trading below the Ichimoku clouds on the 4-hourly and the hourly charts; plus, we have negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on both time frames. The 4-hourly Chikou-span (closing price plotted 26 periods behind, brown line) is below prices but moving inside the cloud.

With these in mind, I think the area between 1326 and 1321 will play an important role. If XAU/USD fails to stay above this area, prices will continue to slide towards the daily cloud. In that case, look for further downside with 1316 and 1314/2 as targets. A break below 1312 indicates that the market is aiming for 1308/4. To the upside, the initial resistance sits in 1333.30-1332. If the bulls can pass through, they will have a chance to challenge the next barrier in the 1336.50-1336, the confluence of the daily Tenkan-sen and Kijun-sen. Closing above there on a daily basis suggests that the market is getting ready to test 1342/0 and possibly 1345.