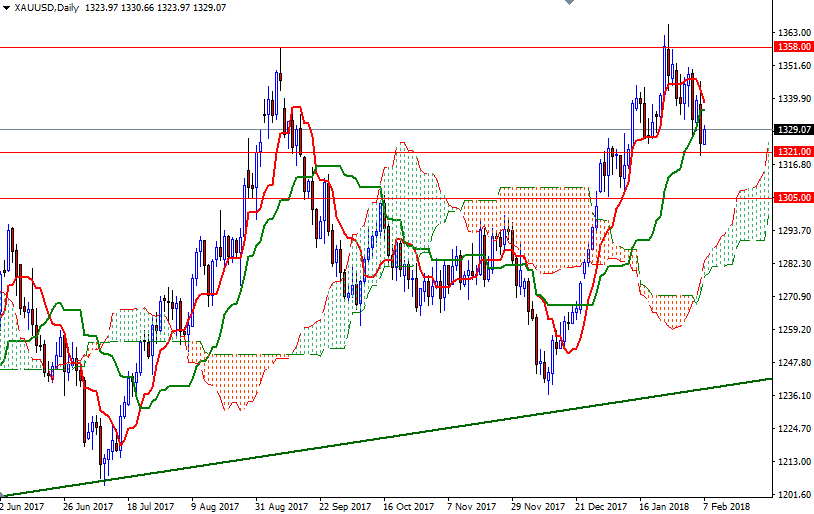

Gold prices fell $13.72 an ounce on Tuesday as strength in the U.S. dollar and a recovery in stock markets weighed on the market. XAU/USD initially reached the Ichimoku cloud on the 4-hourly chart as anticipated but it was unable to pass through. Consequently, prices broke below $1332 and retreated all the way back to the support at the $1321 level. World stock markets were mostly higher yesterday and the major U.S. stock indexes recouped some of Monday’s losses.

Asian share markets gave up their earlier gains today, which is a positive element for the safe-haven gold. From a chart perspective, the bulls still have the long-term technical advantage, with the market trading above the weekly and daily Ichimoku clouds. However, downside risks remain in the near term as prices reside below the clouds on the H4 chart. The 4-hourly Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned.

The bulls have to pass through the area between the 1333 and the 1335 levels to make another trip to the cloud on the H4 chart. The top of the clouds currently sits at 1346.64 so XAU/USD will need to climb above there to gain momentum for 1351/0. On the other hand, if prices fall back below 1325, it is likely that we will retest the support at 1321. Breaking down below 1321 would open up the risk of a fall to 1314.