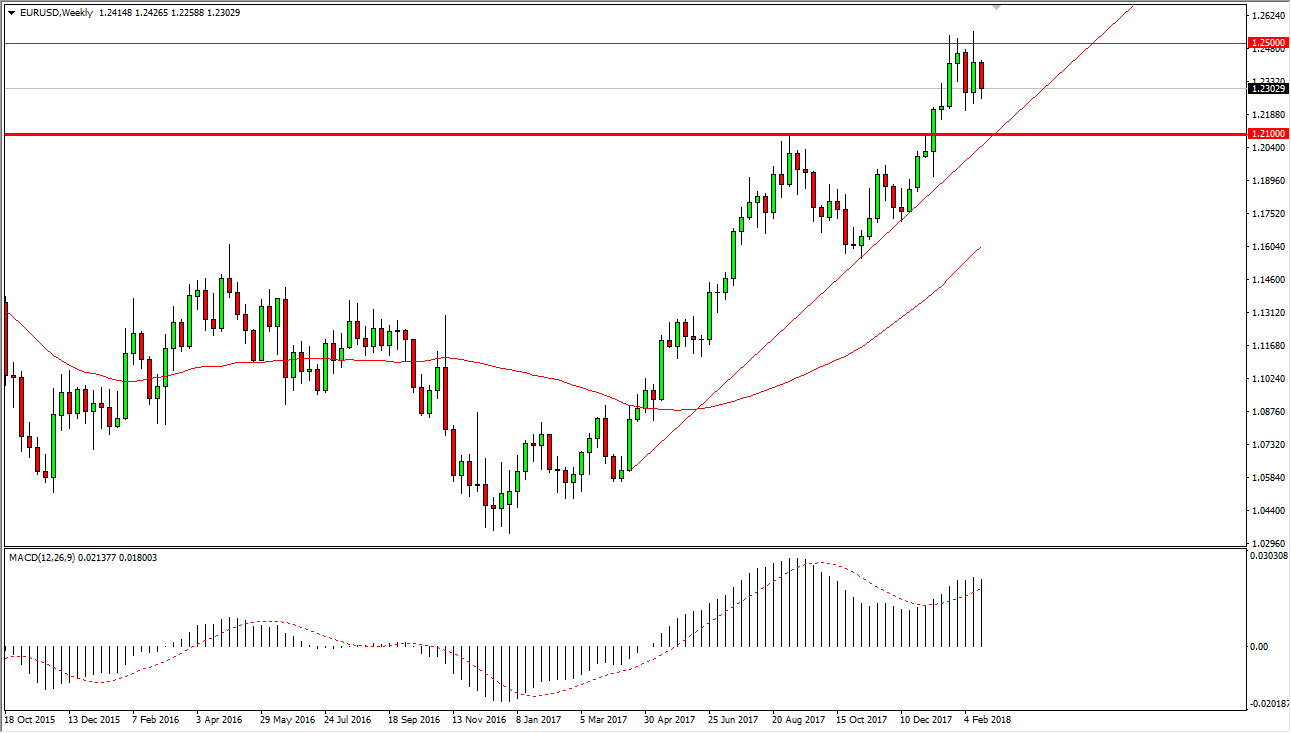

EUR/USD

The EUR/USD pair spent most of the week selling off, but I think going forward we are probably looking at more of a sideways grind than anything else. I expect this week to be very choppy, but I do know that the last 3 weeks have all had higher lows, a slightly positive sign. As we build momentum, I believe that we are trying to finally have enough inertia to break above the 1.25 level. I don’t know it’s going to happen this week, but I do think it will happen relatively soon.

GBP/USD

The British pound fell during most of the week, but as you can see bounced enough to form a nice-looking hammer. The hammer of course is a bullish sign, so break above the top of the hammer is technically a signal to start buying. If we do see that signal fire off, I suspect that we will continue to try to chip away at the resistance above at the 1.43 handle, but I don’t think that a breakout is necessarily imminent. Because of this, I think that could be a short-term “buy the dips” mentality here.

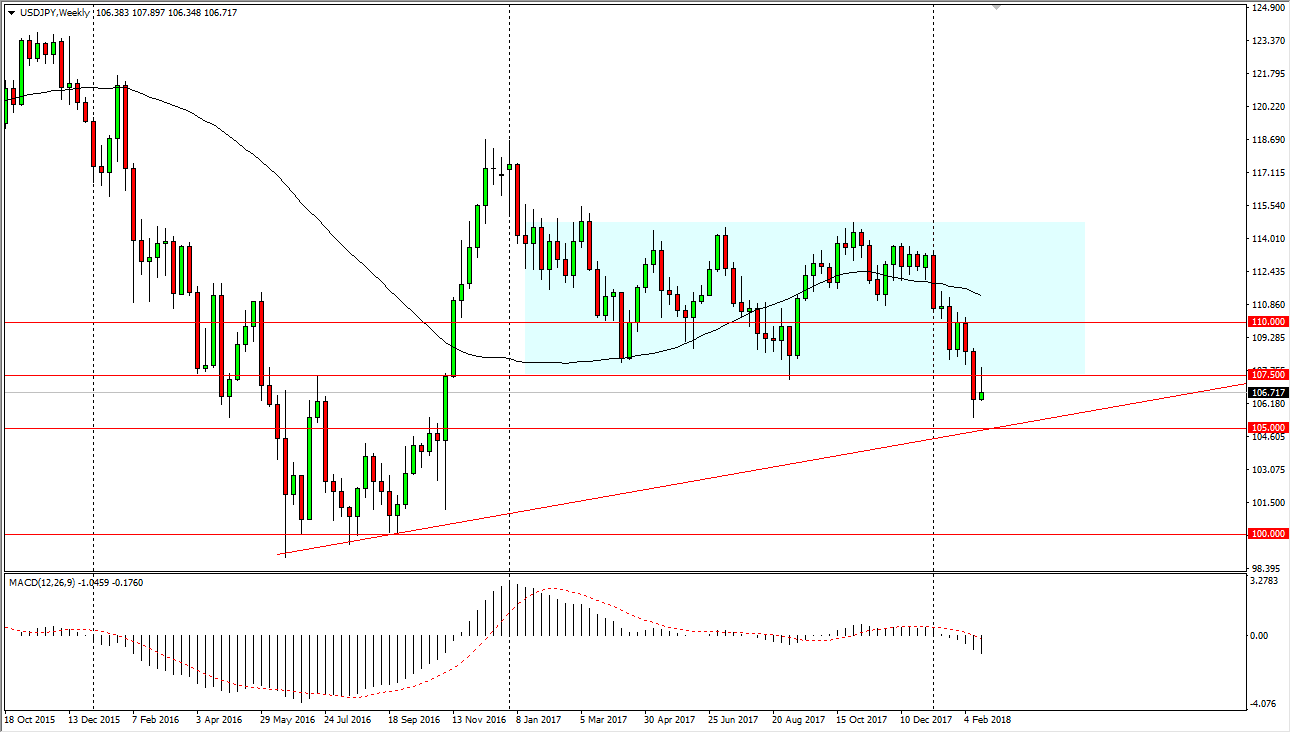

USD/JPY

The US dollar rallied against the Japanese yen initially during the week but found the 107.50 level to be too resistive to continue going higher. Because of this, I think that the market will continue to struggle a bit but given enough time I think that the buyers will return. In the time being, it appears to be that the market could drift towards the uptrend line that I plotted on the chart, which is roughly 105 or so.

AUD/USD

The Australian dollar has fallen during most of the week but found enough support towards the end to bounce above the 0.78 level, showing signs of life again. The market continues to favor the upside overall, and I think at this point we are seeing consolidation that could be the beginning of momentum building to the upside. I recognize that breaking out to a fresh, new high would be a very bullish sign, but I think it’s going to take a lot of work based upon historical precedents of the 0.80 region. Buying short-term dips might work for short-term trades.