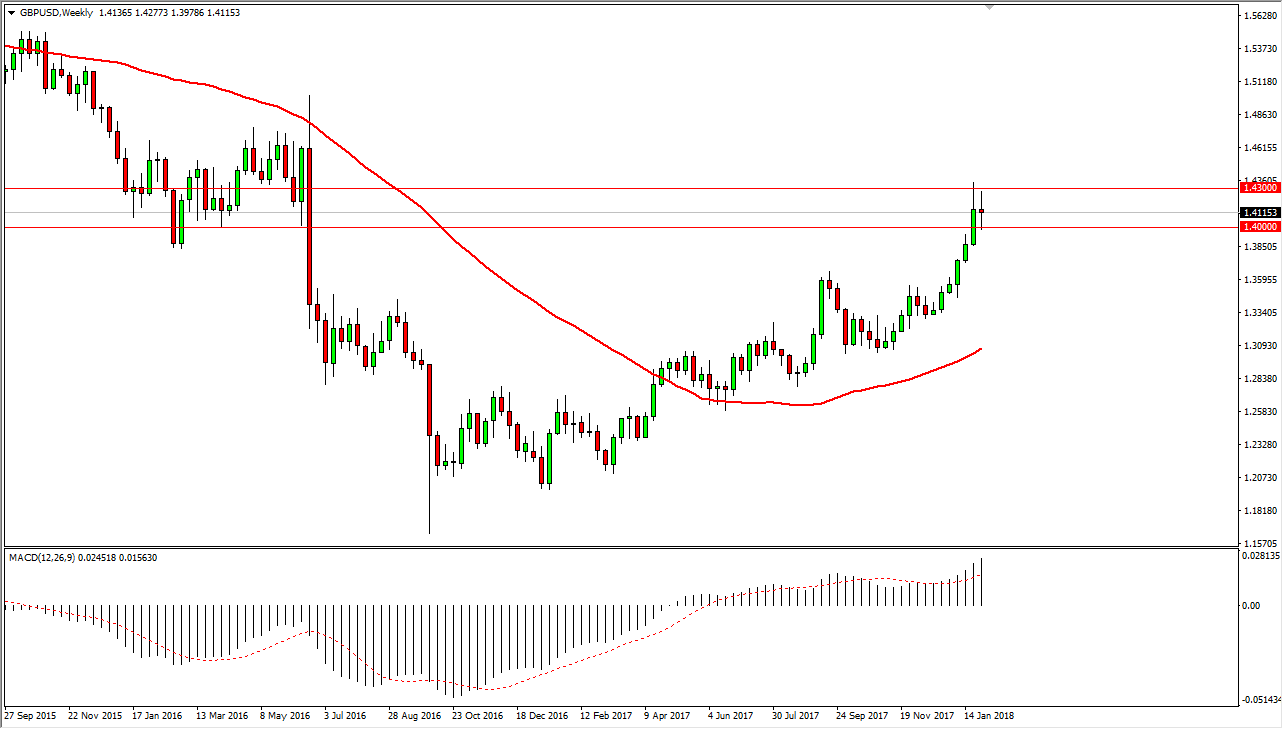

GBP/USD

The British pound has gone back and forth during the week, forming a stagnant candle, showing signs of weakness at one point, but also showing signs of resiliency. I think that if we can break above the 1.43 level, the market should continue to go higher, reaching towards the 1.45 level. Otherwise, I would anticipate that the 1.40 level underneath should be massively supportive. If we break down below there, then the market will go looking towards the 1.3650 level for support which has been there previously.

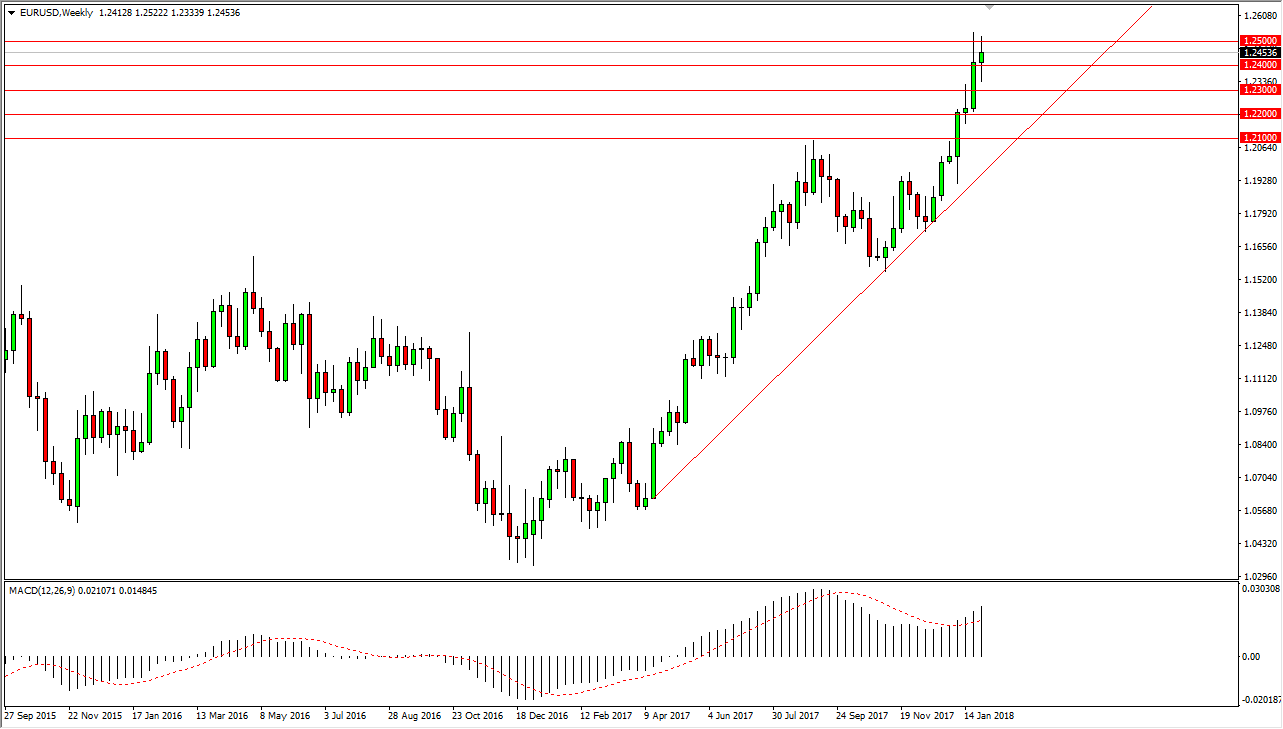

EUR/USD

The EUR/USD pair has gone back and forth during the week, and it looks as if we are trying to break out above the 1.25 handle. I think that the market pulling back from here will more than likely offer value the people are willing to take advantage of, especially near the 1.23 handle. Longer-term, this is an uptrend, but we may be running out of momentum.

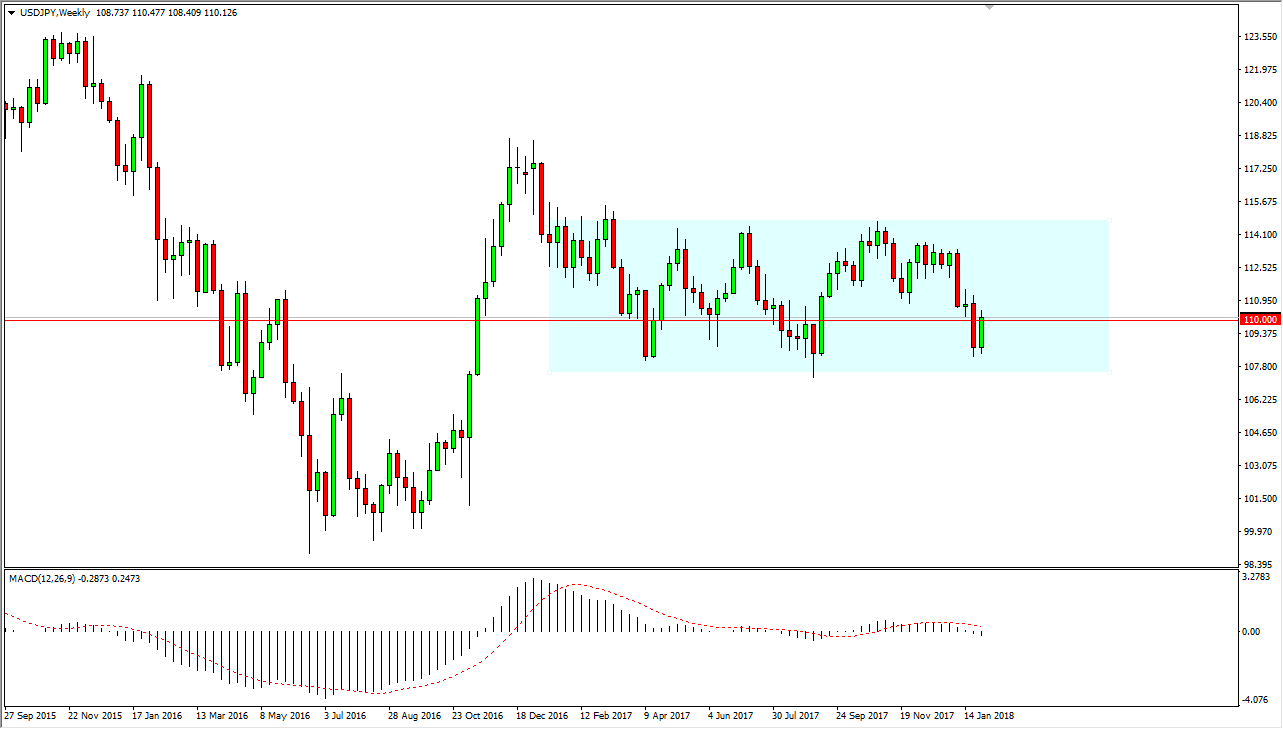

USD/JPY

The US dollar has rallied a bit during the previous week, as we have now broken above the 110 handle. This is a market that has been consolidating for some time, and I think that the market is ready to go higher, perhaps reaching towards the top of this range at the 114 handle. It’s going to take a while to have that happen, so I’m a bit hesitant to jump in with both feet, but if you are a longer-term trader, then obviously this would be a reversion to the mean.

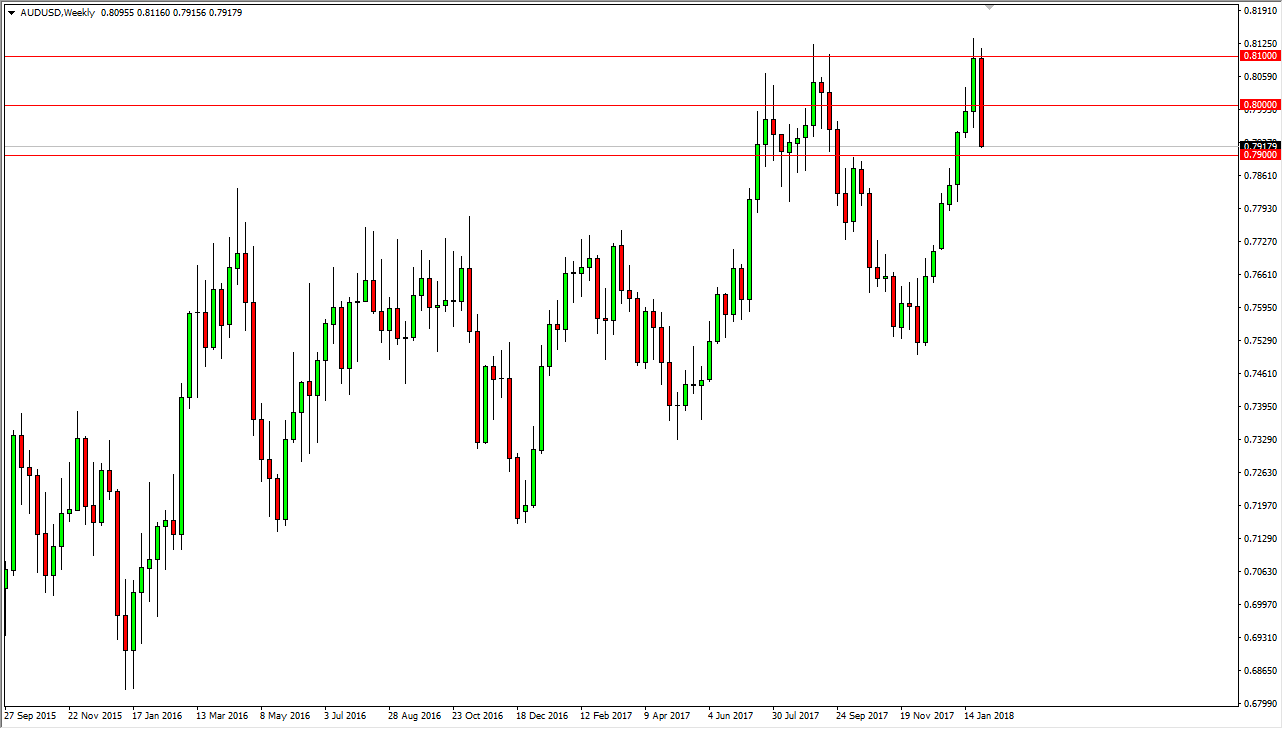

AUD/USD

The Australian dollar has gotten pummeled during the week, breaking down towards the 0.79 level. It looks as if that level will be violated, and if it is I think will lose 100 pips rather quickly. Otherwise, we could consolidate, but I would be very hesitant to buy until gold show signs of significant strength.