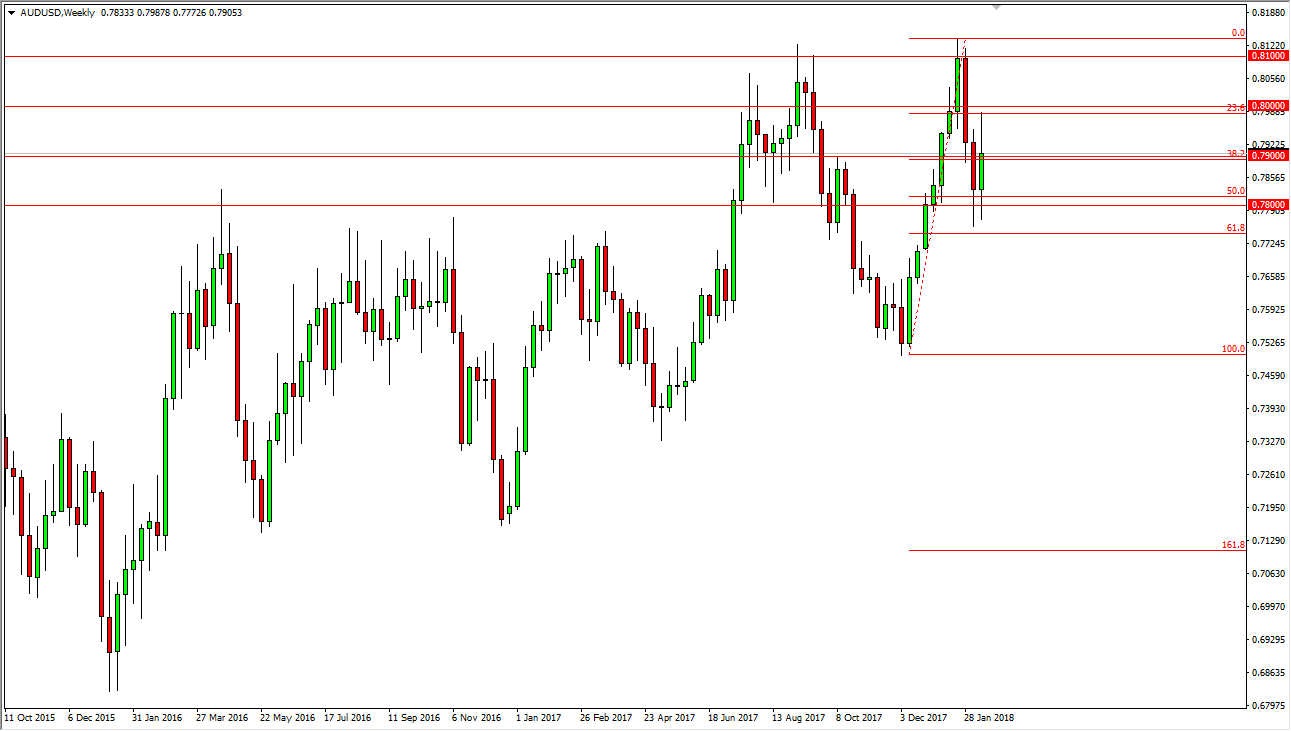

AUD/USD

The Australian dollar went back and forth during the week, but ultimately wiped out most of the losses from the previous week. I think we continue to consolidate going forward, probably using the 0.8 level as a bit of a ceiling, while the 0.78 level underneath will probably offer support. Eventually though, I do believe that the buyers win this argument.

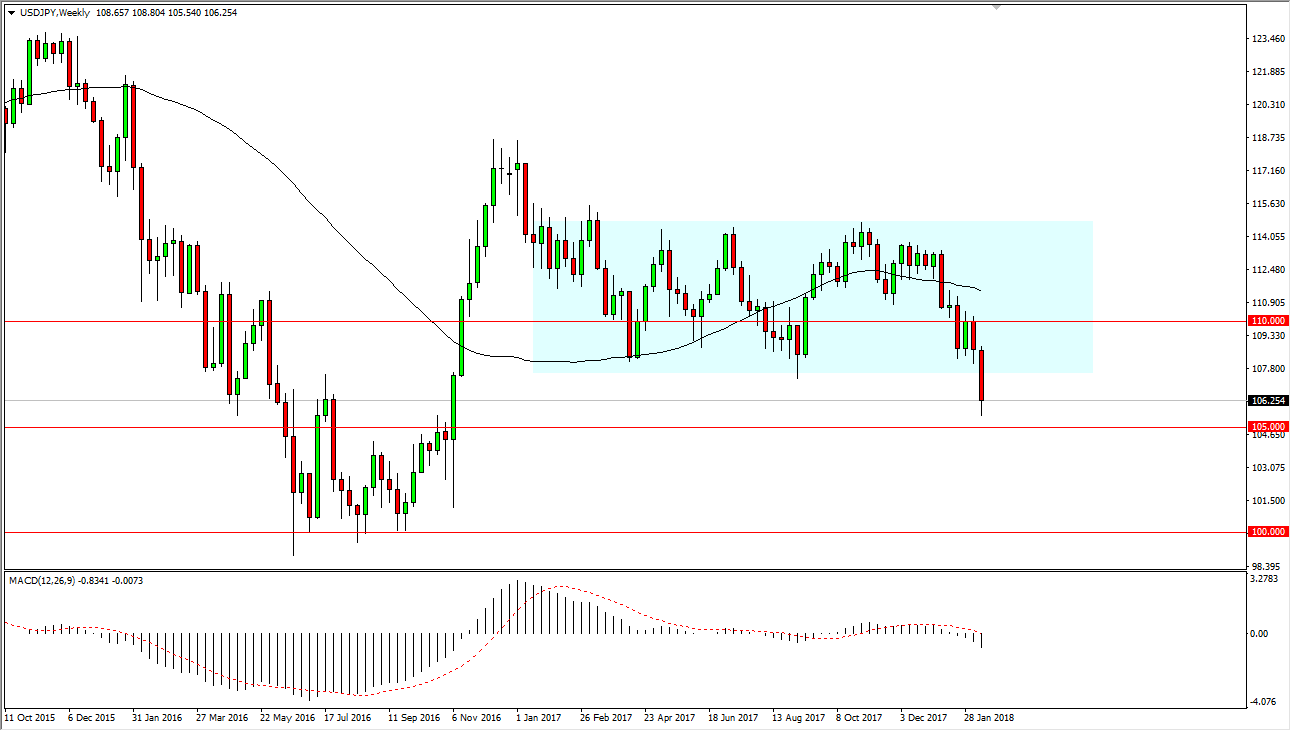

USD/JPY

The US dollar has fallen against the Japanese yen during the previous week, breaking down below the 106 level at one point. I think we will start out the week rallying a bit, but I think that the 107.50 level will offer a lot of resistance. If we roll over from there, the market will go looking towards the 105 level. Alternately, if we get a daily close it significantly above the 107.50 level, the market will start looking for the 110 level again.

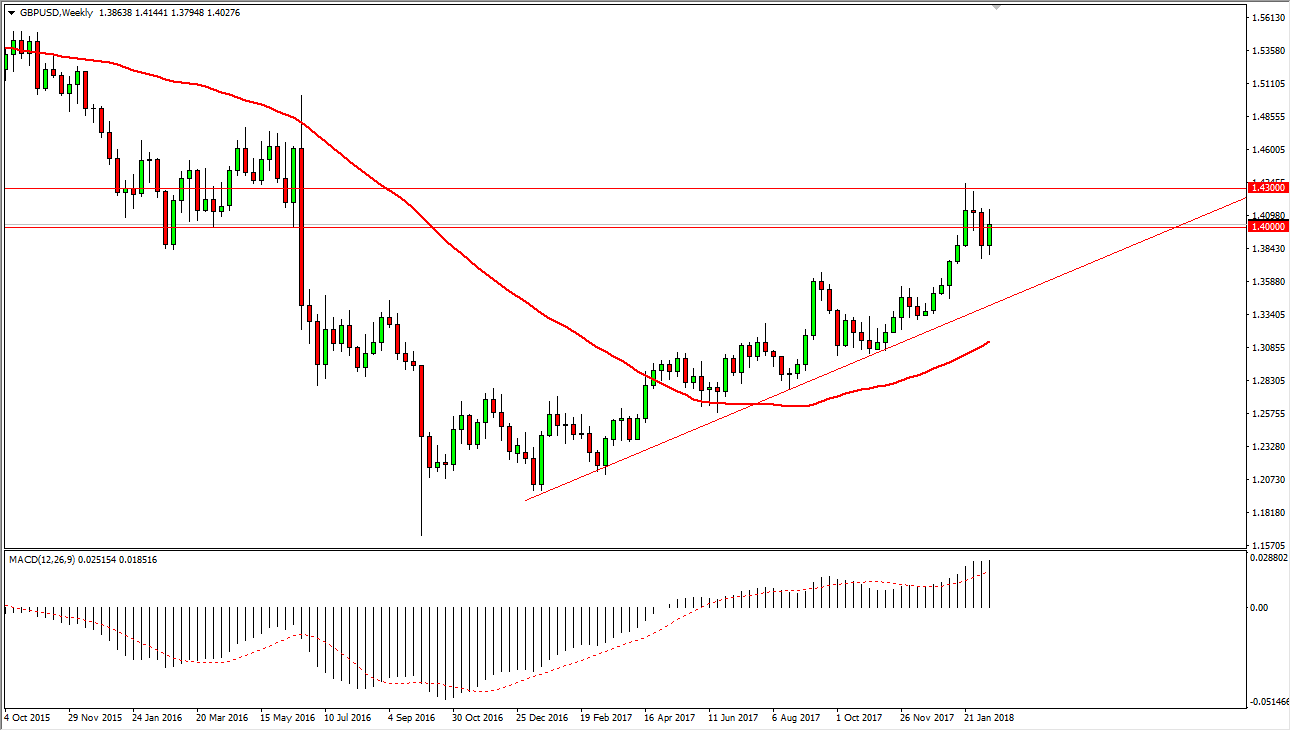

GBP/USD

The British pound rallied during the week, breaking above the 1.40 level. It looks as if there is a lot of noise just waiting to happen above, so I think this is going to be a bit more of a grind than anything else. I do anticipate that we eventually go challenging the 1.43 level again, but I would have to believe that there is a lot of order flow in that area, as we have such a huge red bar after the vote to leave the European Union was announced. This can clearly be seen on the weekly chart.

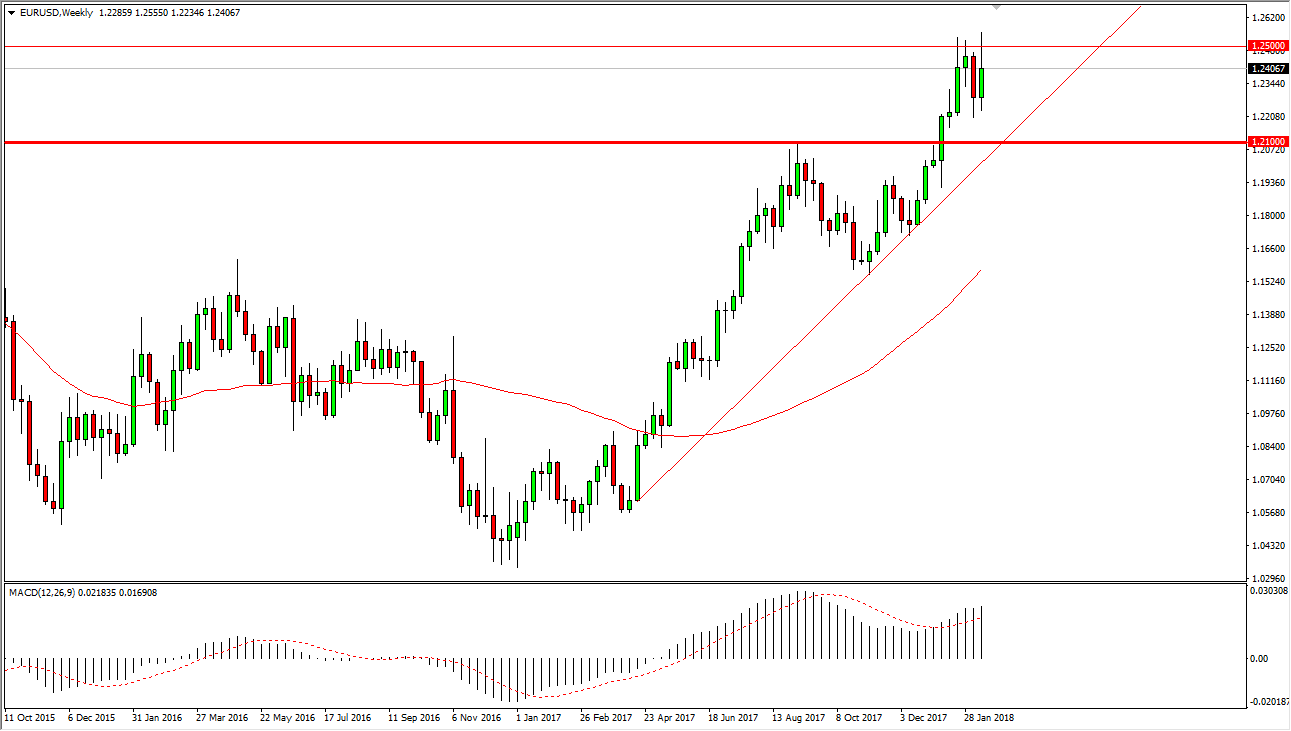

EUR/USD

The EUR/USD pair rallied significantly during the week but saw a lot of selling pressure on Friday. Because of this, I anticipate that we will see more bearish pressure early in the week, but eventually the buyers should return. It’s not until we break down below the 1.21 level that I’m concerned, and of course the uptrend line that you see on the chart. In other words, I think that there will be value to be found in this pair later on in the week as we continue to grind sideways overall, trying to build up enough momentum to finally clear the 1.25 handle.