Gold ended the week up $33.44 at $1347.65 an ounce, driven by a weak dollar. Despite a number of factors that should be driving the dollar higher, it is sliding again. The raft of data releases from the U.S. reinforced the perception that U.S. economy is in pretty good shape. There continues to be some risk aversion in the world marketplace, for the time being, and that is a positive element for the safe-haven gold.

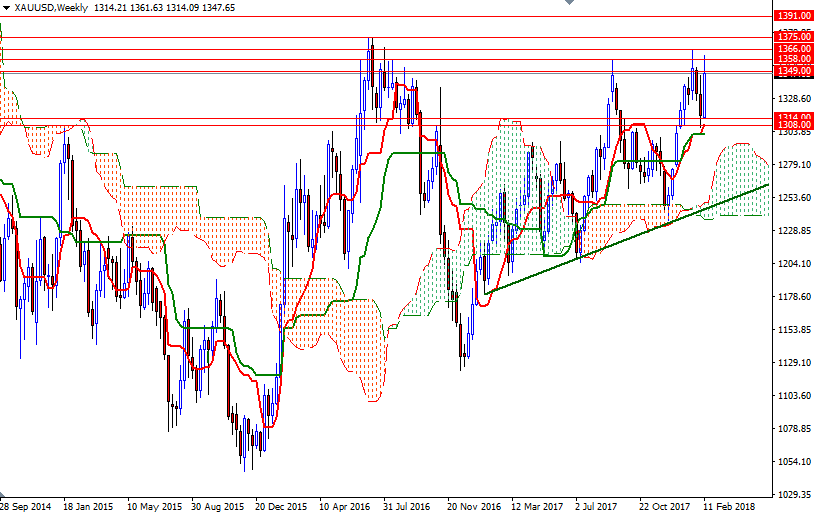

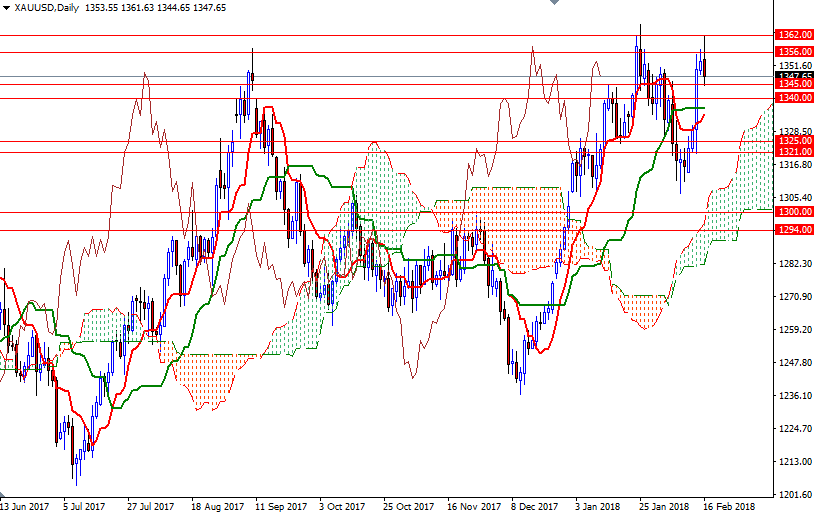

XAU/USD extended its gains after the market managed to stay above the 1325/1 area, some mild profit-taking pressure was featured after recent price gains that saw gold hit a three-week high on Friday. The bulls have the overall technical advantage, with the market trading above the weekly and the daily Ichimoku clouds. The Chikou-span (closing price plotted 26 periods behind, brown line) is above both prices and the clouds. However, if XAU/USD fails to get back above the 1358/6 area, we may see some downside corrective action.

In that case, 1340 and the weekly Kijun-Sen (twenty six-period moving average, green line) at 1335, could be tested. The bottom of the 4-hourly cloud sits in the 1332/0 area and the bears have to produce a daily close below there to challenge the bulls waiting on the 1325/1 battlefield. If the bulls, on the other hand, lift prices above 1358, XAU/USD may retest the resistance at 1362. Closing above 1362 on daily basis implies that the bulls are on their way to tackle 1367/5. The bulls overcome this strategic barrier to reach 1385/2. Beyond there, the 1391 level stands out as an obvious key technical resistance.