Gold prices settled at $1328.75 an ounce on Friday, suffering a loss of 1.37% on the week, as concerns about higher interest rates resurfaced following the release of minutes from the Federal Reserve’s January meeting. Minutes from the Federal Reserve Open Market Committee's January meeting showed that the U.S. central bank remains on track to raise rates gradually this year. Global stocks moved higher Friday and U.S. stock indexes ended the week slightly higher. The big U.S. economic report of the week will be Wednesday’s economic growth report.

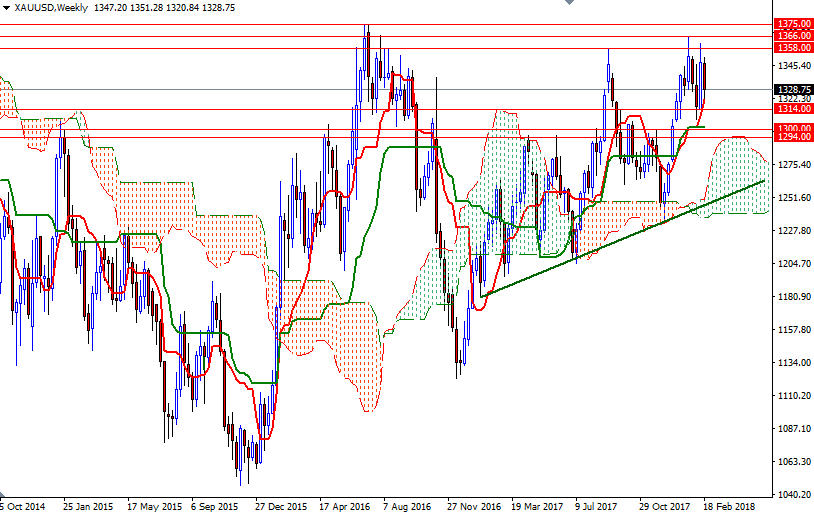

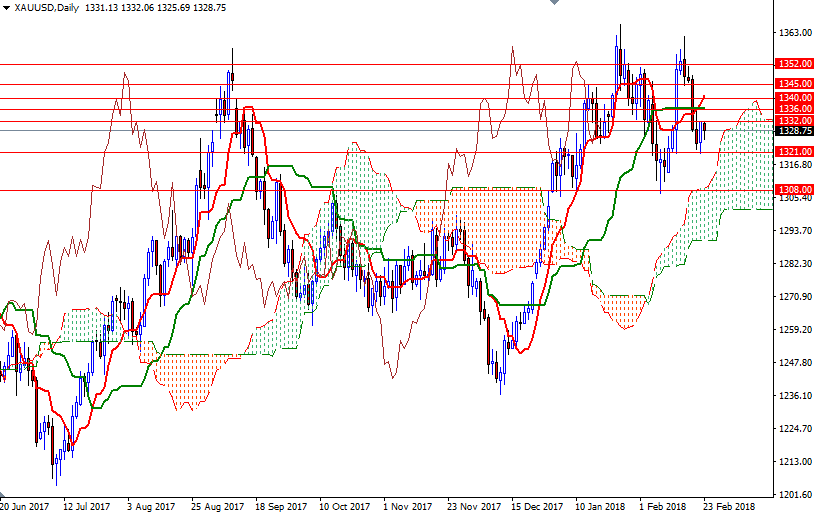

From a chart perspective, there are two things catch my attention at first glance. XAU/USD is trading above the weekly and daily Ichimoku clouds, suggesting that the market is likely to maintain bullish trend over the long term. However, the short-term charts are bearish, with prices below the 4-hourly cloud. In addition to that, prices are also below the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line).

If the support at 1321 is broken, look for further downside with 1316 and 1314/2 as targets. Below there, the 1308/5 area stands out as a major support in sight. Closing below 1305 opens up the risk of a fall to 1301/0, the bottom of the daily cloud. The bears have to capture this strategic camp to make an assault on 1294. The bulls, on the other hand, have to push prices back above 1336 to test 1340 and 1347/5. If this barrier is taken out convincingly, then the next target will be 1352. A daily close above 1352 is essential for a push up to challenge the key resistance in 1358/6.