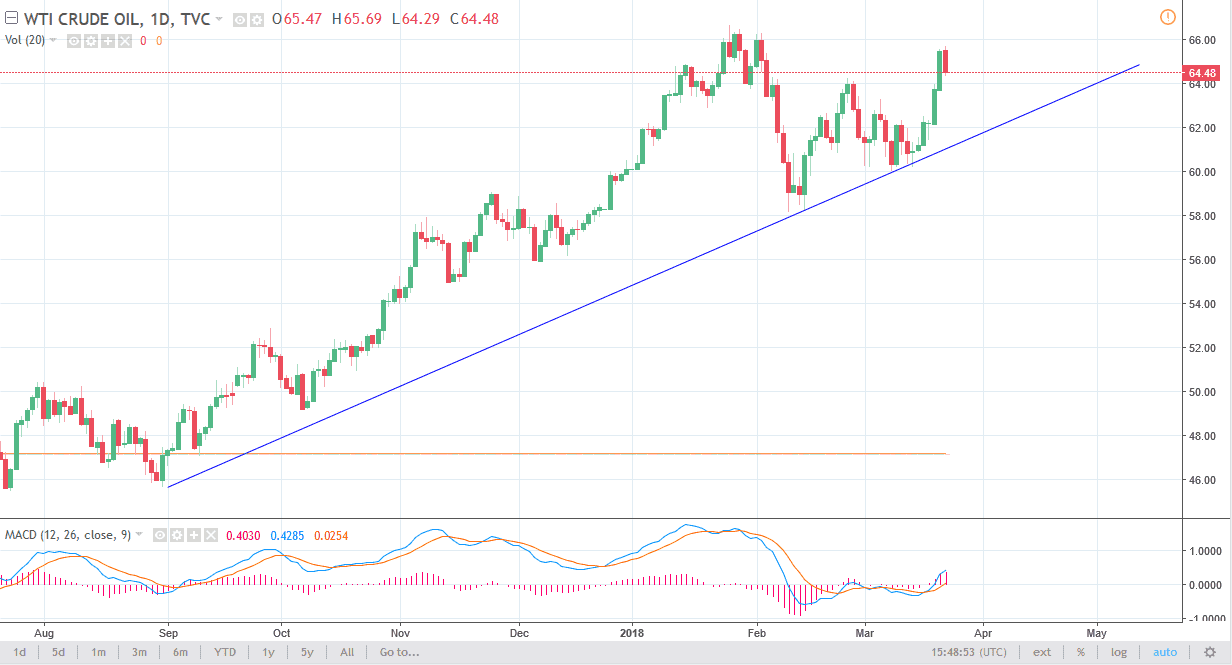

WTI Crude Oil

The WTI Crude Oil market pulled back significantly during trading on Thursday, as the $66 level continues to offer resistance. By pulling back the way we have, we could test the $64 level for support. I think a lot of the selling is due to the potential trade war between the United States and China, which could disrupt a lot of global demand, and of course beyond that we have been a bit overextended. That in mind, I believe that we may pull back a little bit further, but again I think that the $64 level could offer a bit of support. If we break down below the $64 level, the market will probably test the $62 level next. Otherwise, if we break above the $66 level, the market could continue to go much higher, perhaps reaching towards the $70 level.

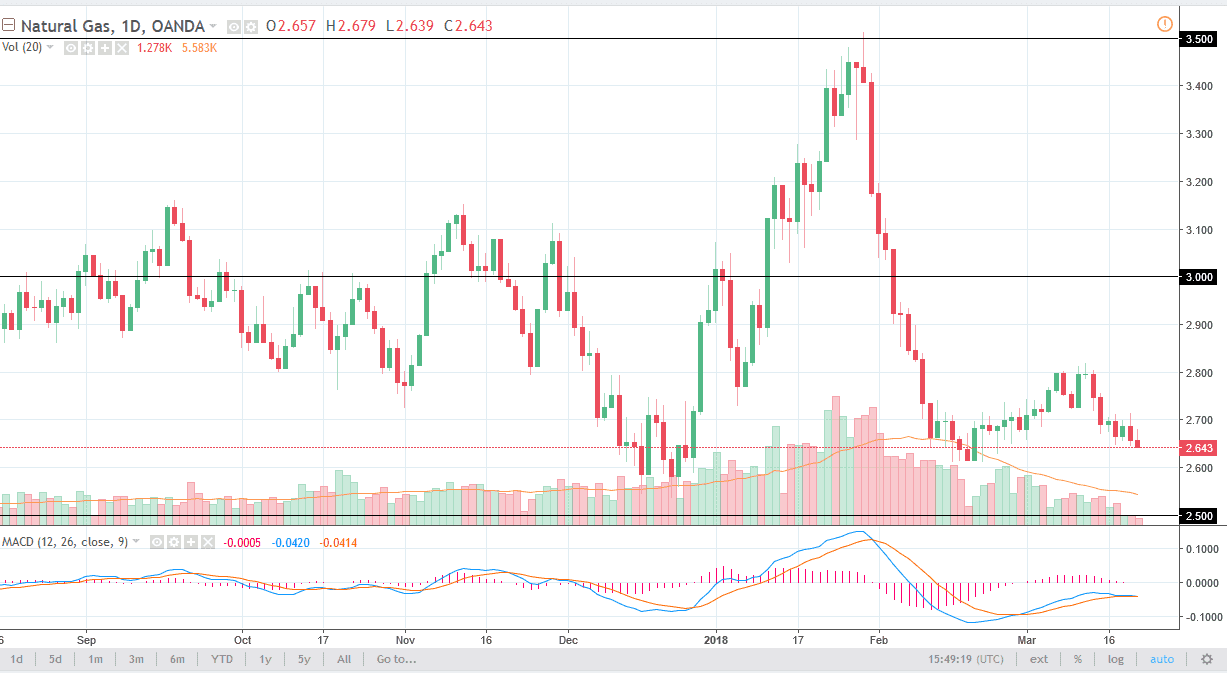

Natural Gas

Natural gas markets initially tried to rally during the session on Thursday but turned around to form a shooting star like candle. The market suggests that the $2.70 level is offering resistance, but I think that we are low enough that perhaps a bounce is needed. In the short term, it doesn’t look like we’re going to get it, but I would be more than willing to sell rallies as they show signs of exhaustion. The $2.80 level was massive resistance, and I think a bounce to that area would invite fresh sellers. The $2.60 level extends down to the $2.50 level as far as support is concerned, and a breakdown below the $2.50 level would be catastrophic. I continue to sell short-term rallies in small positions, as we continue to see a lot of negativity.