Today’s AUD/USD Signals

Risk 0.50%.

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trades

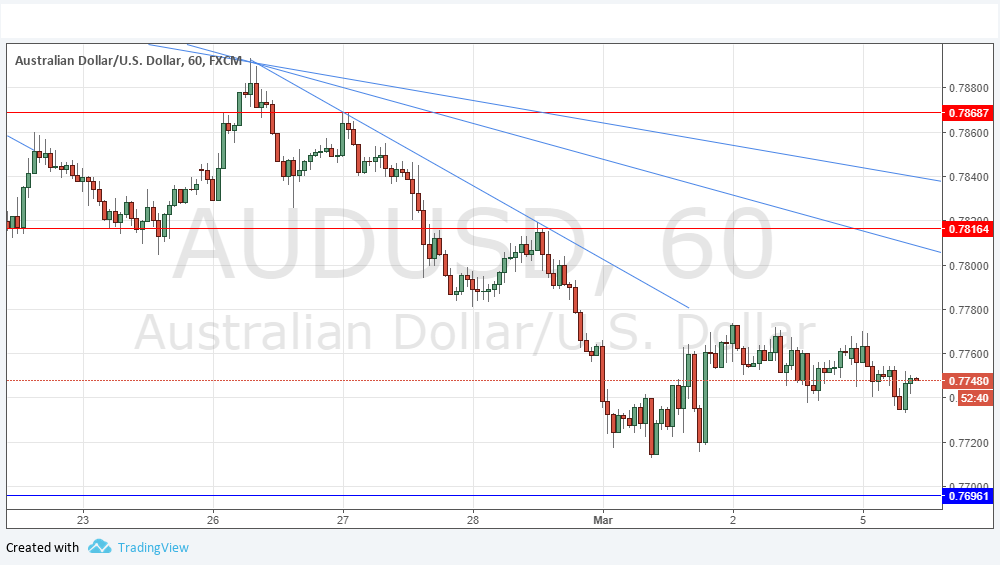

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7696 or 0.7640.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade

Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7816.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

Last Thursday I took a bearish bias, but the price did not go anywhere, just consolidating. I wasn’t exactly wrong, but I wasn’t right either. The price is simply going sideways in between two key levels, so there is no reason to be either bullish or bearish. I have no bias and there will probably be better opportunities elsewhere today, although there are high-impact news items due over the next 24 hours for both currencies, so something interesting might happen.

Regarding the USD, there will be a release of ISM Non-Manufacturing PMI data at 3pm London time Concerning the AUD, there will be Current Account and Retail Sales data releases at 12:30am, followed by the RBA Rate Statement and Cash Rate at 3:30am.