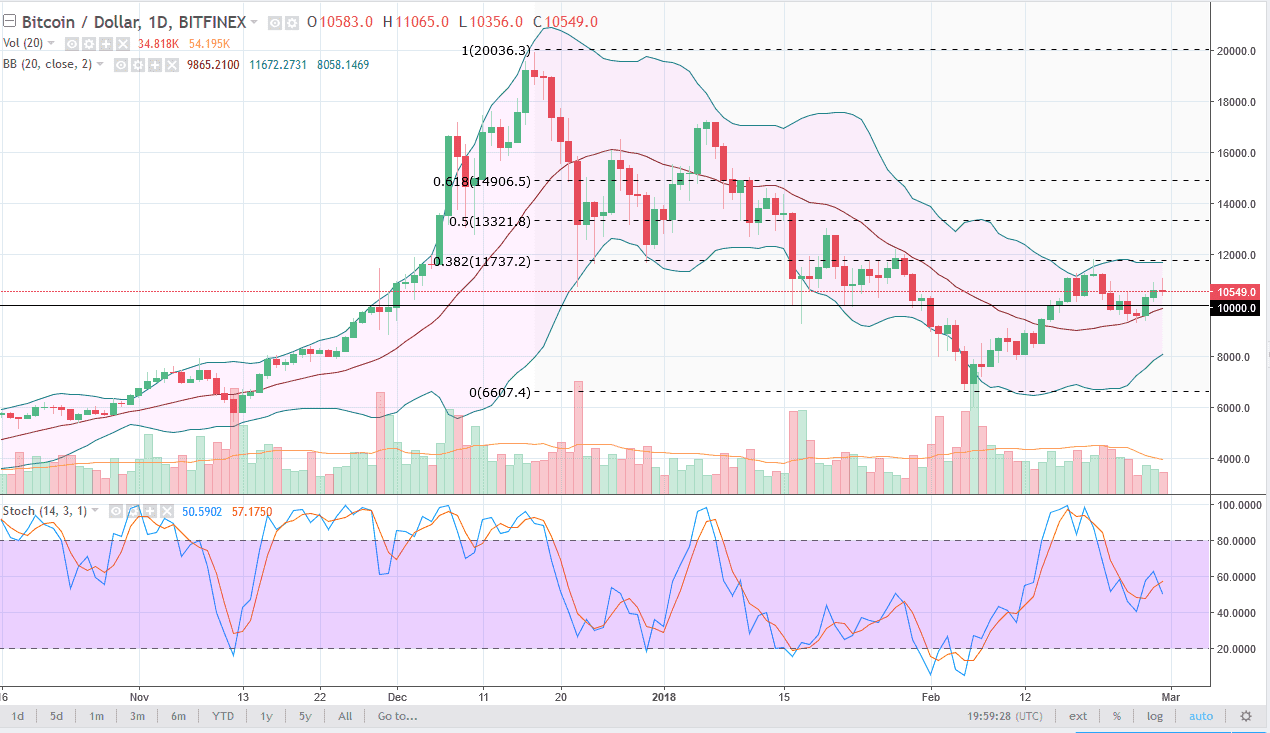

BTC/USD

Bitcoin markets tried to rally on Wednesday but struggled again as we turned around to form a shooting star. It is starting to look like the market may be trying to make another run to the downside. However, in the short run I think that you should look at it as potential consolidation, but longer-term charts have signs of weakness being formed. There was a shooting star from the previous week, and if we roll over to make a fresh, new low, and other words below the $9400 level, that would break that candle down and could send the market towards the lows again. The alternate scenario of course is that we break above the $12,000 level, which would be very bullish. Right now, I think there is a significant risk to the downside in the short run, so it will be interesting to see what happens over the next couple of days.

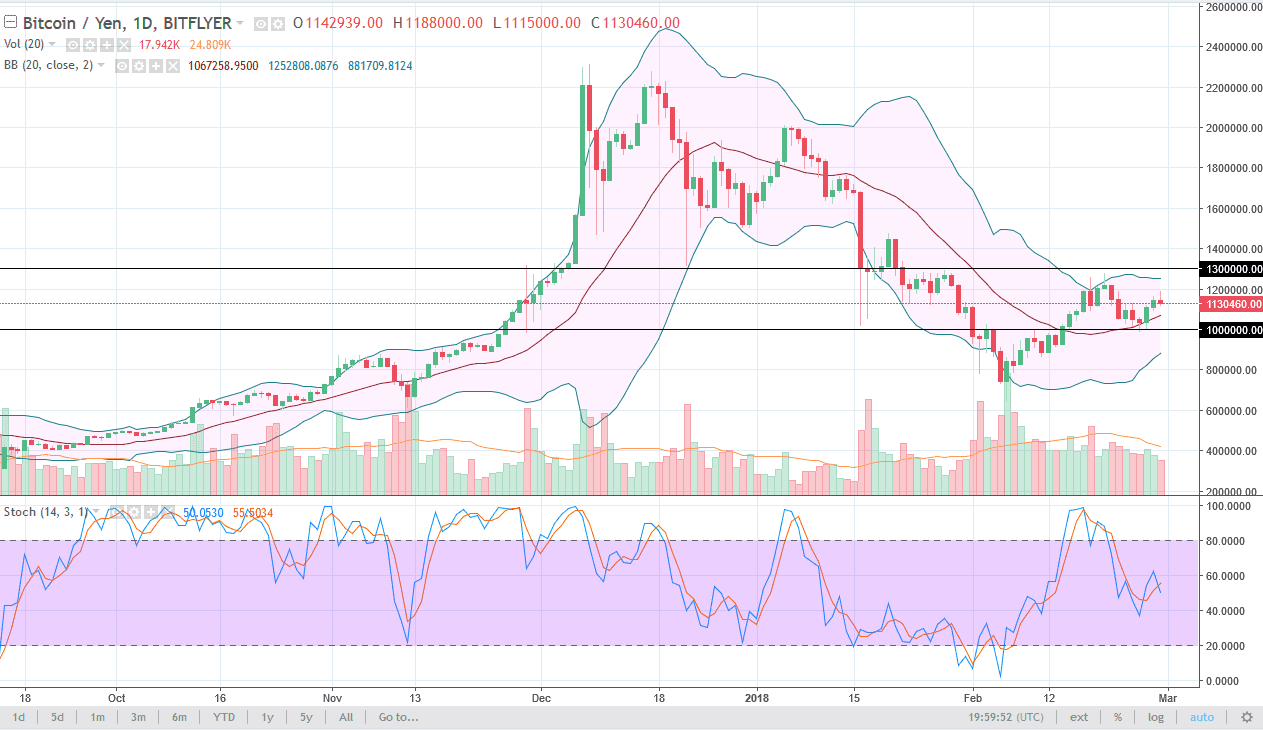

BTC/JPY

Bitcoin markets also try to rally against the Japanese yen but rolled over to form a shooting star the daily chart as well. The ¥1.2 million level has offered resistance, and I think that resistance extends to the ¥1.3 million level. If we can break above the ¥1.3 million level, the market would be free to go much higher. However, right now it looks as if we are ready to roll over and try to reach down to the ¥1 million level underneath, which has offered support just a few sessions ago. If we do break down below the ¥1 million level, things could get ugly and we could go looking towards the ¥800,000 level. If we break above the ¥1.3 million level, the market probably then goes to the ¥1.5 million level, and then eventually higher than that. The next several sessions should be crucial for the longer-term outlook.