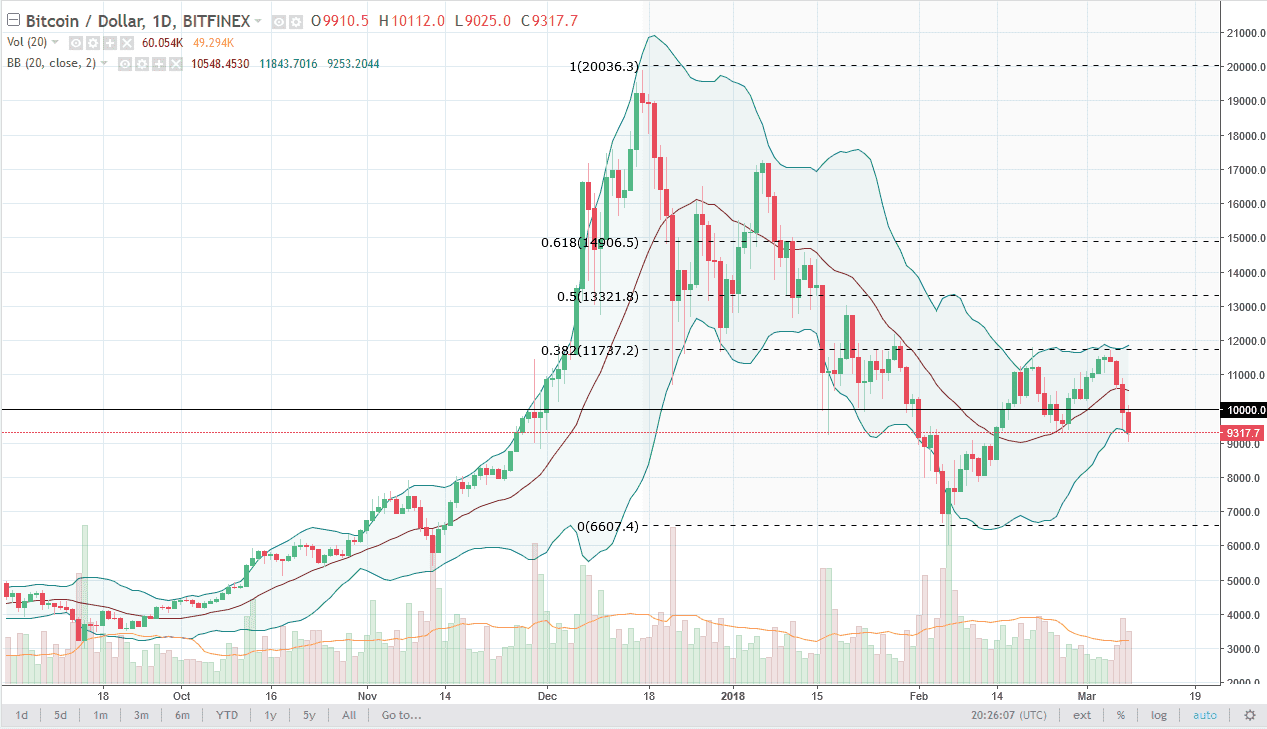

BTC/USD

Bitcoin markets broke down a bit during the trading session again on Thursday, slicing a bit below the $9300 level. If we can break below the bottom of the range for the day on Thursday, extensively the $9000 level, we should continue to go much lower, perhaps reaching towards the $8000 level, perhaps even reaching down to the $7000 level. If we can break above the $10,000 level, that would be a bullish sign, but until then I have no interest in buying this market. I believe that the market is very likely to continue going lower, wiping out the most recent rally. I believe the crypto currencies will continue to struggle, as we continue to see failure. The $12,000 level above needed to be cleared for a change in the downtrend, and we have clearly missed that mark. At this point, the question becomes whether we can break down below $7000.

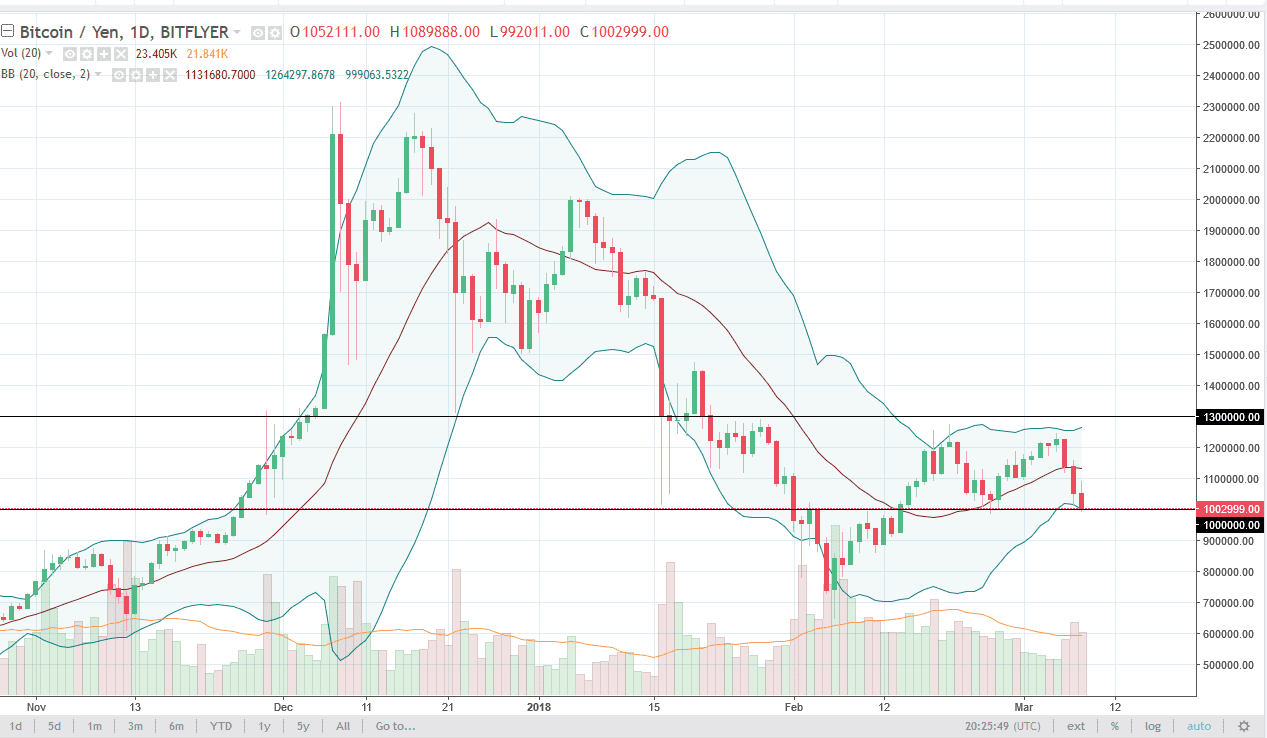

BTC/JPY

The Bitcoin market initially tried to rally against the Japanese yen as well but struggled at the ¥1.1 million level during the day to roll over and fall towards the ¥1 million level. At this point, I think that it’s likely that we continue to go lower, perhaps down to the ¥800,000 level. Beyond that, we probably go looking towards ¥700,000. At this point, it looks very likely that crypto currency markets are going to continue to struggle, as the bubble has most certainly popped. Ultimately, I think if we can break above the ¥1.1 million level, that would be a bullish sign, perhaps reaching towards the ¥1.3 million level which is a massive ceiling. However, right now I have serious doubts that this market will pick up the momentum.