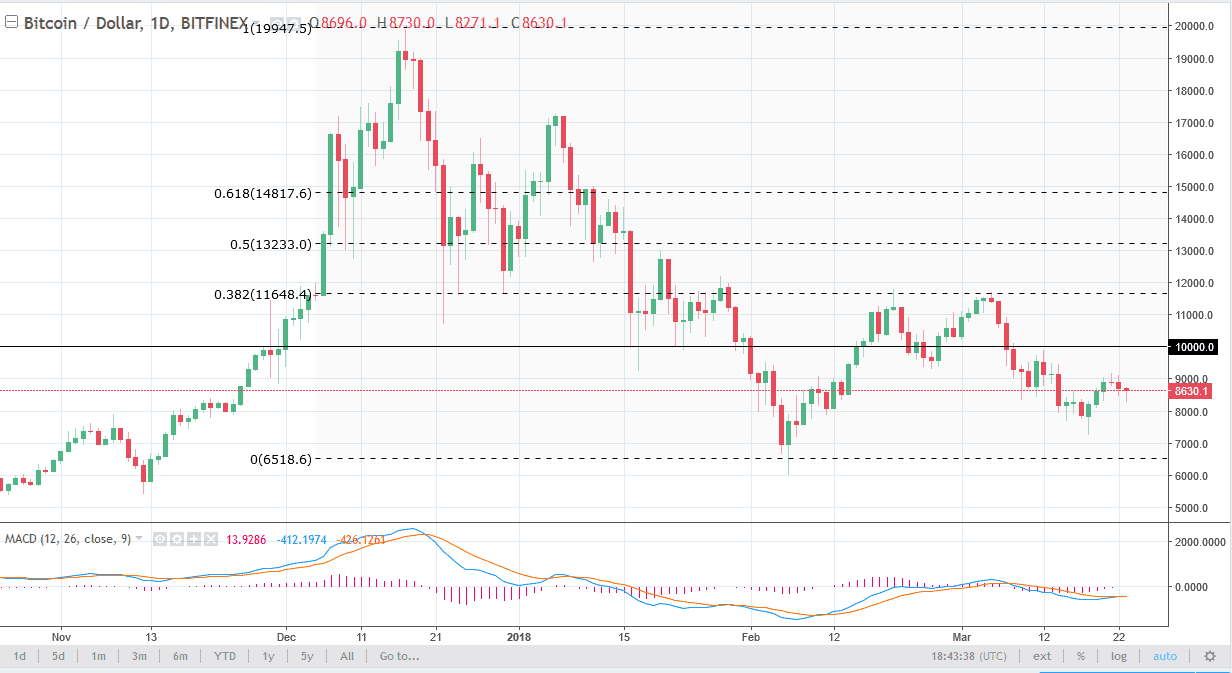

BTC/USD

Bitcoin fell against the US dollar during the trading on Friday, as we continue to drift around in a slow choppy pattern. The market has bounced a bit though, forming a bit of a hammer. This is a bullish sign but is preceded by a couple of negative candles. We could get a bounce from here, but it’s not until we break above the $10,000 level that I would be convinced of validity on the buy side. Otherwise, if we break down below the bottom of the range for the Friday session, I think we go to the $8000 level, followed by the $7500 level. Either way, I do not believe that this market is ready to take off, and I think that we will be very sideways over the next several sessions. Because of this, it’s probably best to keep your position size relatively small.

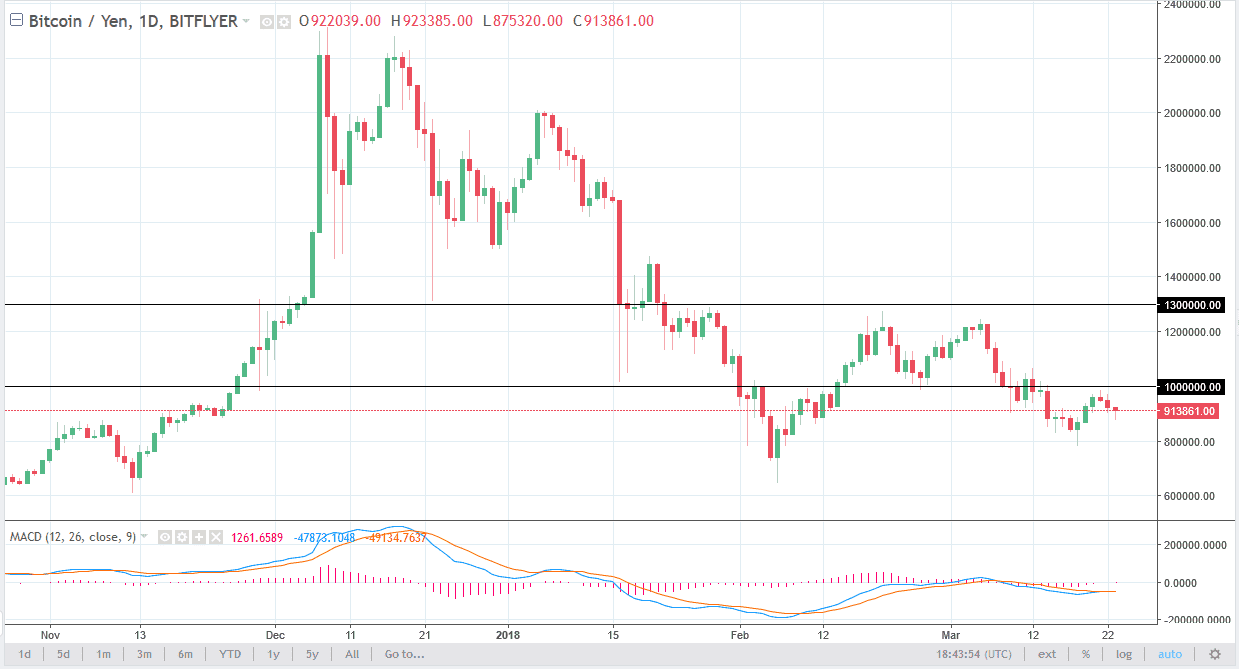

BTC/JPY

Bitcoin fell initially during the trading session on Friday, as the Japanese yen picked up a bit of momentum. I believe that the market will continue to be very choppy with the ¥1 million level above being massively resistive. If we can break above there and extend through the resistance barrier that formed it there, we could go much higher. I would consider the market broken to the upside if we can clear the ¥1.1 million level. Until then, I suspect there is still more downward pressure than anything else. I see support below at the ¥800,000 level, so we break down below there I think we would probably go to the ¥650,000 level underneath which was a massive support level back in February. Volatility will continue to be a major issue down.