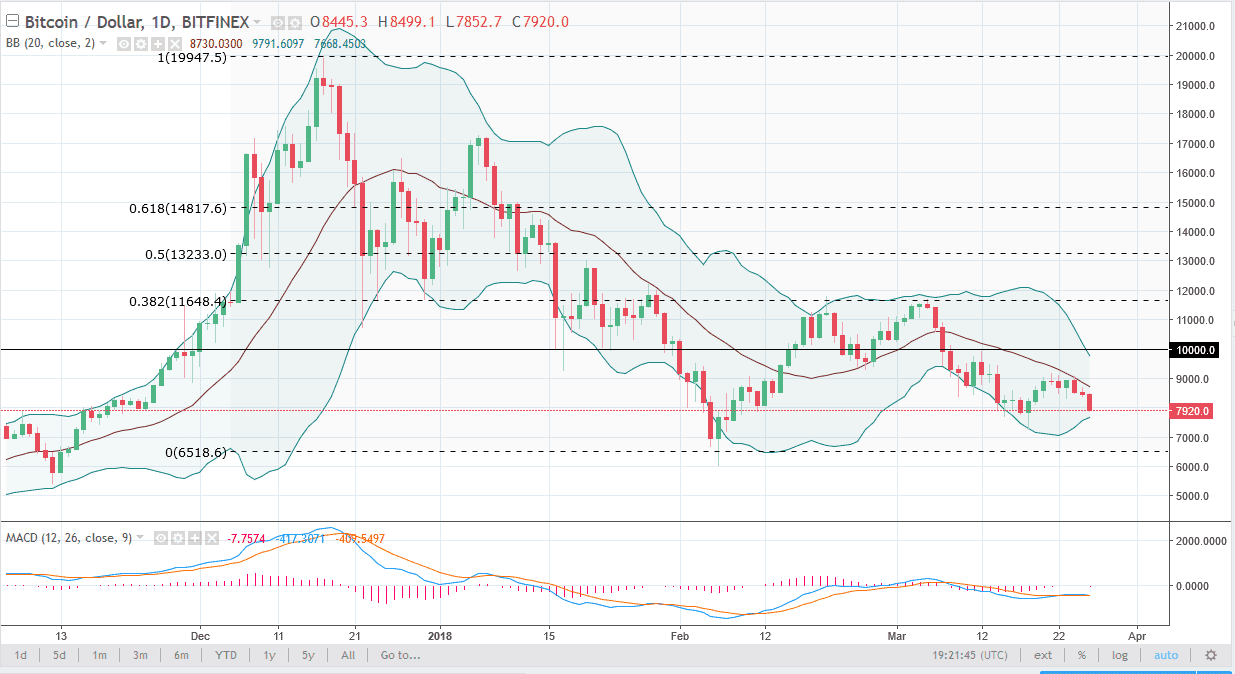

BTC/USD

Bitcoin fell again during the trading session on Monday, losing 6%. The market breaking down below the $8000 level is a negative sign, and I think at this point it’s only a matter of time before we reach towards the $7200 level. Beyond that, the market should then go down to the $7000 level. I think at this point, rallies are to be sold and Bitcoin simply cannot find enough momentum to go higher. In fact, I don’t even have a scenario in which I think this will change. Obviously, it can but I also would need to see this market clear the $10,000 before I would be willing to put money to work. The biggest problem I see with Bitcoin is that I live in the city the size of Amsterdam, and only know of about 3 places I can use it. Bitcoin adoption simply has not happened as quickly as pricing would have suggested.

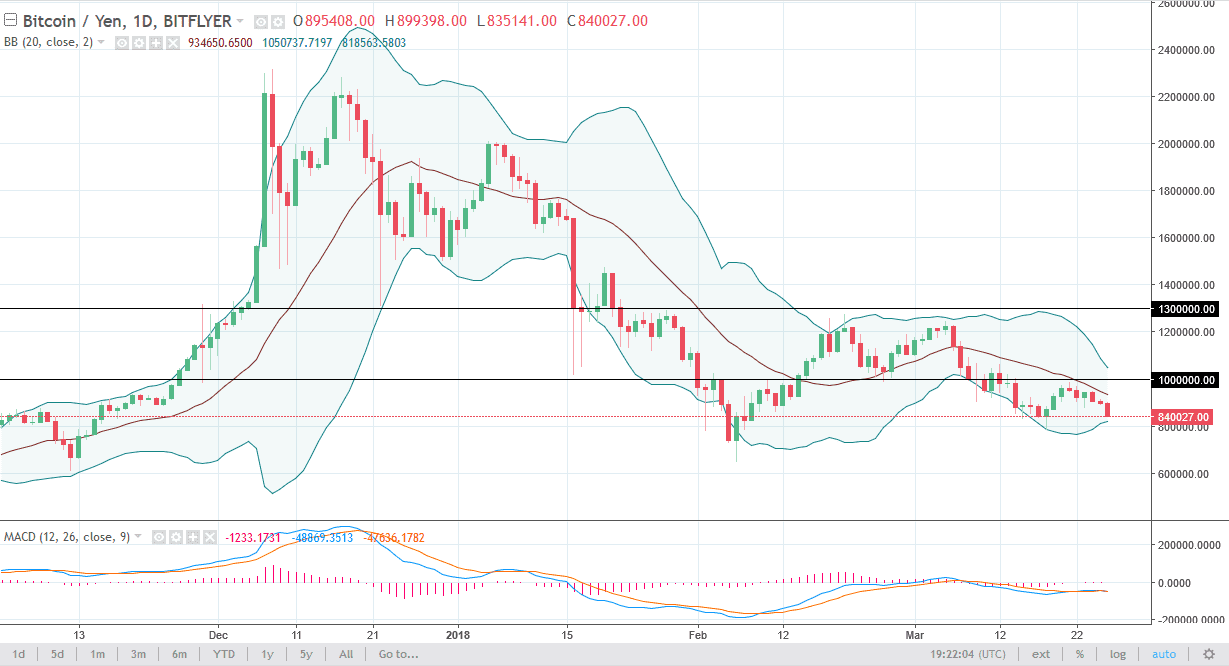

BTC/JPY

Bitcoin markets broke down on Monday, breaking down below the ¥850,000 level. The ¥800,000 level underneath is massive support, but I believe that we will break down below there and reach towards the lows again near the ¥650,000 level. I believe that rallies are to be sold, at least until we can break above the ¥1.1 million level, which is the top of the range that starts at the ¥1 million level. I think that the markets continue to sell off longer-term, and it’s not until something changes fundamentally that I think this market can pick up bullish pressure. The market is likely to go back to pre-bubble levels, meaning that we will sell off for a while, and then simply grind sideways at lower levels. If we did break out to the upside, I would be rather surprised.