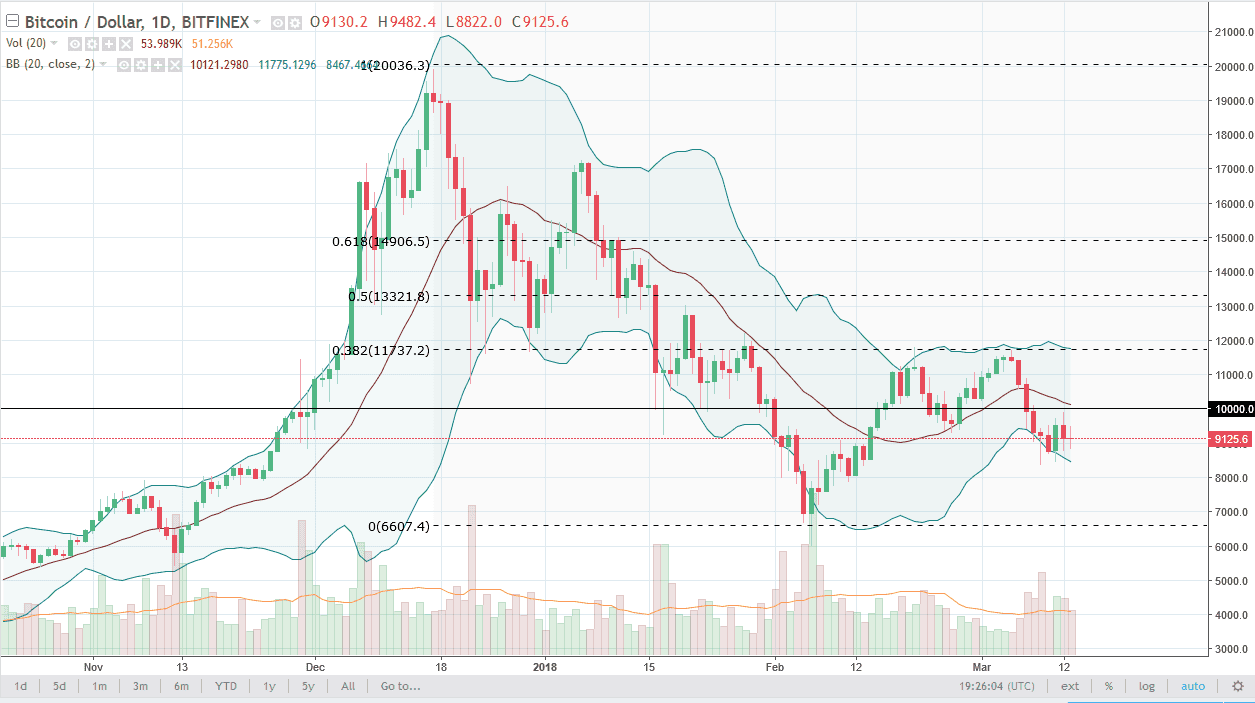

BTC/USD

Bitcoin markets went back and forth during the trading session on Monday, as the Bitcoin/US dollar market hovers around the $9100 level. The area is where we see a lot of noise, as we have gone flat. The markets seem to have lost a lot of momentum, and therefore I think that it suggests that the $10,000 level is going to be a bit too resistive to go above. We would need to see a significant amount of volume into the market so that we can go higher, and at that point we would probably try to reach towards the $12,000 handle above. Alternately, it looks as if the $8500 level should offer support, so if we were to break down below there I think that the market could break down towards the $7000 level. There is a lot of noise in this market, so I think at this point it’s likely that we will see a lot of choppiness in a sideways manner.

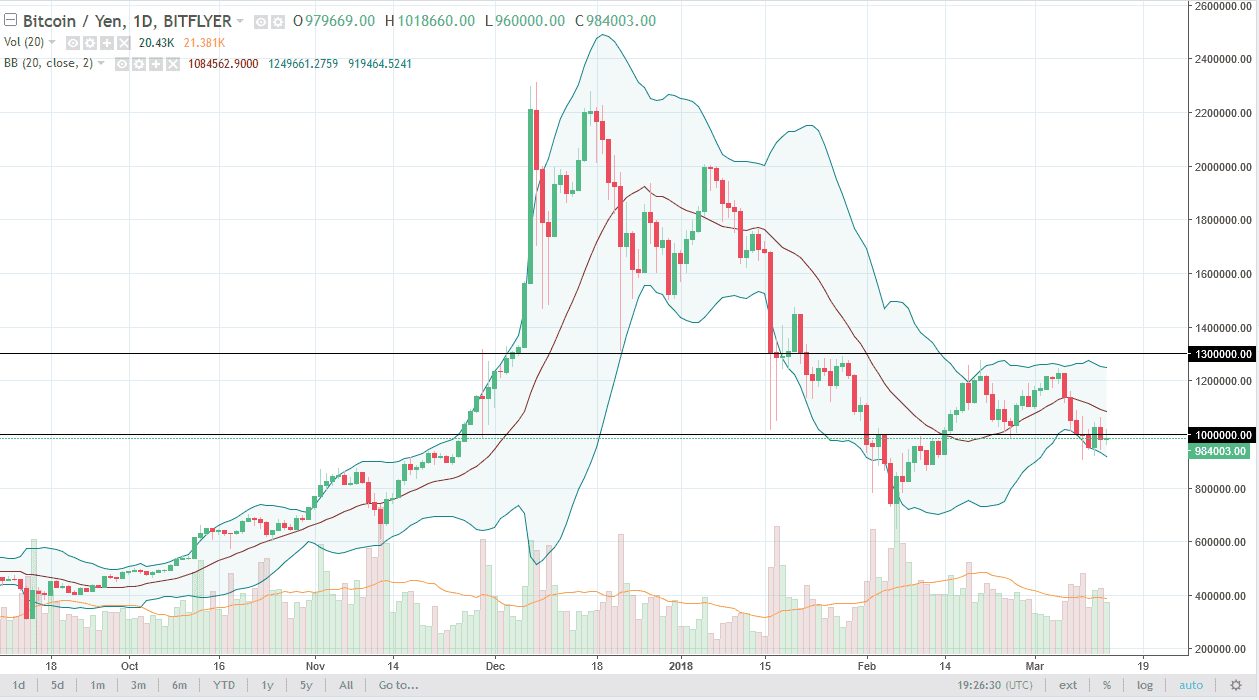

BTC/JPY

Bitcoin markets tried to rally against the Japanese yen during the trading session on Tuesday, but the ¥1 million level looks likely to be a bit resistive as we roll back over. I think if we break down a little bit from here, the market probably breaks down significantly to the ¥800,000 level. This is a bit of a bearish flag, a very negative sign in general. If we can break above the ¥1.1 million level, then I think that the market should then go to the ¥1.3 million level after that. I think overall the crypto currency markets look very susceptible to downward pressure, and I think that it will be the theme overall. If we can break down below the ¥750,000 level, the market will break down significantly.