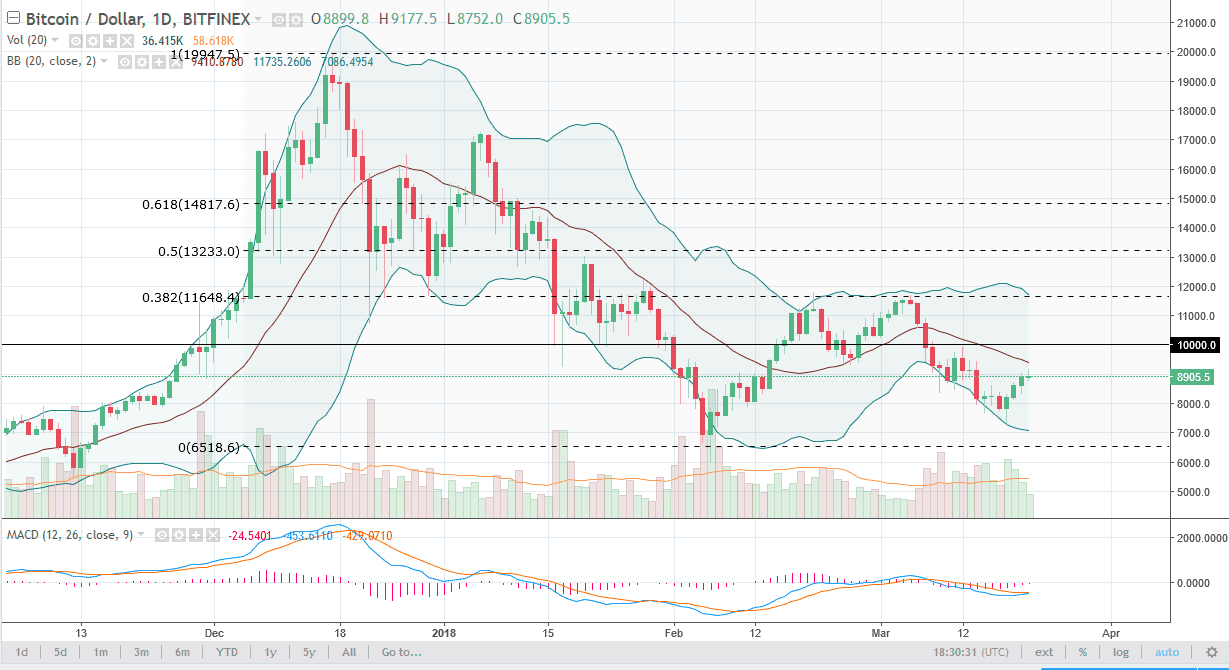

BTC/USD

Bitcoin markets rallied initially during the day on Wednesday, as we continued to see buyers jump into this market, perhaps value hunting. However, later in the day we rolled over to form a bit of a hammer, so it’s likely that if we break down from here, we may revisit the thousand dollars level. Alternately, we could break above the top of the shooting star, which is a very bullish sign, especially considering that the 20 SMA is just above there as well. If that happens, the next target will be the $10,000 level. Clearing that level could open the door to $12,000 above, but there will be a lot of work to be done. It appears that volume is rolling over a bit, so I suspect that the pullback makes sense over the next couple of sessions. Either way, there’s nothing compelling on this chart for me to start buying aggressively until we break the $10,000 level.

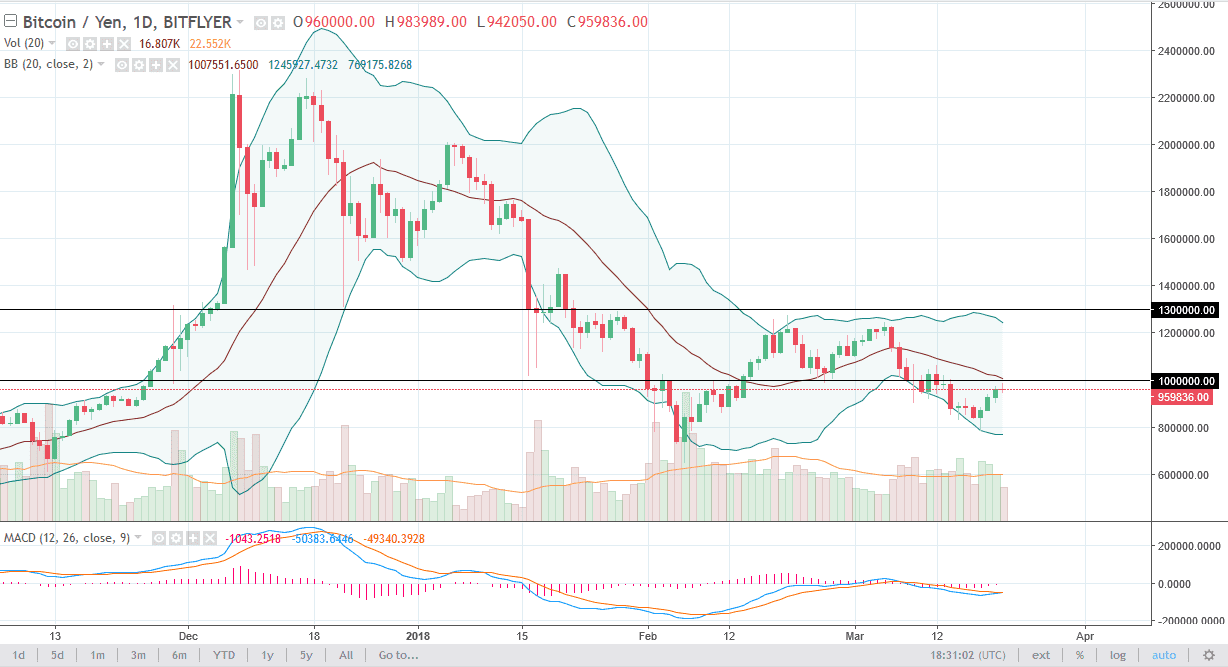

BTC/JPY

Bitcoin also rallied against the Japanese yen initially during the day, but just as it did against the US dollar, we rolled over to form a bit of a shooting star. We are seeing a significant amount of resistance near the ¥1 million level, so it makes sense that we could pull back from here. Alternately, if we break above the top of the shooting star, that in and of itself is a bullish sign but it would be even more important if we can break above the ¥1.1 million level, an area that I believe is the top of a significant resistance “zone”, and that could open the door to the ¥1.3 million level. In the short-term though, if we pull back I suspect that we will reach towards the ¥800,000 level underneath.