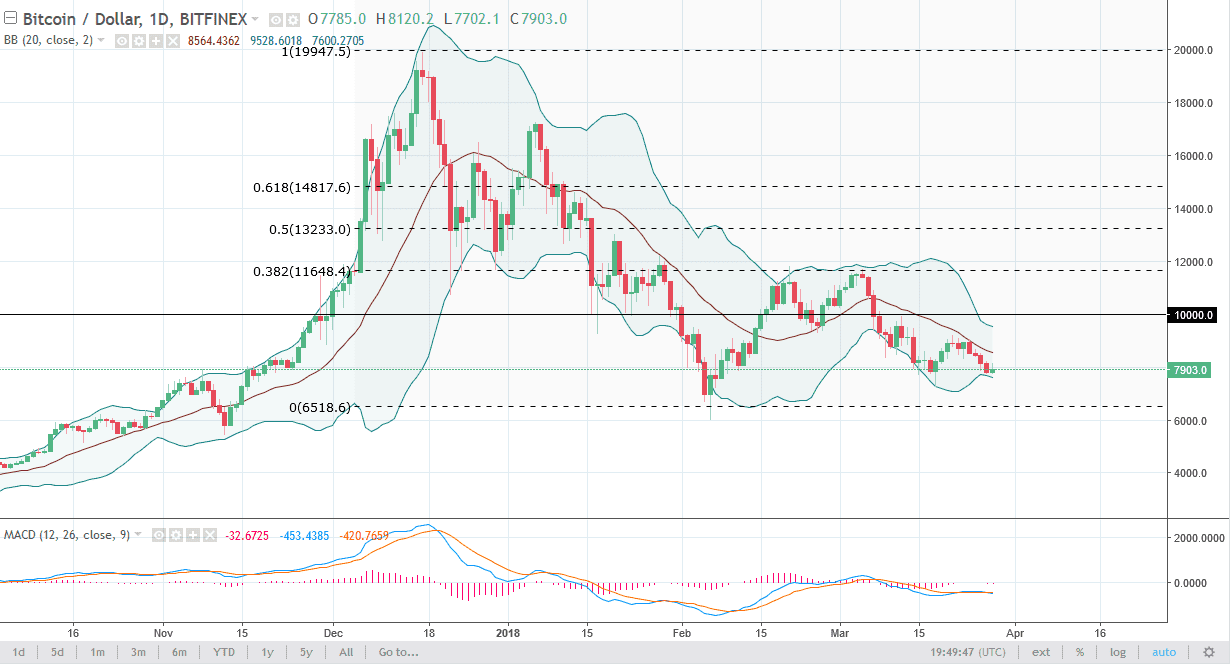

BTC/USD

Bitcoin traders tried to rally during the day on Wednesday but gave back most of the gains. We ended up forming a bit of a shooting star for the day, and a breakdown below the bottom of the range for Wednesday would be a negative sign, perhaps sending this market down to the $7800 level, followed by the $7000 level. The alternate scenario of course is that we could break above the top of the range for the day, sending this market to the $9000 level. Ultimately, the market looks week, and I think that continues to be the case. The market looks likely to wipe out the entirety of the recent rally from late last year, so I believe that the sellers are very much in control, and they will be looking to take advantage of any pop in pricing.

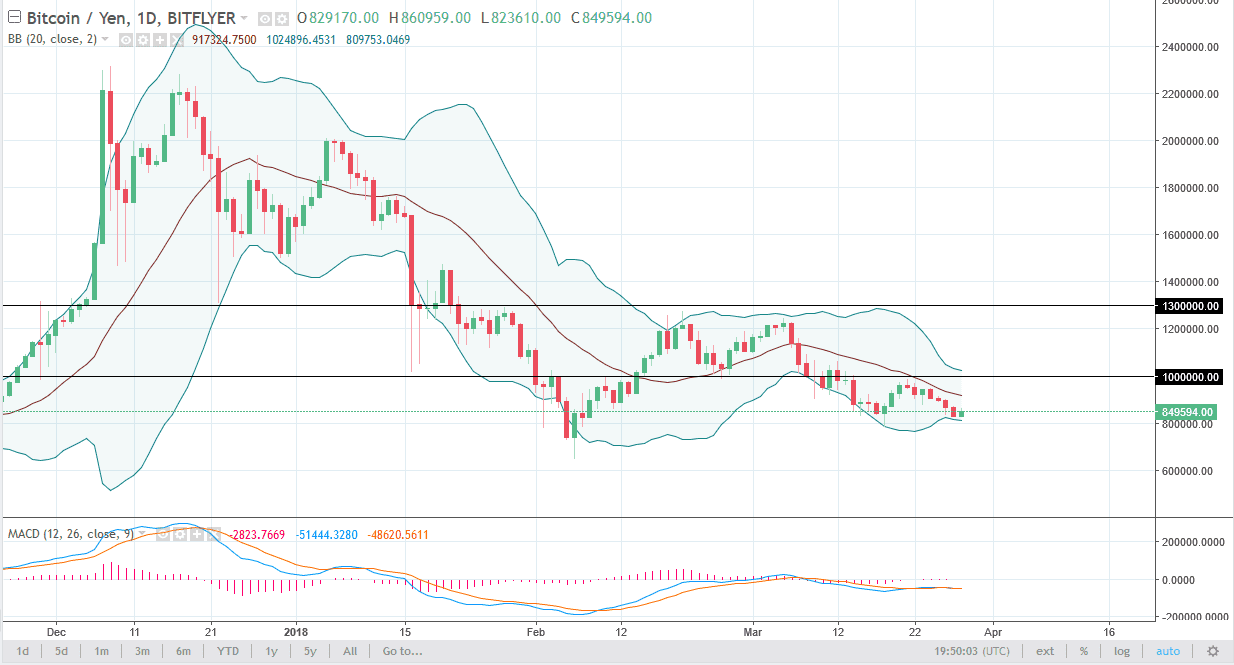

BTC/JPY

Bitcoin also rallied against the Japanese yen but didn’t give the back is much of the gains as they did against the US dollar. I believe that the ¥1 million level continues to be a major barrier this can be very difficult to cross, and I believe that the resistance runs to the ¥1.1 million level above there. I believe any rally at this point in time should invite selling, as the market cannot pick itself up. A breakdown below the ¥800,000 level sends this market down to the ¥650,000 level, which was where the recent bottom was found. 40% of all Bitcoin trading is done in Japan, so this market needs to rally so other crypto currencies can continue to go higher. For my work, I follow 7 different crypto currencies, and none of which look good right now. I believe that this is the most important crypto currency chart to pay attention to.