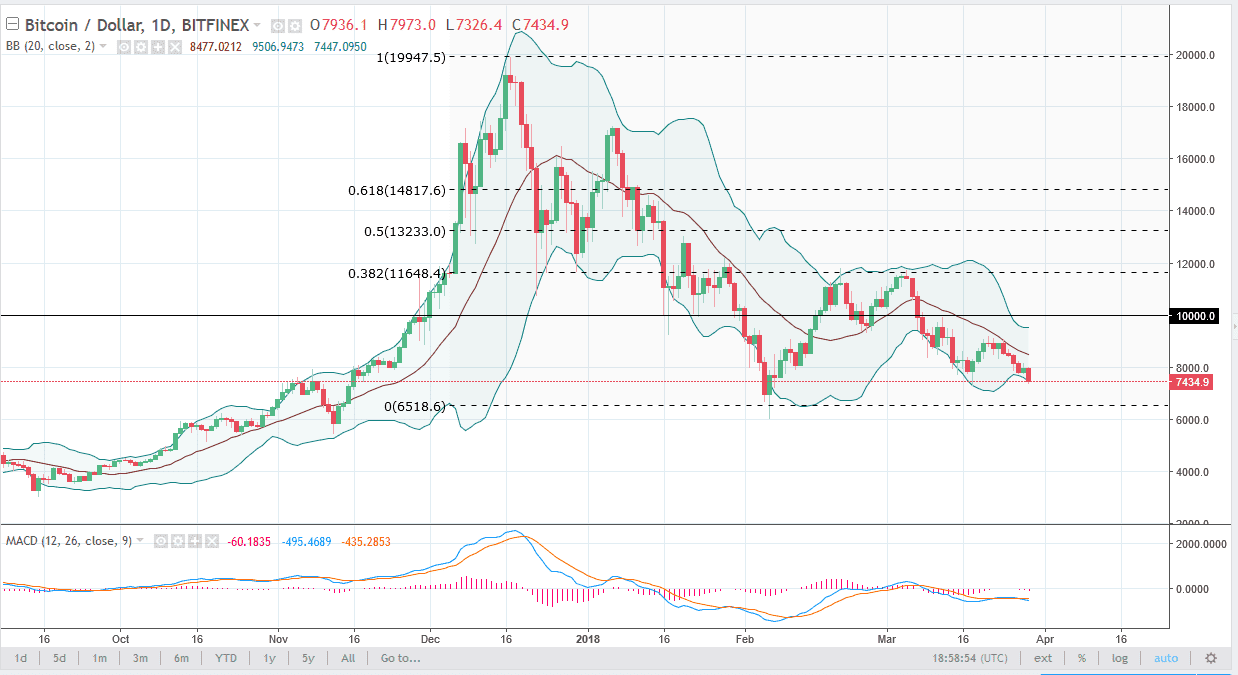

BTC/USD

Bitcoin fell against the US dollar during trading on Thursday, breaking below the $7500 level, and even below the $7450 level. The market looks as if it is ready to retrace the entirety of the bounce, perhaps down to the $6500 level. After that, I expect the $6000 level to be targeted. I believe that the market is broken, and I don’t see any reason to start going long quite yet. Rallies of this point will be sold as they have been over the last several months, and I think that now that the bubble is pop, we will return to pre-mania levels again. The overall attitude of the market is indicative of one that is failing to attract new money, and if the futures markets are any indication, it seems as if that is an about to change. Sell the rallies, and benefit from the obvious.

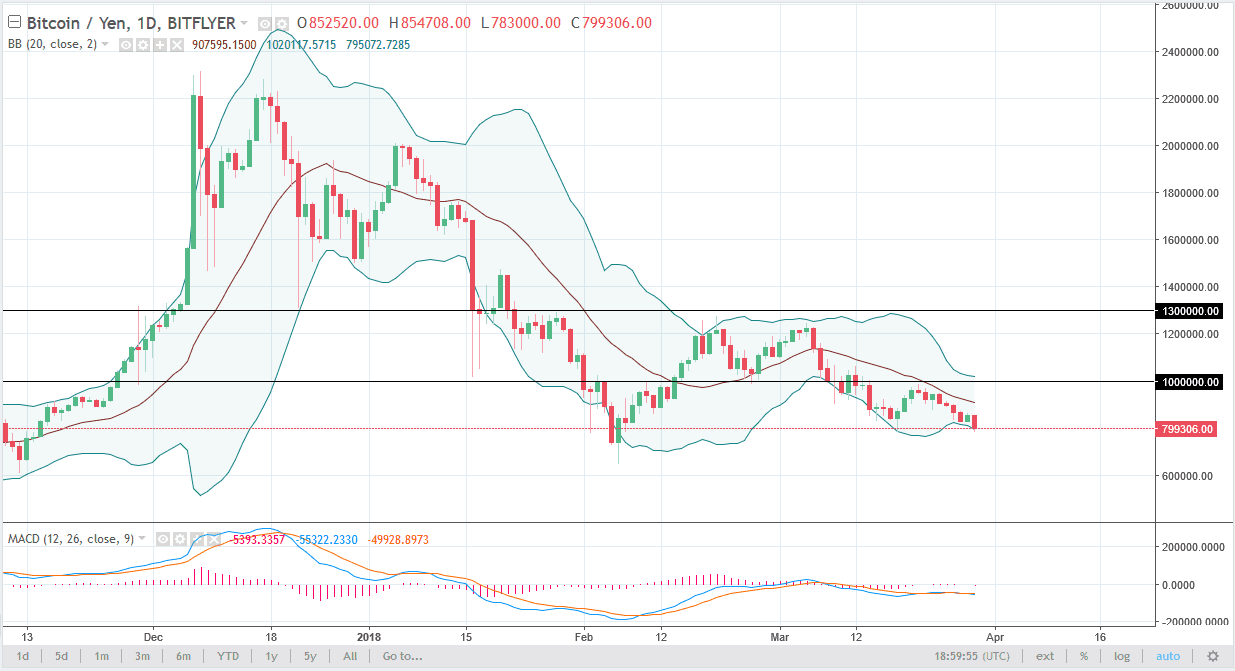

BTC/JPY

Bitcoin fell below the ¥800,000 level, and now should go looking towards the ¥650,000 level. Just as against the US dollar, I think every time this market rallies, it will be a selling opportunity. The ¥1 million level continues to be massively resistive, extending to the ¥1.1 million level. With the Japanese yen losing a bit of strength during the day in the Forex markets, the fact that Bitcoin couldn’t rally against the Japanese yen shows just how soft it is. I think that the market continues to be very volatile, but most certainly will struggle to keep any type of bullish stance. Bitcoin is broken, and I don’t think that’s changing anytime soon. If we did break above the ¥1.1 million level, that might be bullish enough to hang onto, but until then, this is a market that continues to be sold off.