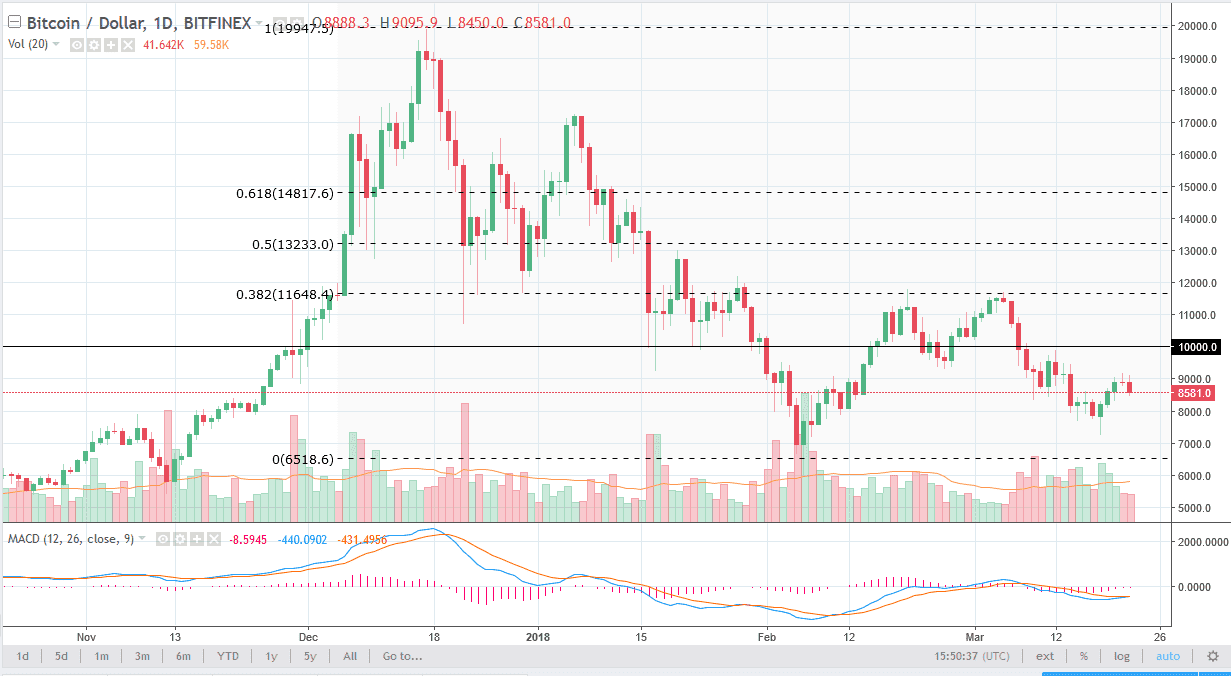

BTC/USD

Bitcoin markets fell a bit during the trading session on Thursday, rolling over from a shooting star that formed on Wednesday. By breaking down below the bottom of the shooting star, it suggests that we are ready to roll over yet again. The Bitcoin market simply cannot find enough momentum to continue going higher, and I believe that the $9000 level is now acting as significant resistance. In fact, it’s not until we break above the $10,000 level that I think Bitcoin will be able to pick up a significant momentum. The market is much more likely to see $8000 tested before $10,000, so I think short-term sellers are going to continue to jump into this market. If we break down below $8000 soon, we could test $7000. A break above the $10,000 level could have the market looking towards $12,000 but it does not seem that buyers have enough wherewithal currently.

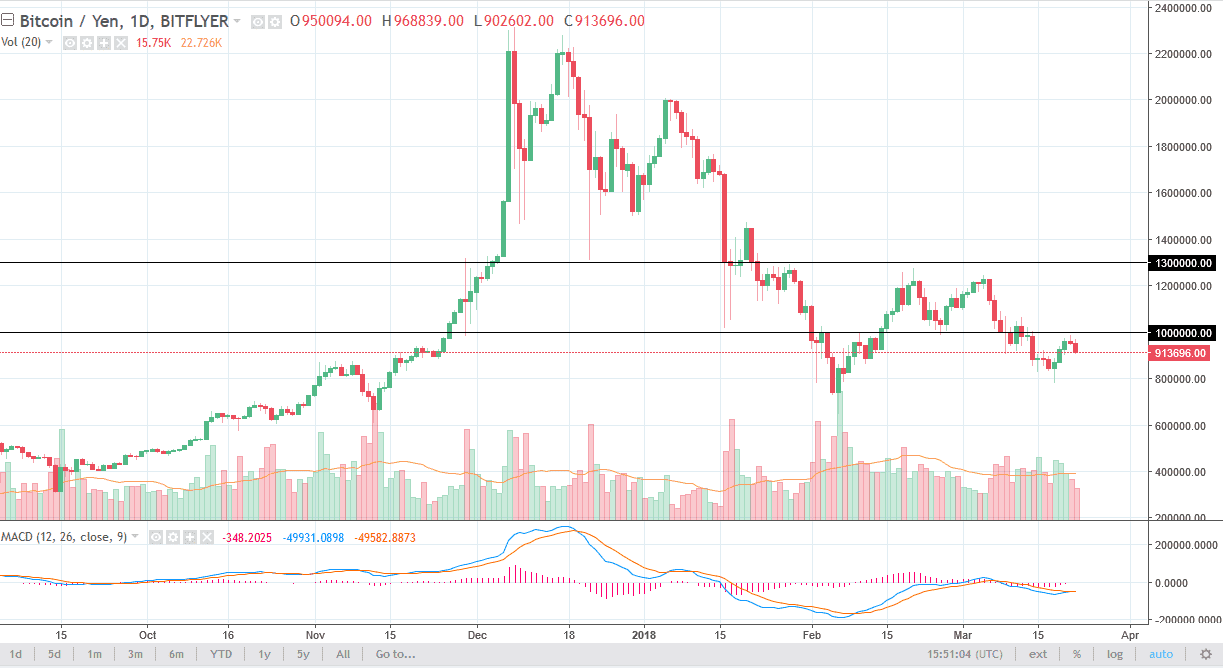

BTC/JPY

Bitcoin traders also sold off against the Japanese yen, which of course is very significant as 40% of Bitcoin trading is done in Japan. The ¥1 million level has acted as resistance, just as I thought it would, and now that we had formed a shooting star and broken down below it, I think it’s more likely that the market goes down to ¥800,000 that it was just 24 hours ago. If we could break above the ¥1 million level, I am not comfortable buying until we break above the ¥1.1 million level, which would free the way to the ¥1.3 million level. This is a market that looks as if it is trying to roll over, and therefore I continue to look at this as a “sell the rallies” situation, as Bitcoin volumes continue to tumble at most exchanges.