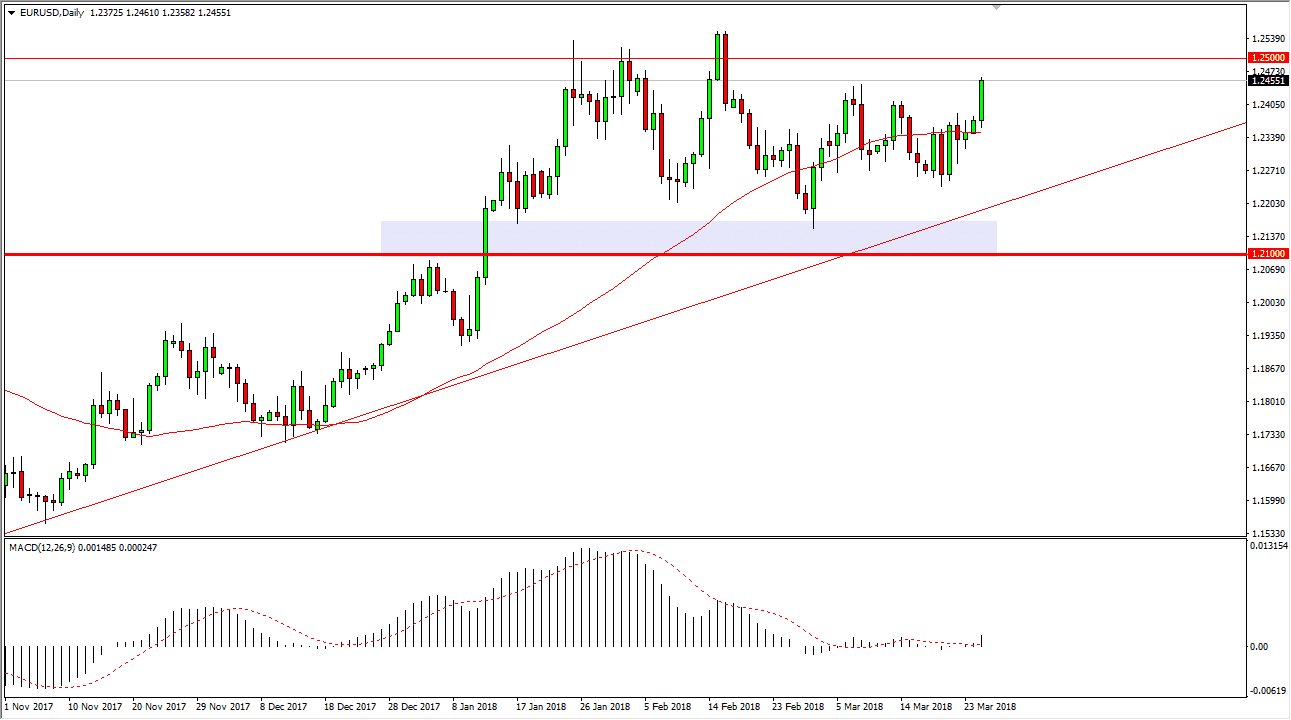

EUR/USD

The EUR/USD pair pulled back slightly during the trading session on Monday but found the 50-day EMA supportive enough to turn around and shoot to the upside. The 1.245 level was targeted, and I think we are eventually going to test the 1.25 handle, and then perhaps even break out for a much larger move. I think that short-term pullbacks will be buying opportunities, and I believe that we will focus on the 1.32 level eventually, based upon the break out above the top of a major bullish flag on the weekly chart. I think that the uptrend line will also be very supportive, just as the 1.21 level will be. So, at this point, I don’t have any interest in shorting this market, and I look at those pullbacks as an opportunity to take advantage of value. It will more than likely take several attempts to break above 1.25, but once we do we should take off.

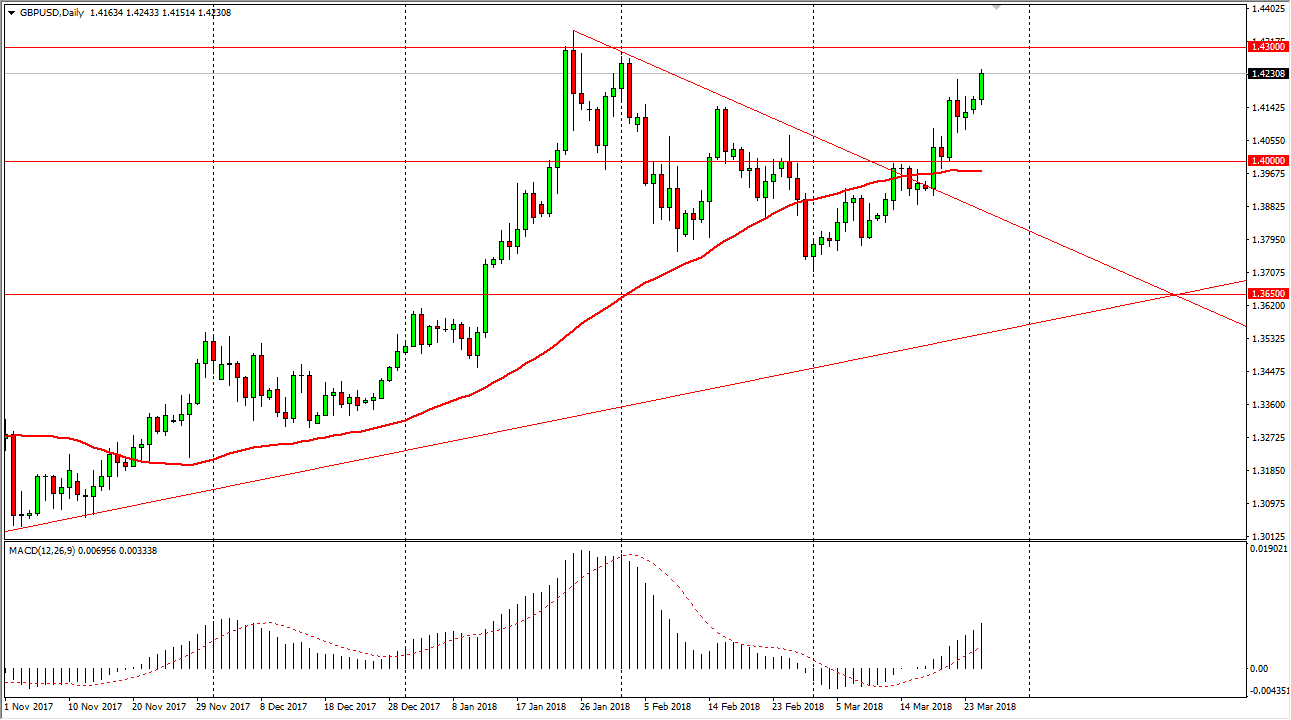

GBP/USD

The British pound rallied during the session on Monday, breaking above the 1.42 level. You can see that we broke above a negative candle from last week, and now it looks likely that we were going to reach towards the 1.43 level. If we can finally break above that level, eventually we should then go to the 1.45 handle. The market has been a bit overextended, and at this point I think that the 1.40 level underneath is the “floor.” Ultimately, this is a market that should continue to grind higher as the Bank of England has suggested an interest rate hike is coming this summer. I believe that eventually the British pound will break the 1.43 level, but it may take several attempts as it was so resistive in the past. There is a lot of noise between here and the 1.45 handle, so it’s going to take a significant amount of momentum.