The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 4th March 2018

In my previous piece last week, I saw the best possible trades for the coming week as long of the S&P 500 Index, and short of the USD/JPY currency pair. The S&P 500 Index fell by 2.02%, but the USD/JPY also fell by 1.38%, producing an average loss of only 0.32%.

The most important development in the market last week was a stall in the continuing recovery in the U.S. stock market from its recent corrective low, with the price falling by more than 2% over the week but ending with a bullish pin candlestick which suggests higher prices next week. The market has also seen the U.S. Dollar appear to resume its long-term bearish trend in the greenback. The new concern is over a possible trade war between the U.S.A. and the European Union, as President Trump announces plans to impose steep tariffs on imports of foreign steel and aluminum. The long-term yield on the U.S. Dollar also continues to threaten to rise above 3%.

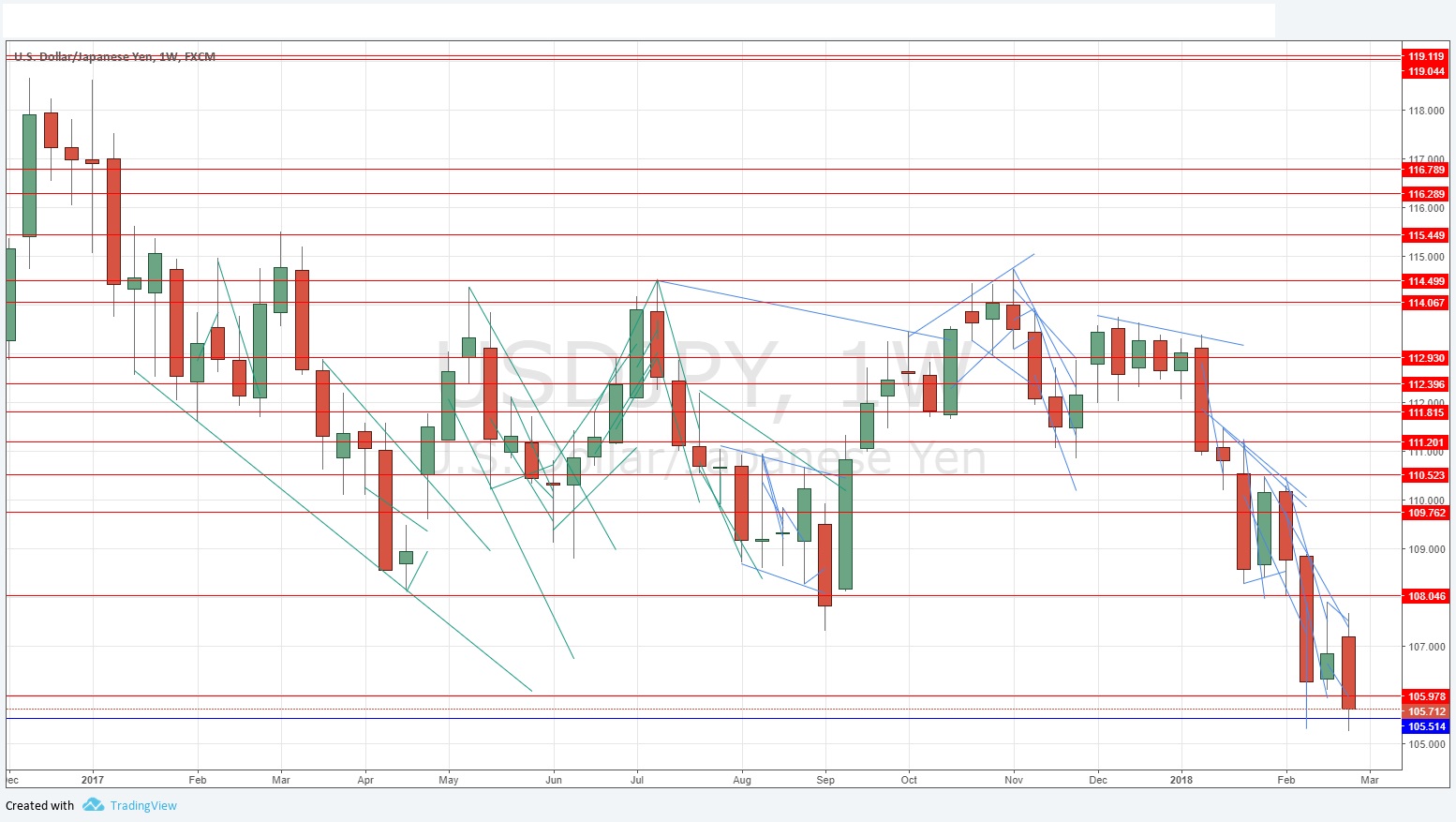

As for other currencies, the Japanese Yen remains in the spotlight, as it again this week made a new 15-month high price against the U.S. Dollar, and a new 3-month high price against the Euro. The Japanese Central Bank is not sending out any signals in favor of this strengthening, and there is speculation that some of the Yen’s rise may be caused by Japanese investors repatriating overseas investment, yet that is questionable. It is true however that the market consensus sees the Bank of Japan as likely to begin tightening monetary policy later this year, even though dovish senior staff are being left in place, and the Finance Minister recently remarked upon the importance of exchange rate stability and the possibility of market intervention.

Fundamental Analysis & Market Sentiment

Sentiment and fundamentals are hard to read, there is certainly renewed concern over the health of U.S. stock market and the U.S. Dollar also looks weak. There is a very busy week ahead in the market with lots of central bank input regarding several major currencies, and major U.S. economic data in the shape of Non-Farm Payrolls numbers. This means we are likely to see strong and possibly surprising price movements.

Technical Analysis

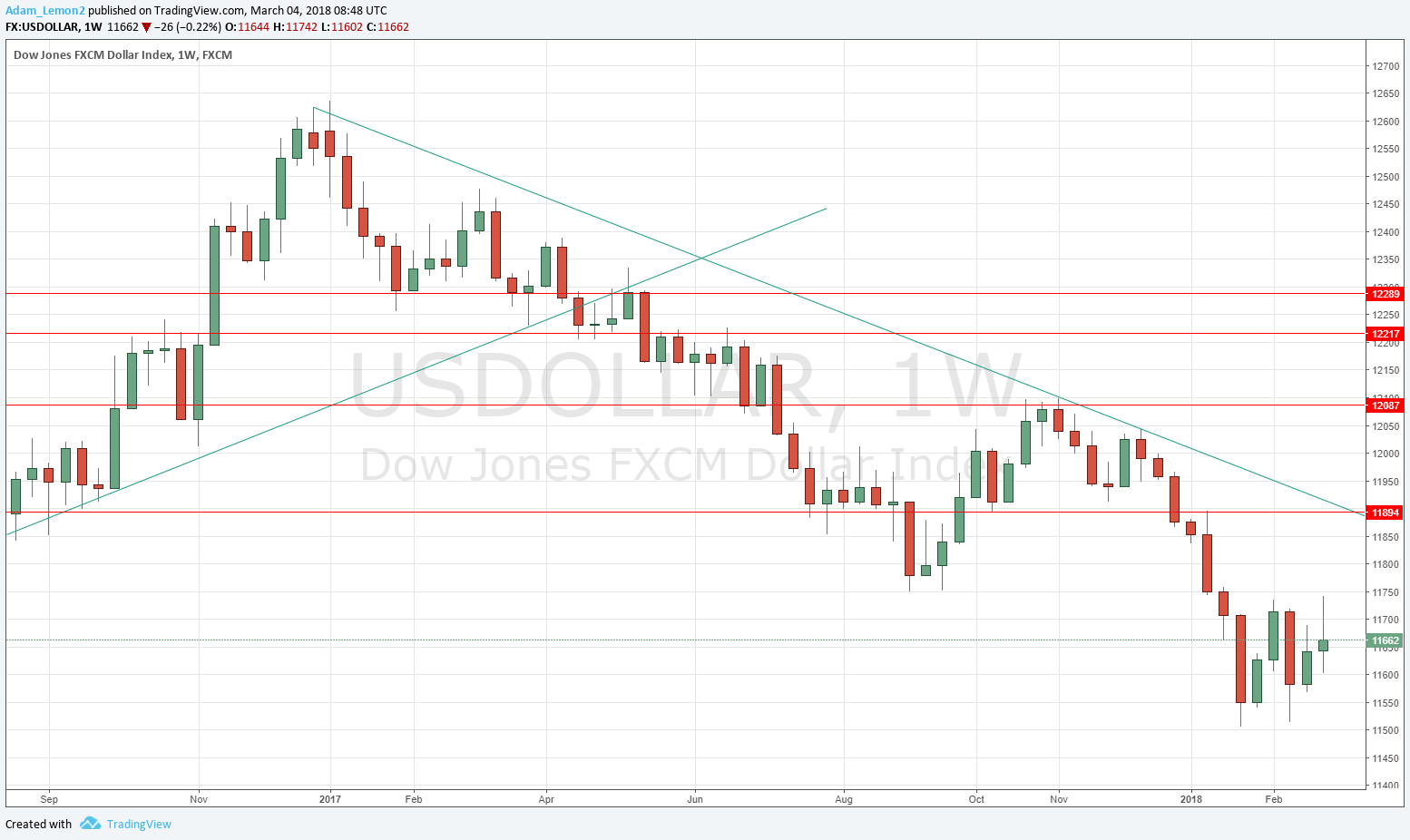

U.S. Dollar Index

This index printed a weakly bullish inside candlestick, although it has a significant upper wick, which closed in its upper half. The price was again unable to make a new low. There is a strong, long-term bearish trend, and a bearish trend line dominates the price chart shown below. However, despite the generally bearish action, this indecisive candle might give bears some reason for caution and suggest a bottoming out.

USD/JPY

This pair has been in a long-term downwards trend, but the long-term picture is relatively consolidative, with a lot of ranging movement within the trend and rejection of key long-term lows. However, a new 15-month low price was again made this week, by a large bearish candlestick. The Japanese Yen is trending more strongly against the U.S. Dollar than any other major currency. The Euro and British Pound both made new 1-month lows against the greenback last week.

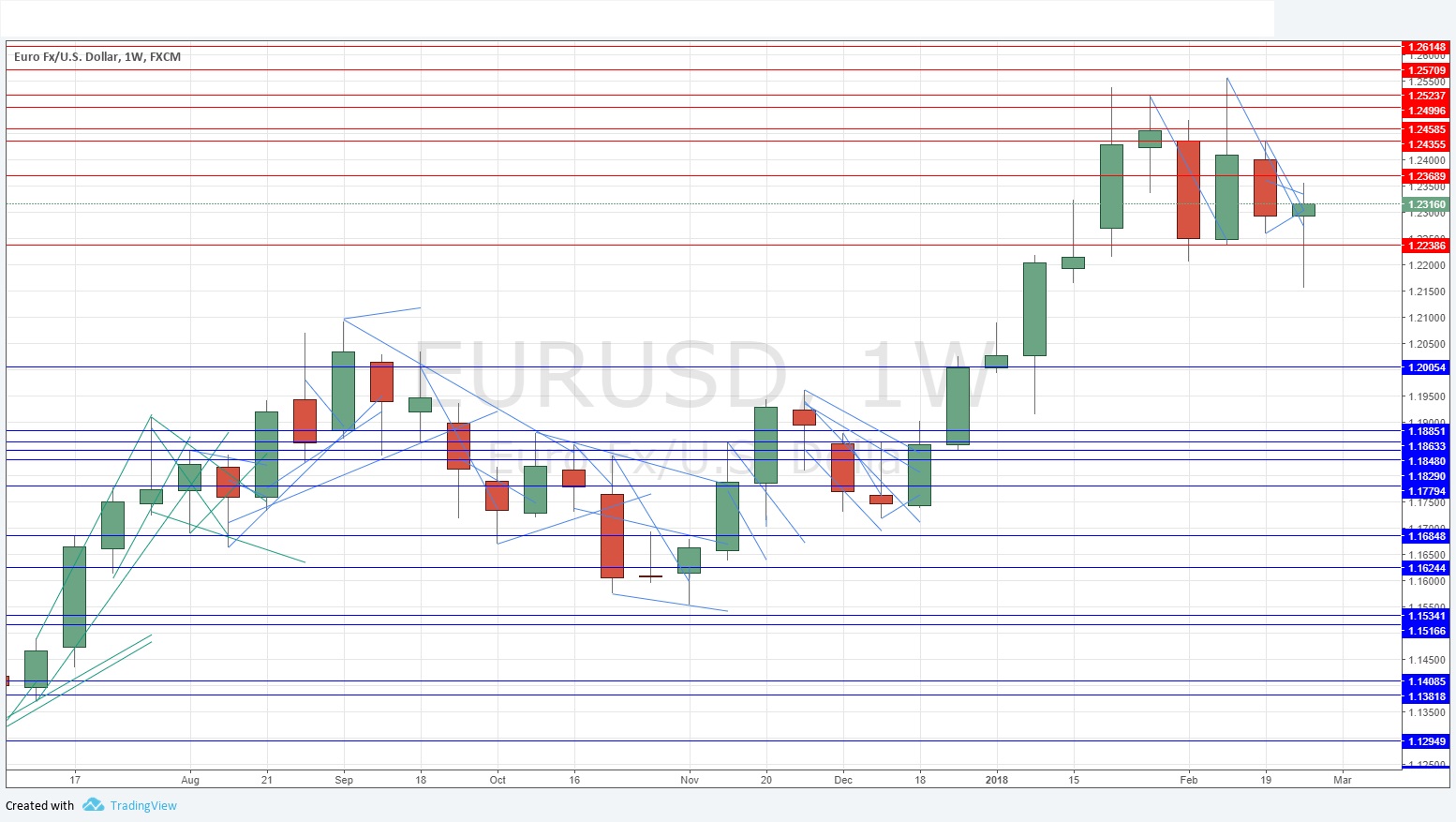

EUR/USD

This pair is in a long-term bullish trend. It has been selling off over recent weeks but has remained relatively resilient. The end of last week saw it rise sharply, and the weekly candlestick has formed into a bullish pin candle. This suggests that the price is likely to rise next week.

Conclusion

Bullish on the EUR/USD currency pair; bearish on the USD/JPY currency pair.