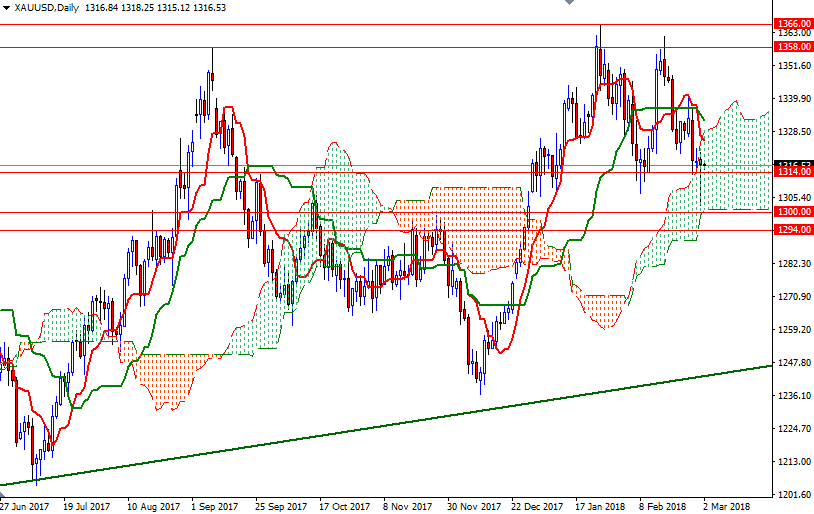

Gold prices ended Thursday slightly lower after a volatile session. XAU/USD moved towards the bottom of the daily Ichimoku cloud as expected after prices broke below the 1314/2 area, but the market found strong support there and recouped losses. The dollar came under pressure after President Donald Trump announced plans to impose heavy tariffs on imported steel and aluminum.

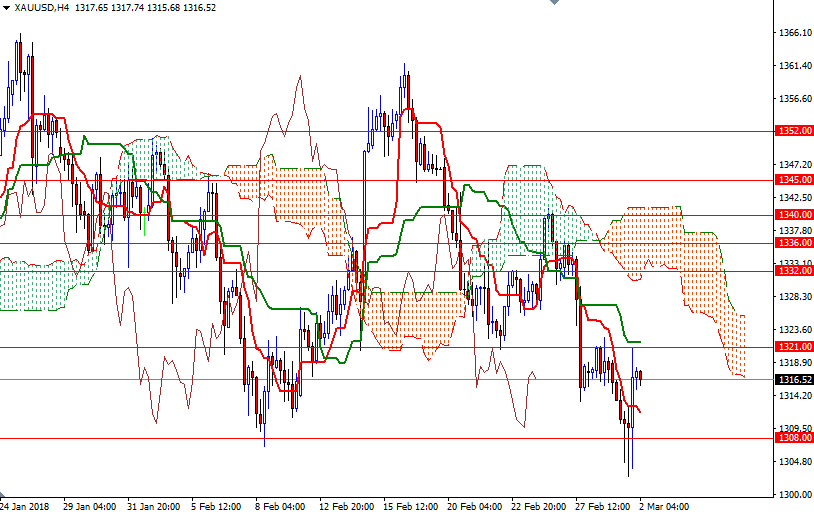

The market is trading below the 4-hourly cloud and we have negatively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) on both charts. The Chikou-span (closing price plotted 26 periods behind, brown line) is below prices as well, indicating that the bears still have the near-term technical advantage. However, the tall lower shadow of yesterday’s candle suggests that the bears may have lost their momentum.

If XAU/USD stays above the 1314/2 area, we may revisit the resistance in 1322.60-1321, where the Kijun-sen sits on the H4 chart. A break through there could foreshadow a move to 1327/5. The bulls have to capture that strategic camp to challenge the next barrier at 1332. On the other hand, if prices get back below 1312, look for further downside with 1310 and 1308/5 as targets. Below there the 1301/0 zone stands out as a solid technical support.