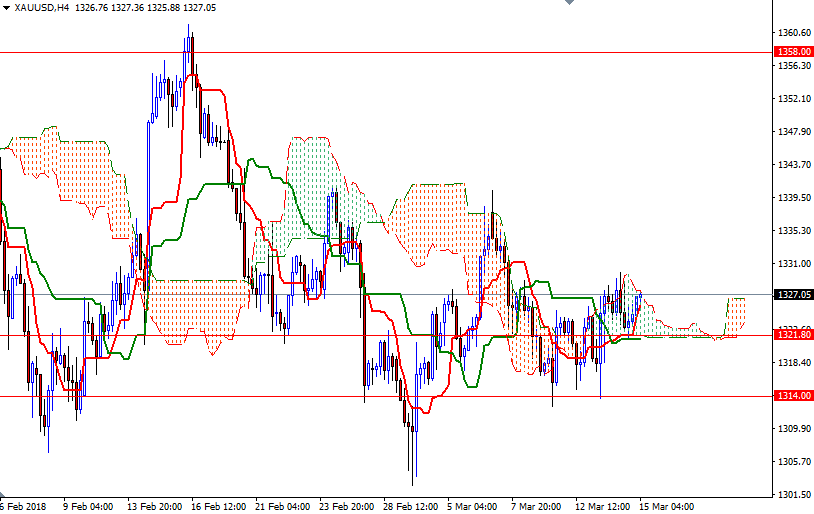

Gold prices ended Wednesday’s session down $1.65 an ounce, pressured slightly by a firmer U.S. dollar index. XAU/USD traded as high as $1329.92 before giving up gains and testing the support in the $1321.80-$1320 area. The market is currently trading at $1327.07, higher than the opening price of $1324.42.

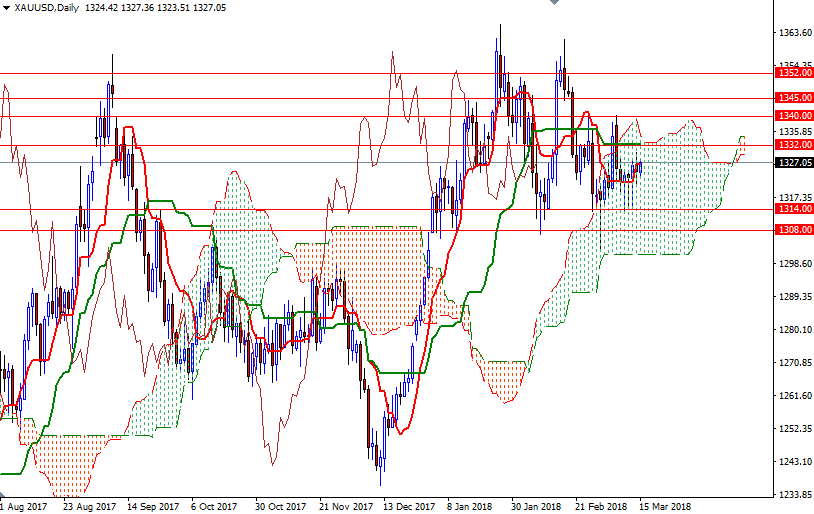

The gold bull have the near-term technical advantage as prices continue to stay above the Ichimoku clouds on the H1 and the M30 charts. We have positively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) on the H4 chart and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices. However, note that prices are still moving within the borders of the 4-hourly cloud.

If the bulls can take out yesterday’s high, the top of the daily cloud will be the next target. XAU/USD has to break through 1334.32-1332 to test 1336-1335.50. Once above there, the market will be aiming for 1340. The bears, on the other hand, have to capture the aforementioned support in the 1321.80-1320 zone if they don’t intend to give up. In that case, look for further downside with 1318 and 1316/4 as targets. A daily close below 1314 would deteriorate the near-term technical outlook and open a path to 1308/5.