Gold prices settled at $1322.05 an ounce on Friday, falling 0.42% on the week and 1.99% over the month. A rebound in the U.S. dollar and technical selling pressure sapped demand for the precious metal. Minutes from the Federal Open Market Committee’s January meeting and comments from Federal Reserve Chairman Jerome Powell boosted expectations for higher interest rates this month. The Fed’s economic projections in December pointed to three rate hikes this year.

A strong U.S. dollar index and a deteriorating near-term technical outlook worked against the gold bulls, but it seems that the market has pretty much digested new Fed Chairman Powell’s testimony, in which he hinted that there could be four small rate hikes in 2018. The Trump administration’s decision to impose heavy tariffs on steel and aluminum imports as well as increasing daily volatility in the stock markets may prop up the precious metal. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 178718 contracts, from 190922 a week earlier.

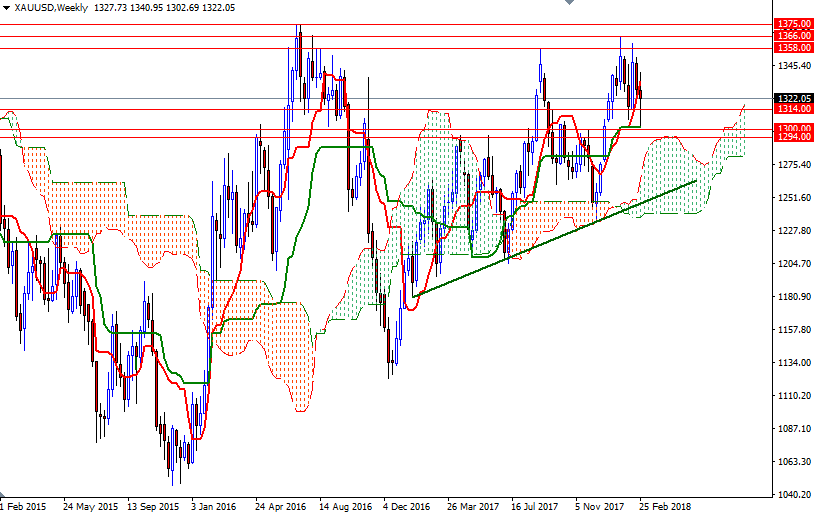

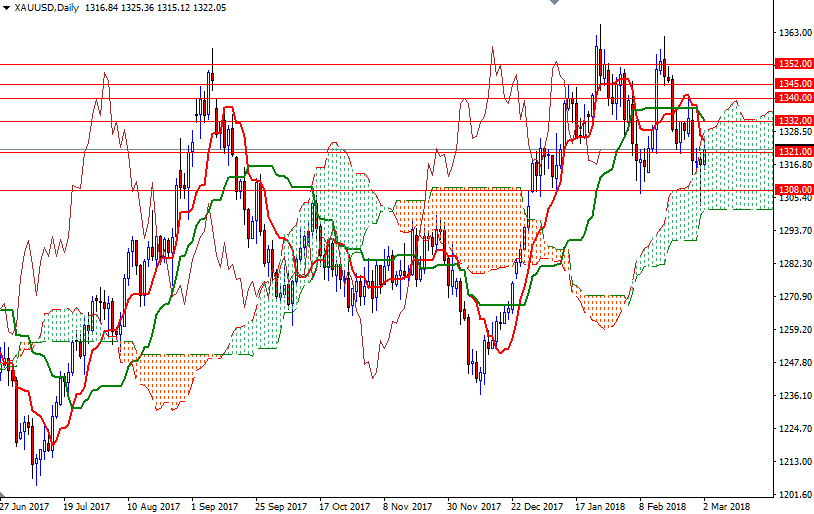

From a chart perspective, the trend is bullish in the big picture as XAU/USD continues to trade above the weekly clouds. However, prices are trading within the borders of the daily cloud and there are strong barriers on both sides. As long as these key levels are not taken out convincingly, gold prices may consolidate over the next few weeks. The bulls have to overcome the initial hurdles at 1332 and 1340, to test the strategic resistance in the 1347/5 area. If the bulls successfully break through 1347, look for further upside with 1352 and 1358 as the next targets. A weekly close beyond there suggests that the bulls will are getting ready to challenge the key resistance in 1375/68. To the downside, there important supports such as 1308/5 and 1301/0. If XAU/USD drops through the bottom of the daily cloud, the bears could gain enough momentum to tackle 1294, the top of the weekly cloud. A break below there on a weekly basis would prelude a deeper correction. In that case, the market will be aiming for 1284/2 and possibly 1265.