Gold prices rose $3.46 an ounce on Tuesday, supported by a weaker dollar. The dollar weakened after data from the Labor Department showed U.S. consumer prices rose moderately in February. Lower Treasury yields and declines across global equity markets were supportive daily elements for gold. XAU/USD is currently trading at $1327.61, slightly higher than the opening price of $1326.15.

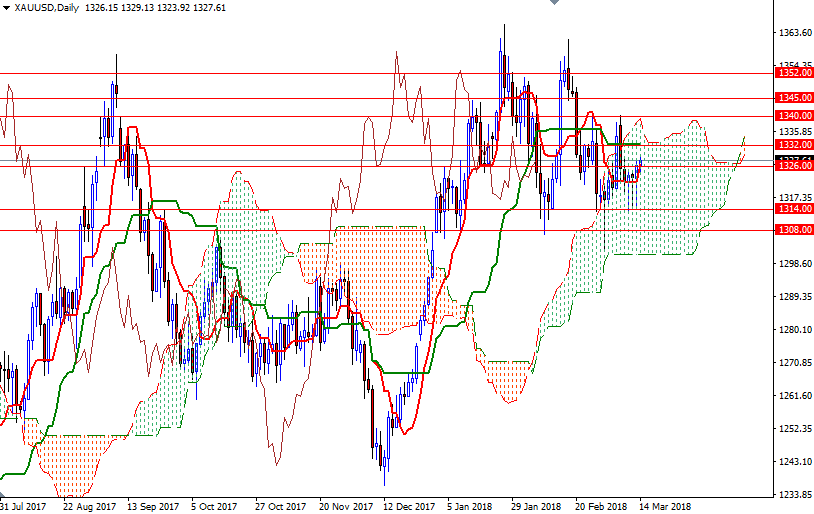

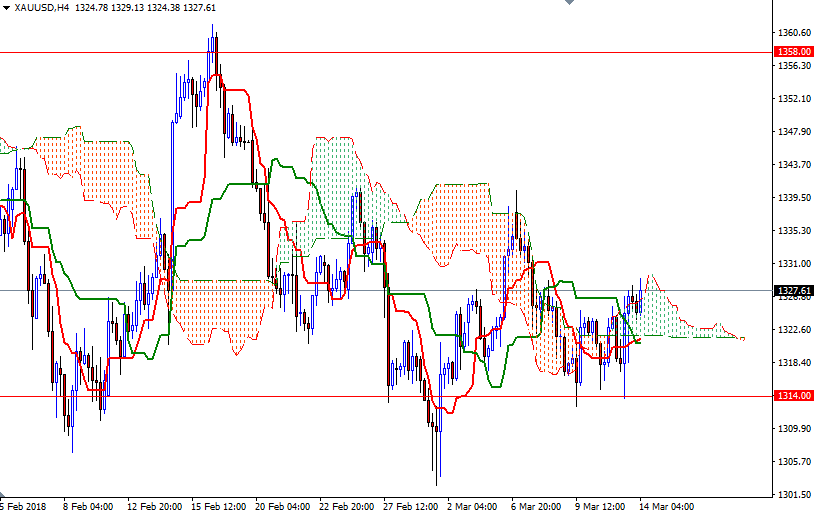

The short-term charts are bullish at the moment, with the market trading above the Ichimoku clouds on the H4 and the H1 time frames. Positive Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses, along with Chikou Span/Price cross in the same direction on these charts, indicate that the market may test the initial resistance in the 1334.32-1332 area. If the market successfully breaks through this critical barrier, then 1340 will be the next port of call.

To the downside, the initial support sits in 1321.80-1320, where the bottom of the 4-hourly cloud, Tenkan-sen and Kijun-sen converge. If XAU/USD gets back below 1320, the next target will be 1316/4. Note that the support in the 1316/4 area held the market for three sessions in a row so the bears have to capture this strategic camp to march towards 1308/5.