Gold prices fell for a second straight session and settled at $1321.76 an ounce with investors cautious ahead of the Labor Department’s monthly non-farm payrolls report. The greenback rallied following the European Central Bank’s policy update. World stock markets were mostly higher yesterday. XAU/USD is currently trading at $1318.03, lower than the opening price of $1321.56.

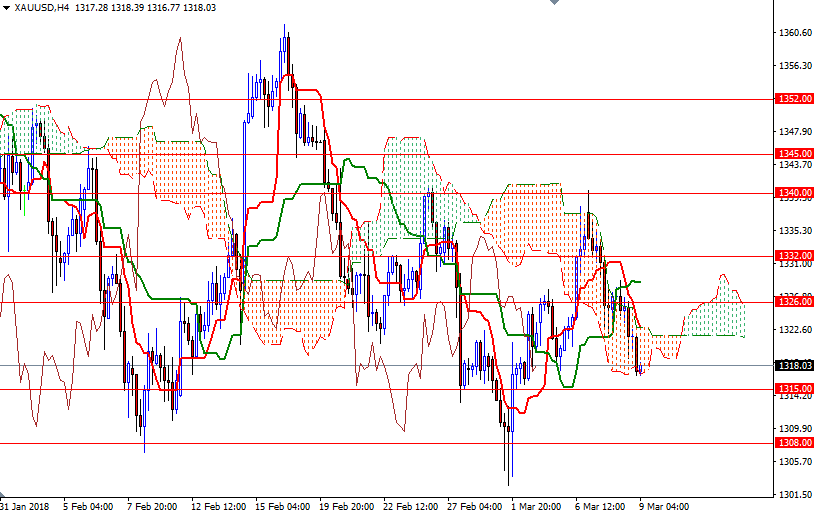

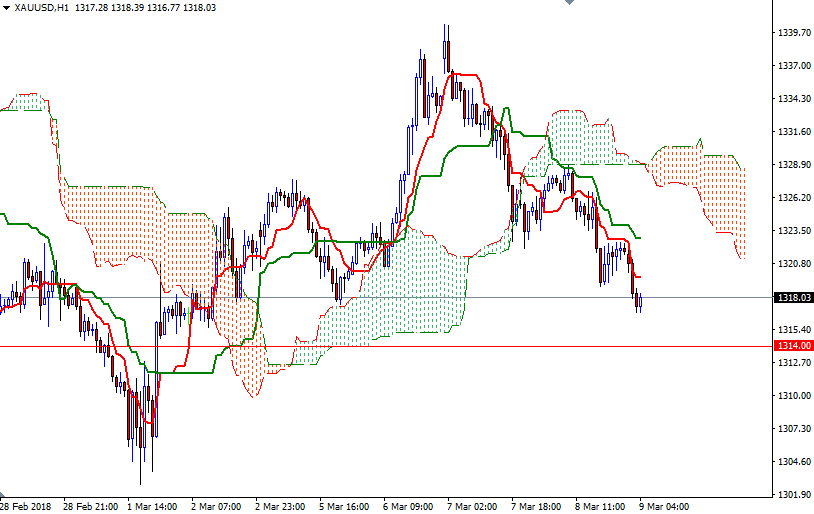

The market initially edged higher and reached the Ichimoku cloud on the hourly chart but found resistance as expected. Breaking below the support at 1324 inspired the technically biased sellers, and consequently, XAU/USD retreated to the 1317/5 area where the bottom of the 4-hourly cloud sits. XAU/USD is still trading within the borders of the daily and the 4-hourly clouds. The Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on the daily and the 4-hourly clouds.

The bear will need to pull prices below the 1317/5 area to tackle the support in 1308/5. If this strategic support is broken, the market will test the 1301/0 area next. To the upside, the initial resistance stands at 1322, followed by 1327/6. The bulls have to overcome these barriers if they don’t intend to give up. In that case, look for further upside with 1329.61 and 1333/2 as targets. A daily close above 1333 is essential for a bullish continuation towards1340.