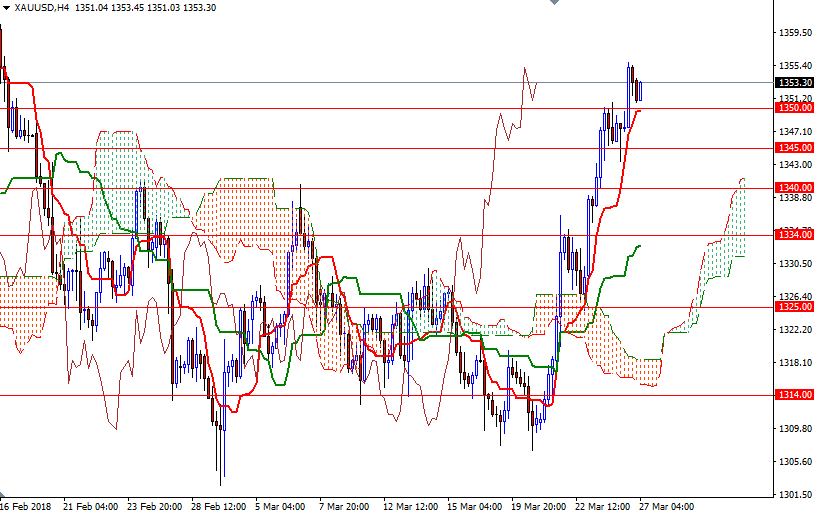

Gold inched higher on Monday as the dollar’s weakness persisted but a strong session for equities limited buying interest. U.S. stock indexes bounced back on reports that China and the United States started negotiating to improve U.S. access to Chinese markets. XAU/USD tested the support in the $1345-$1343 area before climbing above the strategic barrier at around $1350. U.S. economic data due for release Tuesday includes consumer confidence and house price index.

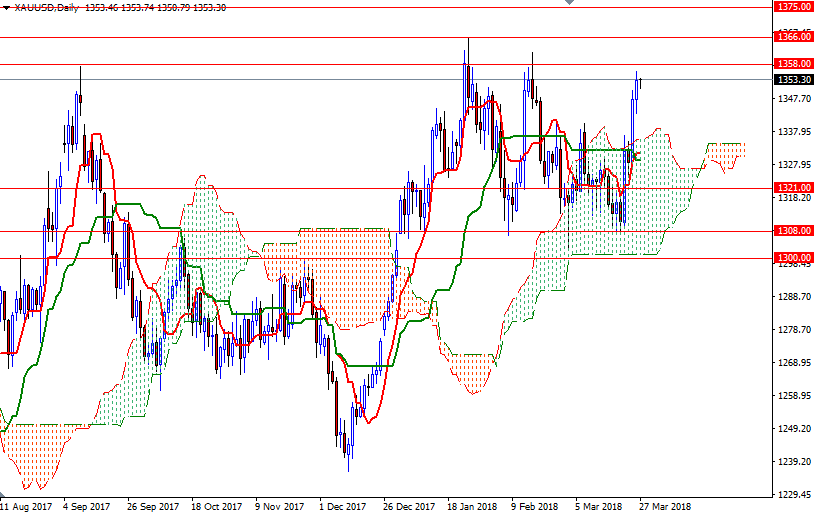

From a chart perspective, the bulls still have the overall technical advantage, with the market trading above the weekly and the daily Ichimoku clouds. We have positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line), along with Chikou Span/Price crosses in the same direction. If the bulls take out yesterday’s high, then it is likely that XAU/USD test 1360/58. The bulls have produce a daily close above 1360 in order to challenge the bears waiting in the 1367/5 zone.

If the market fails to break through 1360/58 and we get back below 1350, keep an eye on the 1345/3 area. A drop below 1343 could lead to a test of the 1340 level. The bears will need to drag prices below 1340 to increase pressure on the market. In that case, XAU/USD will head back to the daily Ichimoku cloud.