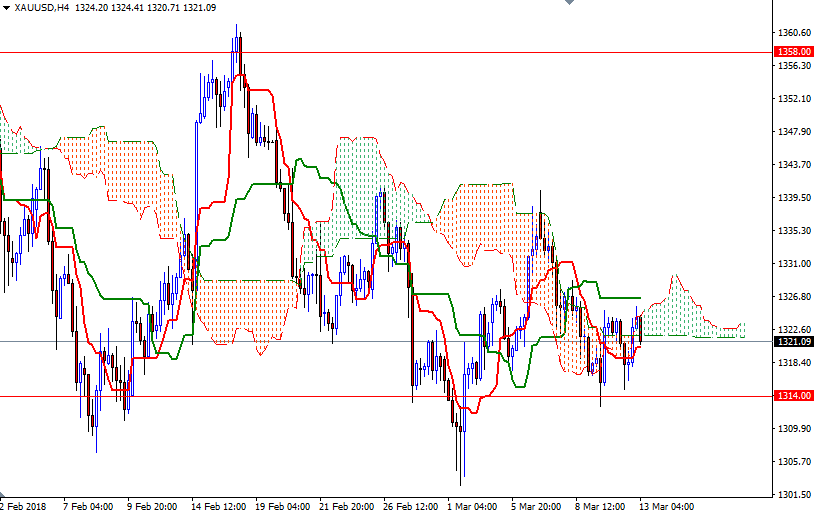

Gold prices ended Monday’s session down $0.77 an ounce as investors took a cautious stance ahead of U.S. inflation data. XAU/USD initially headed lower yesterday but the anticipated support around the $1314 level pushed prices higher. The market tried to break through $1326 in early Asia trading today but a bounce in the U.S. dollar index put pressure on prices.

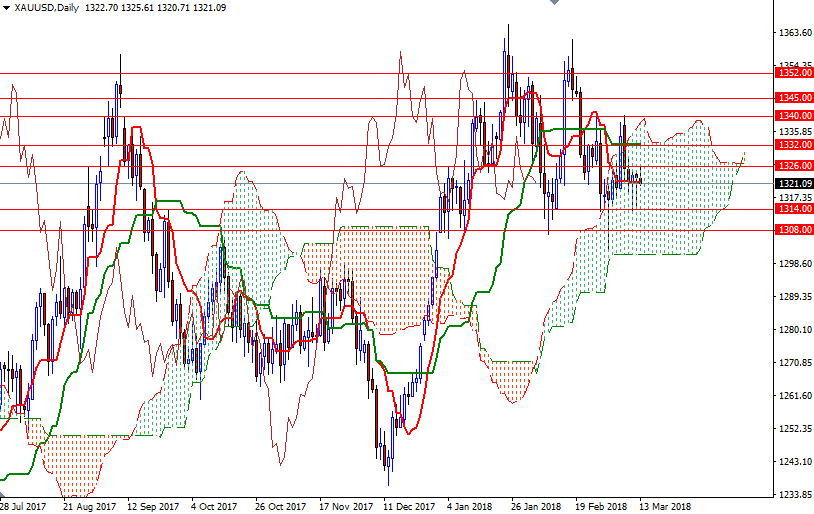

The market is in the daily Ichimoku cloud and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are completely completely on both the daily and the 4-hourly charts, indicating that there is lack of a strong momentum. The key levels remain unchanged as XAU/USD is struggling to make it out of the 1326-1314 range.

At this point, XAU/USD will have to either break through 1326 and challenge the next barrier standing in 1334.32-1332 or drop below the 1316/4 area and pay a visit to the strategic support in 1308/5. While a successful drop below 1305 would put more pressure on the market and open up the risk of a drop to 1301/0, a break up above 1265 makes me think that the bulls are about to make an assault on 1340.