Gold prices rose $14.58 an ounce on Tuesday as a sell-off in the U.S. dollar index prompted buying interest in the market. The dollar slumped after White House economic adviser Gary Cohn said he would resign. The uptick in volatility in global stock markets was also a supportive element for the precious metal.

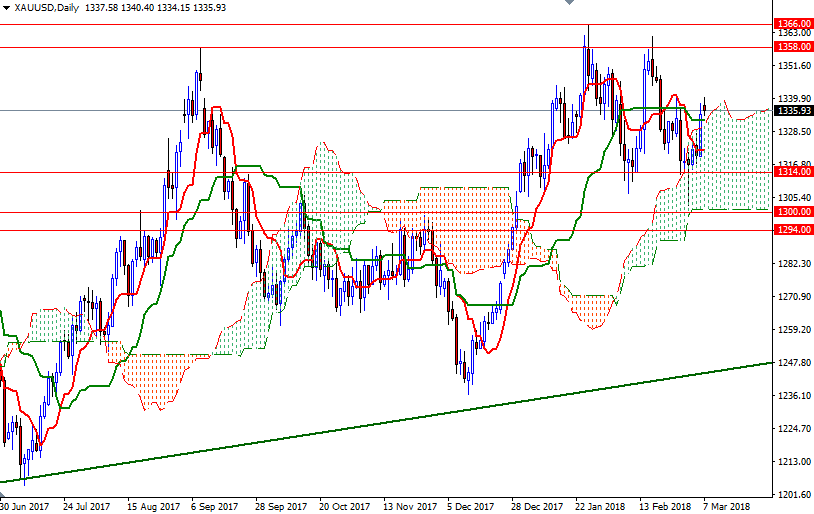

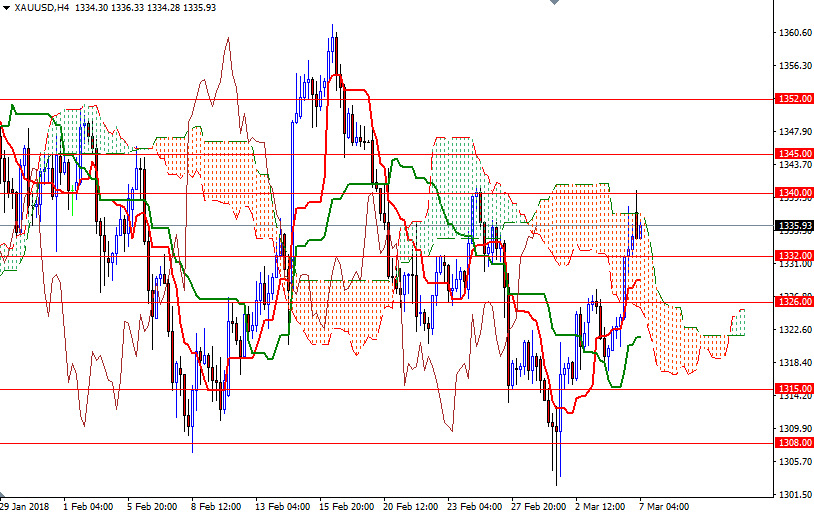

XAU/USD tested the 1340 level as expected after prices broke through the resistance in the 1333/2 zone, but it seems that reaching this strategic barrier triggered some profit taking. The failure to sustain a break above the 4-hourly cloud suggests that the market will revisit the 1333/2 area. If prices can’t hold above 1332, the market may grind lower to test 1329, the Tenkan-sen (nine-period moving average, red line) on the H4 chart, or even 1327/6. The bears have to drag the market below 1326 to gain momentum for 1322, the daily Tenkan-sen.

To the upside, keep an eye on the aforementioned resistance at 1340. If this is taken out convincingly, the market will be aiming for 1347/5 next. Closing above 1347 on a daily basis implies that the bulls are getting ready to challenge 1352.