Gold prices ended Wednesday’s session up $21.32 an ounce as the U.S. dollar weakened after the Federal Reserve took a less hawkish view on monetary policy than some market players were expecting. The yellow metal is being supported not only by a slump in the greenback, but also by worries about a potential trade war between China and the United States. China accused the United States of repeatedly abusing international trade rules after a White House official said President Donald Trump will announce more tariffs on Chinese imports on Thursday.

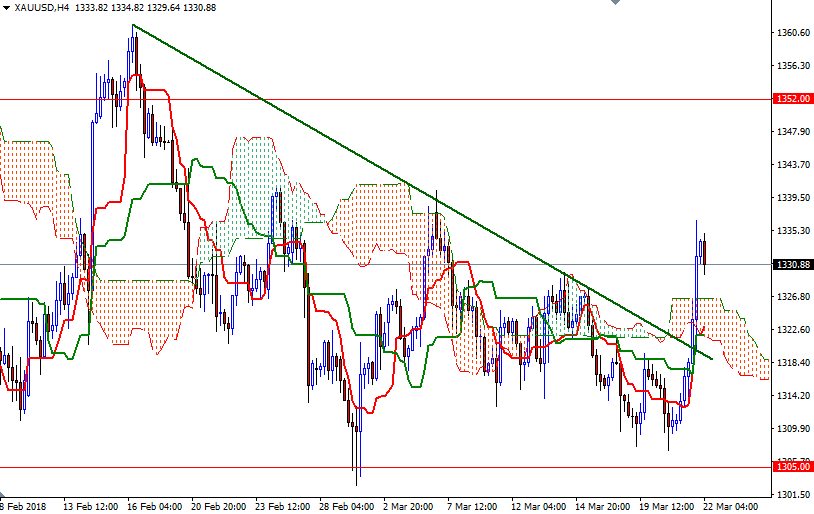

XAU/USD extended its gains after the market saw an upside breakout from a sideways trading range, but some mild profit-taking pressure was featured after prices reached a technical resistance at around the 1334 level. The near-term technical posture for gold has improved since the market penetrated the 4-hourly Ichimoku cloud. Positive Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses on the 4-hourly and the hourly charts also support this view.

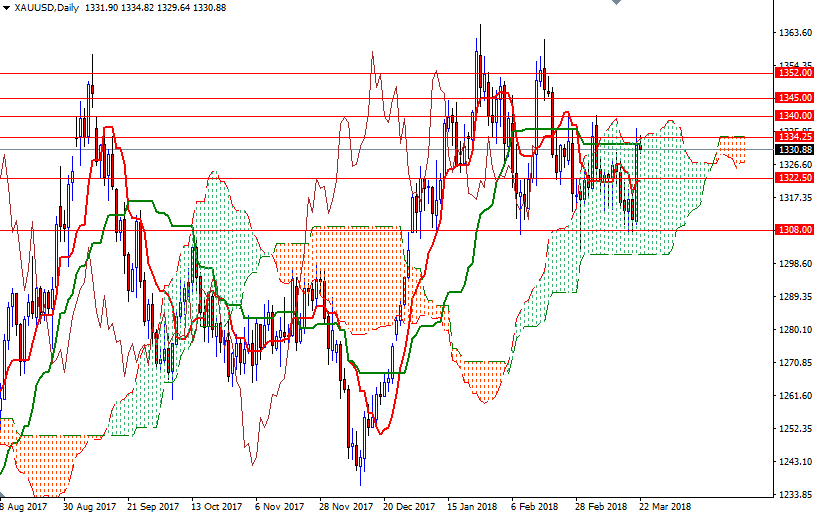

If the bulls can push through 1335.37-1334.25 (the top of the daily cloud), then 1340 will be the next target. A break through there brings in 1345. The bulls have to produce a daily close above 1345 to gain momentum for 1352/0. However, at this point, I wouldn't rule out a pullback towards the top of the 4-hourly cloud (1326.50-1325) or even 1322.50-1321 before heading higher. The bears will need to drag prices below 1321 to challenge the bulls waiting in the 1318.70-1316 area.