Gold prices fell $20.03 an ounce on Wednesday as the market’s inability to hold above the $1340-$1339 area and better-than-expected U.S. economic data prompted investors to unwind bullish bets. The U.S. dollar gained after a Commerce Department report showed that gross domestic product rose at a 2.9% annual rate in the fourth quarter. The precious metal extended its losses after prices fell below the $1334 level, and tested the support at around $1325 as anticipated. XAU/USD is currently trading at $1327.40, slightly higher than the opening price of $1324.70.

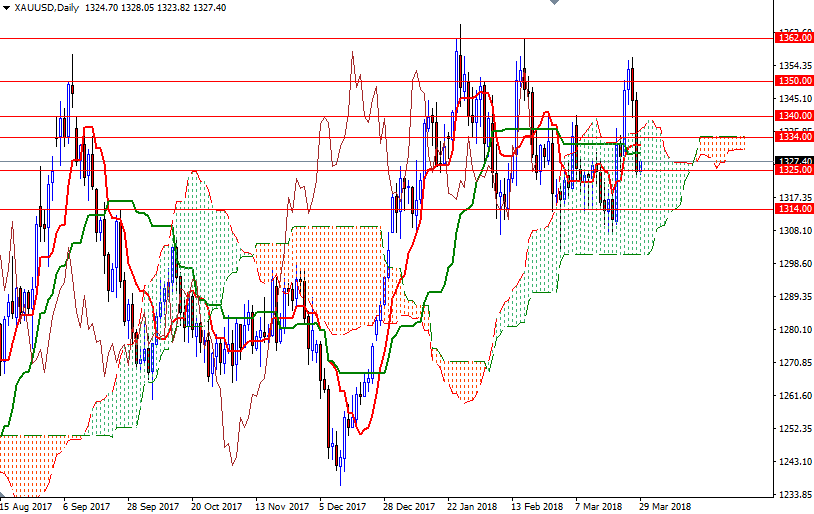

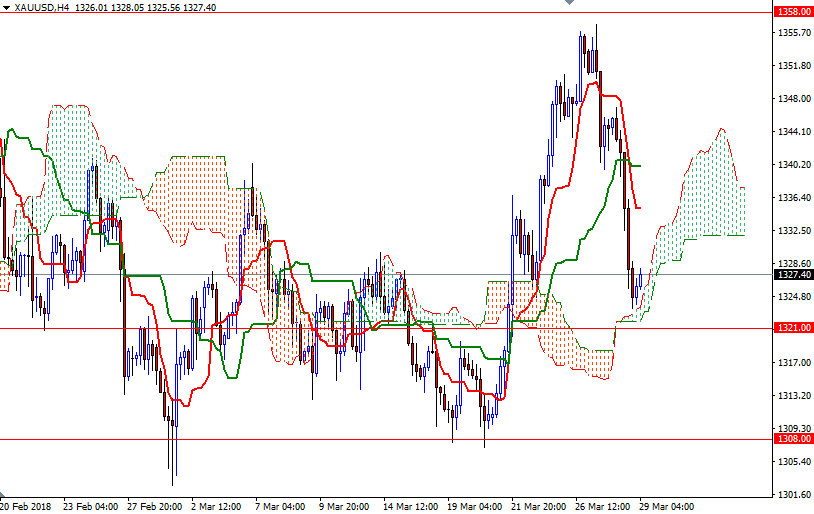

The market is trading just above the Ichimoku clouds on the H4 chart, but we are inside the daily cloud. Although the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned on both the weekly and the daily charts, they also indicate that there is no strong momentum (to break out of the trading range that the market has been trapped for the past 12 weeks). Trading below the hourly clouds suggests that downside risks remain and XAU/USD is likely to test 1321/0 if the support in 1325/4 is broken. A successful break below 1320 opens up the risk of a drop to 1316/4. Below there, the 1308/5 area stands out as a key technical support.

To the upside, the initial resistance sits in 1330.90-1329.70, followed by 1336/4 (the top of the cloud on the M30 chart). If the bulls lift prices back above 1336, they will have a chance to challenge the strategic resistance at 1340, which also happens to be the top of the 4-hourly cloud. The bulls have to produce a daily close above 1340 to gain momentum for 1347/5.