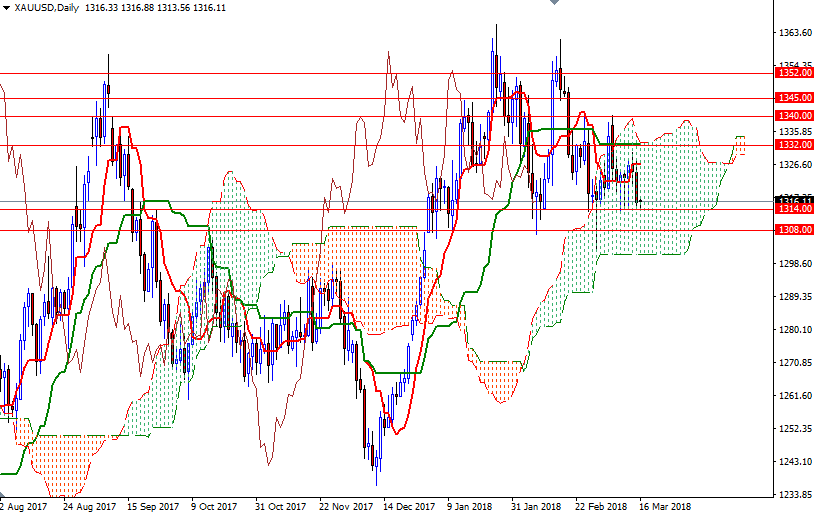

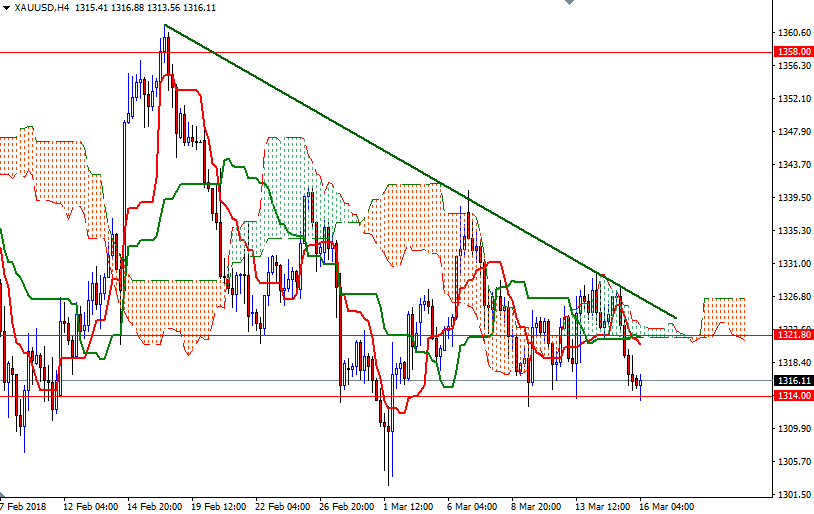

Gold prices fell $8.47 an ounce on Thursday, weighed down by a rise in the U.S. dollar after a report showed that the number of Americans filing for unemployment benefits dropped last week. Gold extended its losses and tested the support at $1314 as expected after prices pierced below the $1321.80-$1320 area. A stronger U.S. dollar kept buyers on the sidelines but the support at $1314 seems to be holding so far.

If the bulls manage to defend this area, XAU/USD may revisit 1319/8. Beyond there, the bears will be waiting in the 1322.75-1321.80 area, which is occupied by the 4-hourly Ichimoku cloud. The bulls have to push prices above 1322.75 to challenge the next barrier in 1328/5.

However, trading below the 4-hourly cloud and negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) suggest that downside risks remain. If the market successfully dives below 1314, then 1308/5 will be the next target. Breaking below this strategic support could trigger a fall to 1301/0. A close below 1300 is essential for a bearish continuation towards 1294/2.