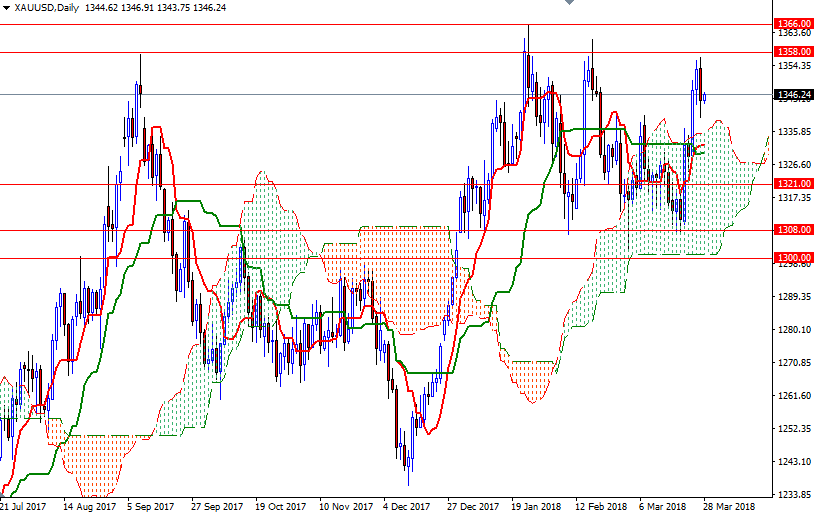

Gold prices ended Tuesday’s session down $8.98 an ounce, pressured by a rebounding dollar. XAU/USD initially headed higher but it was unable to break through the resistance around $1358. Consequently, prices fell below $1345-1343 and returned to the support at the $1340 level as expected. In the latest economic data, The Conference Board’s consumer confidence index came in at 127.7, down from the previous month’s 130.0 and below expectations for a reading of 131. The S&P/Case-Shiller index of property prices was stronger than anticipated.

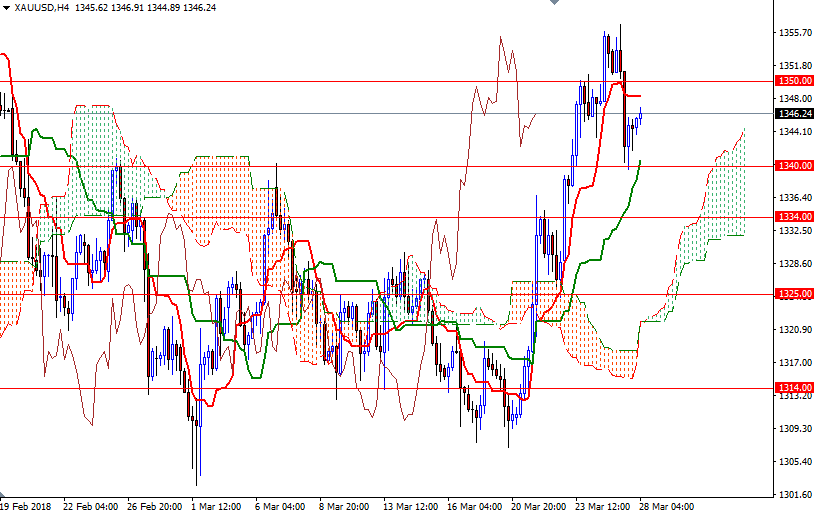

The market is currently moving within the borders of the Ichimoku cloud on the H1 chart, roughly the area between the 1352 and the 1349 levels. In addition to that, the hourly Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned. At this point, the bulls have to lift prices back above 1348.20, the top of the hourly cloud to take the reins and to test the strategic resistance in the 1352/0 zone. If this resistance is broken, the market will be targeting 1360/58 next.

However, if XAU/USD fails to penetrate the Ichimoku cloud on the M30 chart and drops through 1340/39, then 1336.50 will be the next stop. The bears have to capture this camp to march towards the 1334/2 area. A break below 1332 on a daily basis opens up the risk of a fall to 1328/5.