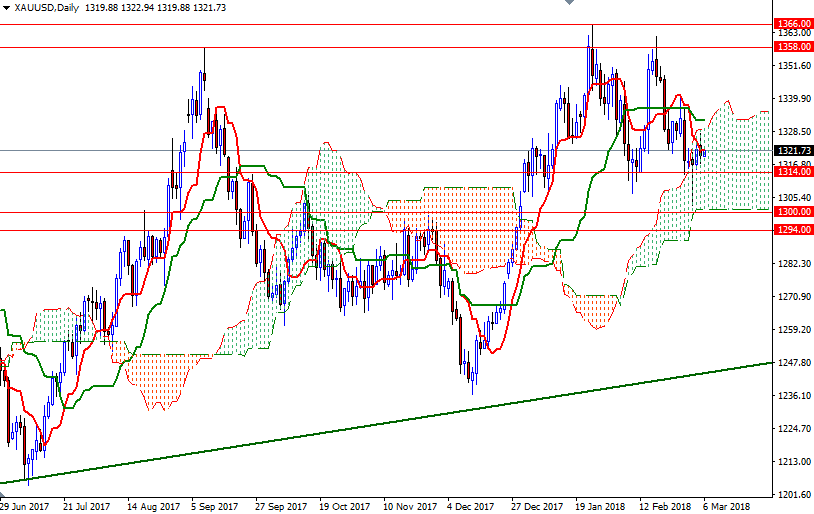

Gold prices ended Monday’s session down $3.33 an ounce as waning risk aversion in the marketplace dented demand for the safe-haven assets. XAU/USD initially edged higher but the market was unable to pass through. Prices headed back to the Ichimoku cloud on the hourly chart after ISM reported that growth across U.S. service industries continued at a solid pace in February. XAU/USD is currently trading at $1321.73, slightly higher than the opening price of $1319.88.

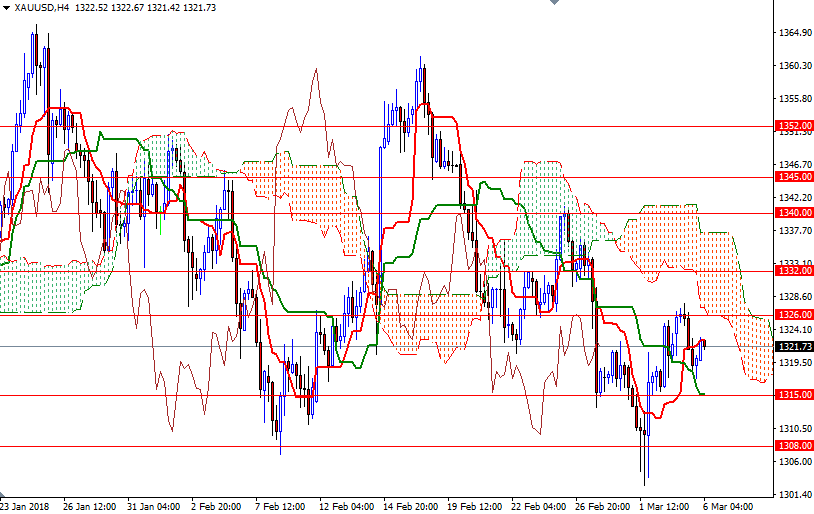

The market is still trading below the 4-hourly Ichimoku cloud but the hourly cloud, which occupies the area between 1317.25 and 1314 continues to be supportive. If the bulls can defend this area, they may have a chance to push prices higher and test the initial barrier in the 1327/6 area, the bottom of the cloud on the H4 chart. The bulls have to successfully lift prices above 1327 to gain momentum for 1333/2, the daily Kijun-sen (twenty six-period moving average, green line).

However, if the bears increase pressure on the market and XAU/USD breaks below the hourly cloud, we may revisit the support in the 1308/5 zone. Once below there, the market will be targeting 1301/0, the bottom of the daily cloud. The bulls have to produce a daily close below this strategic support to make an assault on 1294.