Gold prices fell $12.21 an ounce on Wednesday as traders cashed in recent gains ahead of key U.S. economic data later in the week. Gains across global equity markets and a better-than-expected ADP jobs report also weighed on the precious metal. Market players are waiting for the European Central Bank and the Bank of Japan to announce their latest policy decisions.

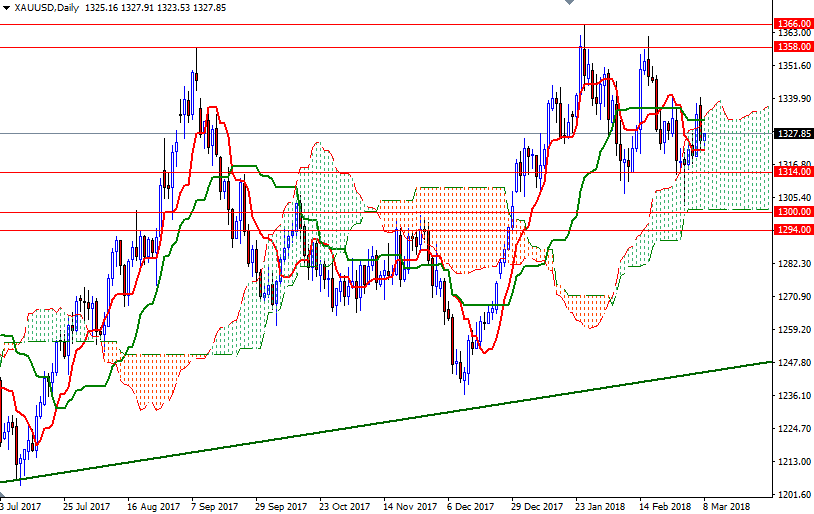

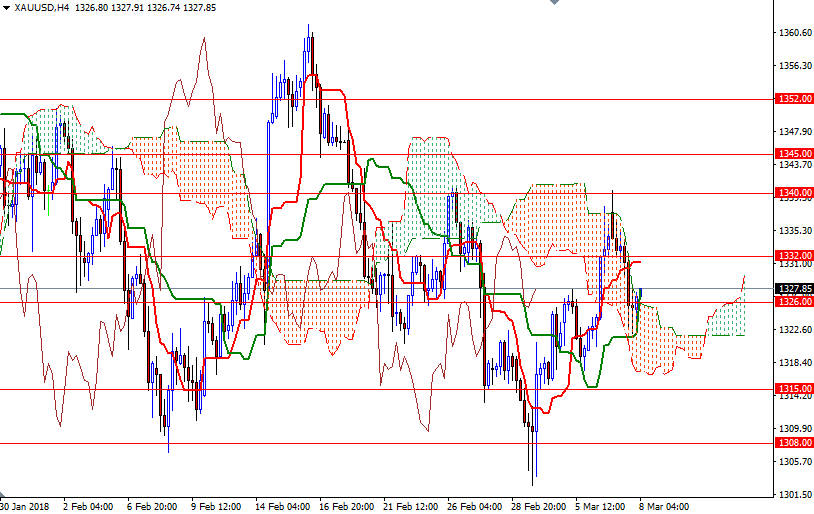

XAU/USD is trying to hold above the Ichimoku clouds on the H4 chart for the time being but prices are still below the hourly cloud. Also note that the market is trading inside the daily cloud and the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) are flat. These suggest a range-bound movement in the near term.

If the bulls can defend their camp in the 1326/4 area and push prices above 1329.50, the market will grind higher to reach 1333.30-1332, the top of the hourly cloud. The bulls have to push through this barrier to gain momentum for 1336. A break above 1336 indicates that the 1340 level will be the next target. However, if XAU/USD fails to penetrate the hourly Ichimoku cloud and drops below 1324, we may revisit the support at 1322. The bears will need to drag the market below 1322 to increase pressure and challenge the bulls waiting in the 1317/5 area.